The recent battery raw material (BRM) global outlook webinar provided invaluable insights into the evolving landscape of the battery materials industry.

These key takeaways shed light on the current state of affairs and offer a glimpse into the future trajectory of this dynamic sector. You can listen to the recording of the webinar here.

ESS demand will be a key growth sector for battery material demand in the near-term

One of the prominent revelations from the webinar was the anticipation of a surge in demand for energy storage systems (ESS). This sector is poised to become a pivotal driver for the growth of battery material demand in the near term. The increasing focus on sustainable energy solutions and the growing need for efficient energy storage underscores the significance of ESS in shaping the industry’s landscape.

As more renewable energy comes onto the grid and we see increased power generation that renewable energy provides, we expect ESS demand to reach over 800 gigawatt-hours in 2033. Lithium iron phosphate (LFP) is expected to remain the dominant chemistry because of its cost, affordability and the trustworthiness that many developers have in this chemistry.

However, the optimistic outlook is met with apprehension regarding China’s rapid expansion of domestic manufacturing capacity. The concern looms large that this aggressive development may lead to a supply overshoot, potentially outpacing domestic demand. Striking the right balance between supply and demand remains a critical challenge that industry stakeholders must navigate.

Lithium prices are likely to remain around current levels in the short-term

Lithium, a key player in the battery materials realm, is expected to maintain its current price levels in the short term. Yet, the market is characterized by significant volatility, presenting a challenge for industry players to adapt and strategize effectively in response to unpredictable market dynamics.

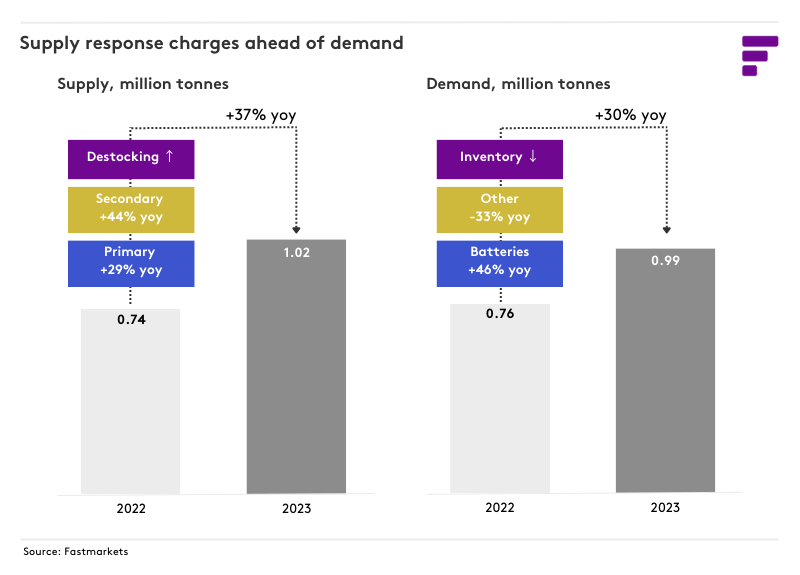

The supply response has outpaced demand growth, compounded by aggressive destocking that has increased supply availability. This has coincided with weaker-than-expected demand, with consumers happy to utilize volumes off long-term contracts.

A pessimistic attitude to demand next year has resulted in continuing bearish sentiment, which is expected to remain in the short term and put pressure on prices. However, the short-term price downside may be relatively limited due to cost pressure on marginal producers and this should keep prices range bound around current levels.

Price rises across cobalt raw materials will be limited in the near-term

In contrast, cobalt raw materials are projected to experience limited price rises in the near term. This forecast offers a semblance of stability in a market that has historically been marked by fluctuations and uncertainty.

The nickel market will remain in oversupply for several years with prices remaining subdued

The battery sector has now joined the stainless steel industry as one of the major drivers of demand growth. Despite the strong growth in nickel consumption for (mostly electric vehicles) batteries, this sector will remain smaller than the stainless steel sector, but it will consolidate its position as the second-largest consumer of primary nickel – by an increasingly large margin.

Despite two industries now driving most of the growth in demand, refined nickel supply is rising strongly, driven by a strong rise in Indonesian supply at all stages: mine, intermediates and refined. The government has supported the industry and is keen to develop downstream demand as well.

Concerns about the reliability of the high-pressure acid leach technology – the main way to produce the intermediate products that become the nickel sulfate the battery industry requires – have now disappeared. The technology has now matured, and supply is rising strongly. As a result, worries about the availability of suitable feed for the battery industry have disappeared.

With refined nickel supply rising strongly, the nickel market is expected to grapple with oversupply for several years, resulting in subdued prices. Navigating this period of abundance poses challenges for industry players, requiring strategic planning to weather the storm of market saturation.

Chinese export controls may encourage graphite projects outside of China

Chinese export controls, set to be enforced in December for graphite, add a layer of complexity to the global supply chain. This development may serve as a catalyst for projects outside of China, prompting a re-evaluation of supply chain strategies and fostering increased diversification.

China will remain the major supplier of manganese over the next decade

Manganese, a crucial component in battery production, is set to see China maintain its role as the major supplier over the next decade. Nevertheless, significant capacity developments in other regions signal a potential shift in the balance of power within the manganese market.

The automotive industry outside of China should be looking to LFP and LMFP

The automotive industry, particularly outside of China, is urged to explore alternatives such as LFP and LMFP (Lithium Manganese Ferrous Phosphate) along with smaller pack sizes. This strategic shift aims to reduce vehicle costs and accelerate the adoption of electric vehicles in global markets.

Recycling sector set to take off as supply increases

Recycling emerges as a key player in the sustainable evolution of the battery materials industry. While currently a small supply base, recycling is expected to gain importance, driven by environmental concerns and the need for a more circular and sustainable approach to resource utilization.

The distinct difference in maturity and capacity between the Asian and European markets contributes to the price differentials observed in the industry. Bridging this gap will require collaborative efforts and strategic investments to foster a more balanced and harmonized global battery materials market.

Listen to our recent webinar to find out more

The Fastmarkets battery materials global outlook webinar provided a comprehensive overview of the challenges and opportunities shaping the industry. Navigating the complexities of supply and demand, market volatility and global dynamics will be key for industry participants seeking to thrive in this rapidly evolving landscape.

Get full access to all the resources and the webinar replay here.