• Turkish mills keep purchases limited amid weak steel markets

• US export market to offer little relief in August trade

• China import prices gain ground amid stronger ferrous futures

• Import activity thin in Vietnam due to bid-offer gap

• Taiwan import prices weaker, sentiment bearish

• India’s import market quiet on sluggish demand.

Turkey

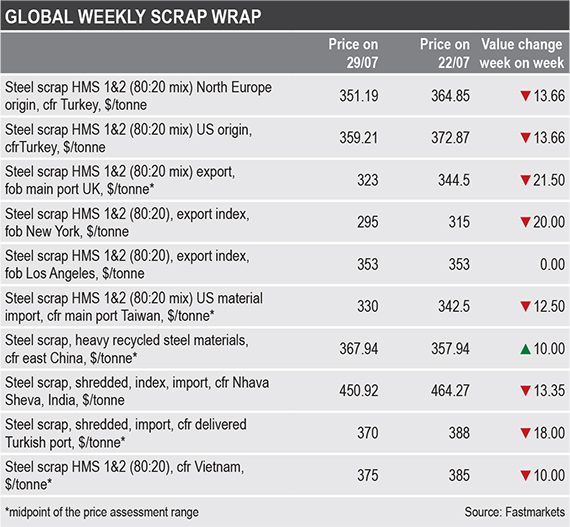

Turkish deep-sea steel scrap import prices tumbled early in the week to July 29, with buyers booking several cargoes from the United States at softer prices and expecting further price declines, according to sources.

Turkish buyers then stayed on the market sidelines following the price downturn later in the week.

Due to recent poor demand for finished steel, Turkish steel mills have been limiting their deep-sea scrap bookings, putting downward pressure on scrap prices.

Pricing history

steel scrap HMS 1&2 (80:20 mix), Northern Europe origin, cfr Turkey.

steel scrap HMS 1&2 (80:20), US origin, cfr Turkey.

United States

Expectations of a drop in US scrap export prices were realized late last week, removing a potential source of support for cut and secondary scrap prices during the domestic trade in August. Market participants were expecting more drops in scrap prices into August, according to sources.

Pricing history

steel scrap HMS 1&2 (80:20), export index, fob New York.

steel scrap shredded scrap, export index, fob New York.

steel scrap, HMS 1&2 (80:20), export index, fob Los Angeles.

Vietnam

Spot prices for imports of deep-sea steel scrap in bulk into Vietnam dropped during the week to July 29 amid thin trading, with a bid-offer gap and bearish sentiment dominating the global scrap markets, according to sources.

Slow rebar sales and production cuts were both weighing down the market mood for scrap in Vietnam.

Pricing history

steel scrap, HMS 1&2 (80:20), cfr Vietnam.

China

Stronger futures markets in China led to a rise in bid prices for scrap imports but concluded deals were still thin on the ground, sources told Fastmarkets.

Pricing history

steel scrap, index, heavy recycled steel materials, cfr north China.

steel scrap, index, heavy recycled steel materials, cfr east China.

Taiwan

Spot prices for steel scrap in Taiwan softened in the week to Friday, with market participants expecting more downtrend to come.

Electricity rationing in summer, slow rebar sales, and the availability of lower-cost imported billet were all factors that have been weighing down sentiment in the Taiwan scrap market, sources told Fastmarkets.

Pricing history

steel scrap, HMS 1&2 (80:20 mix), US material import, cfr main port Taiwan.

India

India’s import scrap market was sluggish this week, with heavy rainfall across the country limiting construction activity and weakening downstream demand for semi-finished and finished steel, sources said.

Pricing history

steel scrap, shredded, index, import, cfr Nhava Sheva, India.