- China’s gross domestic product (GDP) climbed by 18.3% year on year in Q1

- US treasury yields dropped, lifting gold and equity prices

Base metals

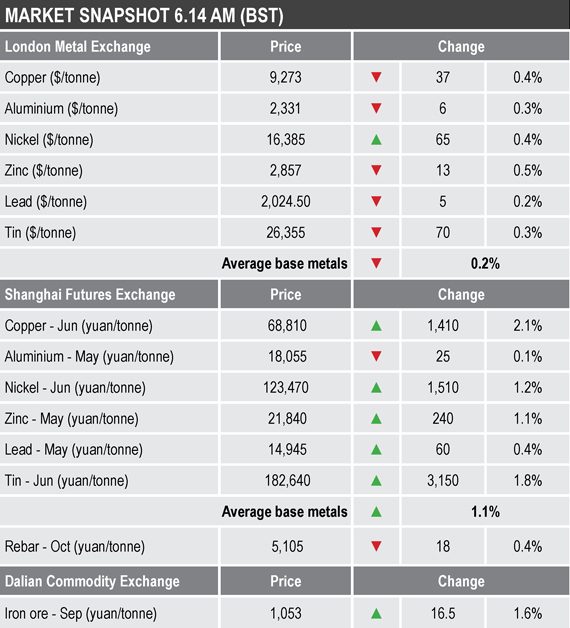

LME three-month base metals prices were mainly weaker this morning, the exception was nickel that was up 0.4% at $16,385, but it has been one of the weaker metals of late. The rest of the metals were down by an average of 0.3% while they consolidated yesterday’s gains that averaged 1.2%.

The most-active base metals contracts on the SHFE were mainly upbeat this morning, the exception was May aluminium that was down by 0.1%, while the rest were up by an average of 1.3%, with June copper leading the way for the second day with a 2.1% gain to 68,810 yuan ($10,536) per tonne – which followed a 1.8% rise on Thursday.

Precious metals

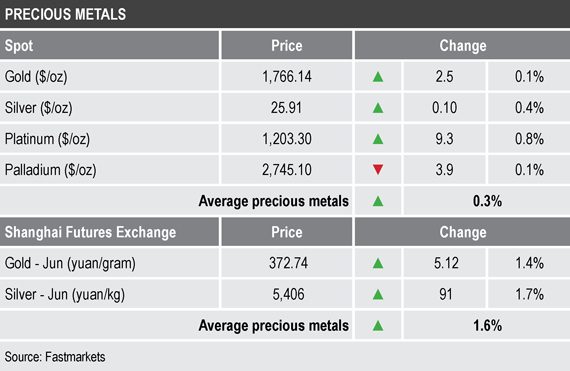

Spot gold prices were up by 0.1% at $1,766.14 per oz this morning, consolidating the 1.6% gains seen on Thursday. Spot silver ($25.91 per oz) and platinum ($1,203.30 per oz) were up by 0.4% and 0.8% respectively, while palladium ($2,745.10 per oz) was down by 0.1%.

Wider markets

The yield on US 10-year treasuries has dropped to 1.58% this morning, from 1.63% at a similar time on Thursday. At one stage yesterday it was as low as 1.53% – the recent high was just shy of 1.78% on March 30.

Asian-Pacific equities were mainly stronger on Friday, boosted by lower US bond yields and good data: the CSI 300 (+0.55%), the Hang Seng (+0.89%), the Kospi (+0.17%) and the Nikkei (+0.13%), while the ASX 200 (-0.06%) was slightly weaker.

Currencies

The US Dollar Index is consolidating this morning but the overall trend is downward; it was recently at 91.71, after 91.67 at a similar time from Thursday, having turned lower from 93.44 at the end of March.

Although most of the other major currencies are slightly weaker this morning, suggesting consolidation, they have generally been on a front footing in recent days: the euro (1.1968), sterling (1.3757) and the yen (108.65), with the Australian dollar (0.7719) slightly firmer.

Key data

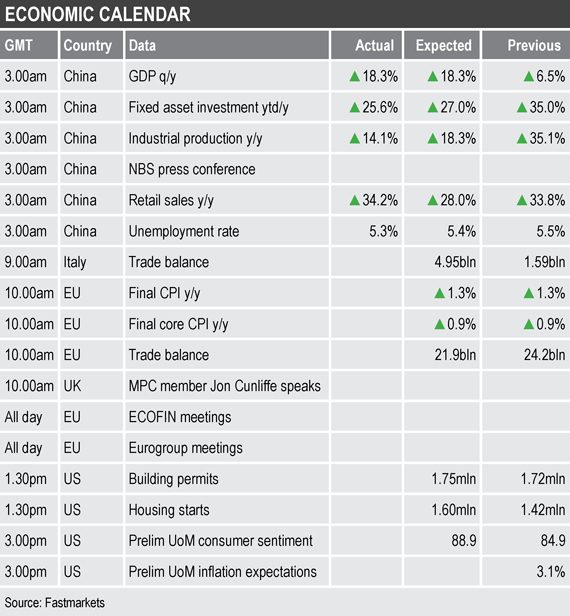

Key data already out this morning in China showed GDP rose by 18.3% in the first quarter, compared with the same period in 2020, when the country went into lockdown due to the Covid-19 outbreak. This compared with 6.5% growth in the fourth quarter of last year. Chinese fixed asset investment, year-to-date, climbed by 25.6% in March, which was below the 27% expected, and industrial production climbed by 14.1%, which was also below the 18.3% expected. Retail sales in China climbed by 34.2% year on year, above the 28% increase that had been expected, and the unemployment rate fell to 5.3% from 5.5%.

Later there is data on Italian and European Union trade balances and EU consumer prices (CPI), with US data on housing starts, building permits and preliminary University of Michigan data on consumer sentiment and inflation expectations.

In addition, Bank of England Monetary Policy Committee member Jon Cunliffe is scheduled to speak and there are Euro and Ecofin meetings taking place.

Today’s key themes and views

More of the base metals have broken out of their consolidation patterns to the upside, with nickel and zinc the ones remaining rangebound for now. Underlying conditions look strong because prices have held up well over the past weeks and months when prices have been consolidating – with dips for the most part being limited.

With the seasonally strong second quarter now underway, it looks like buyers are now returning. We still see potential downside risks on the back of credit tightening in China, or as a result of a broader-based equity correction, but the path of least resistance in the metals seems to have once again swung higher.

Overall the longer-term outlook is supported by the combination of the promised infrastructure spending and the past seven to eight years of low capital expenditure in mining.

Gold’s rebound on Tuesday looked quite constructive and Thursday’s gains have provided further lift, no doubt helped by weaker bond yields and a dollar that is on a back footing. Given the risk of an equity correction, we are keeping an open mind as to whether the weaker bond yields and firmer gold are an early sign of a pick-up in haven demand.