About us

Bringing you commodity prices, news and market analysis for more than 150 years

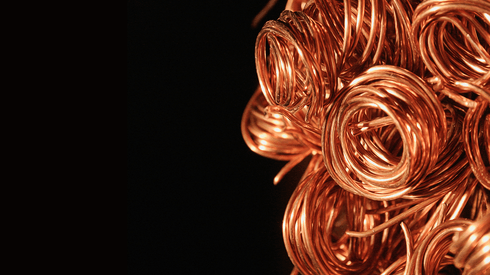

Fastmarkets is one of the most trusted cross-commodity price reporting agencies (PRA) in the agriculture, forest products, metals and mining, and new generation energy markets.

Our price data, forecasts, and market analyses give our customers a strategic advantage in complex, volatile and often opaque markets. Our events provide immersive experiences to network, trade and discuss the critical issues of the day.

Lithium Hangar Holdco Limited is the ultimate holding company for the Fastmarkets group of companies. Lithium Hangar Holdco Limited (14476245) is a company registered in England and Wales and is controlled by funds managed and/or advised by Astorg. Astorg is a European private equity firm with over €20 billion of assets under management.

The commodity markets we serve are the heart of today’s economy and critical to the transition to a low-carbon economy. That reality guides our purpose: to create transparent commodity markets to help our customers build a more sustainable world. Our work helps to create healthy commodity markets that are essential to fuel today’s financial performance and make the key investments to build a more sustainable world.

We marry a culture energized by a diversity of intellect, experiences, and perspective with a passion to make our customers successful.

We combine the authority of our expertise with a pragmatic view of how markets work to help our customers see clearly even in volatile and opaque markets.

We respect and trust each other as shown by our Working 3.0 model that allows each of us to bring our best selves to work each day and make a difference for each other and for the world.

Discover how to master price data for better contract negotiations and stronger strategic decision-making for your business.

In the complex landscape of contract negotiations, the integration of verified price data offers both parties (buyer and seller) a gateway to a dynamic and responsive pricing framework. By utilizing unbiased and market-reflective pricing information, organizations can forge agreements that adapt in real-time, mirroring the fluidity of commodity costs as they fluctuate over time. Yet, beyond mere adaptability lies a deeper imperative: the mitigation of financial risk.

Metal Bulletin • American Metal Market • Scrap Price Bulletin • Industrial Minerals • RISI • FOEX • The Jacobsen • Agricensus • Random Lengths • FastMarkets and more

Read more about the new Fastmarkets-settled Southern Yellow Pine contract to launch at CME Group

Read more about Fastmarkets’ launch of its voluntary carbon pricing and news service

Read more on how the launch provides market participants with a new risk management solution in the renewable energy sector

Read more about the agreed on MOU between Fastmarkets and GME

Read how Fastmarkets is introducing a regional graphite price benchmark for the US

Read how Fastmarkets is stepping in with industry-leading market intelligence

Read more about our recent IOSCO assurance review

Read more on how these indices will further position Fastmarkets benchmark prices in financial markets

Read more about how Fastmarkets will provide much-needed price assessments for green steel

Read more about our recent IOSCO assurance review