- Markets awaiting direction from purchasing managers’ index (PMI) data

Base metals

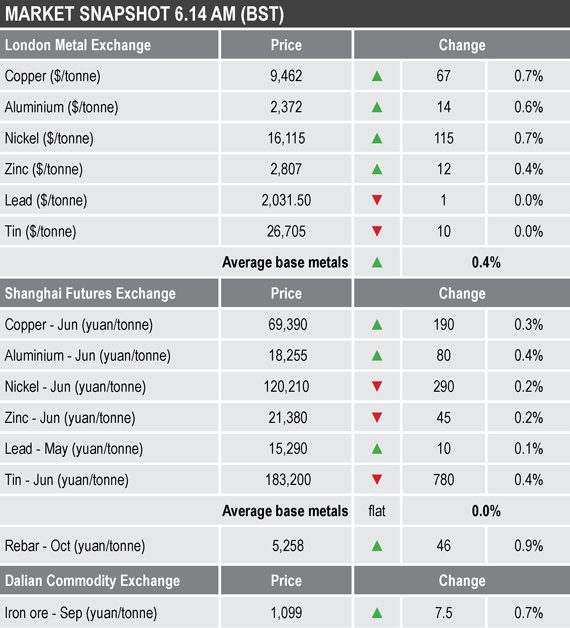

LME three-month base metals prices were mixed, but on average were up by 0.4% this morning, with lead ($2,031.50 per tonne) and tin ($26,705 per tonne) slightly lower, while the rest were up by between 0.4% and 0.7%. Copper was one of the leaders, it was recently quoted at $9.462 per tonne – strong but still struggling to challenge February’s high at $9,617 per tonne.

The most-active base metals contracts on the SHFE were mixed, with the June copper, aluminium and lead firmer by between 0.1% and 0.4%, with copper up by 0.3% at 69,390 yuan ($10,691 per tonne), while the rest were down between 0.2% and 0.4%.

Precious metals

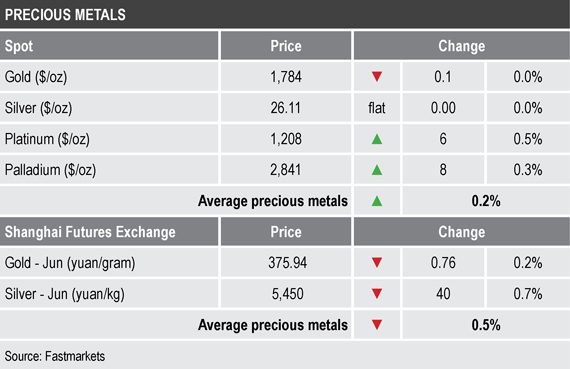

Spot gold ($1,784 per oz) and silver ($26.11 per oz) were little changed this morning compared with Thursday’s close, but down from where they were at a similar time on Thursday, when they were at $1,794.22 and $26.52 respectively. Platinum ($1,208 per oz) was up by 0.5% and palladium (2,841 per oz) was down by 0.8%, compared with Thursday’s close.

Wider markets

The yield on US 10-year treasuries has edged higher this morning and was recently quoted at 1.53%, this after 1.53% at a similar time on Thursday.

Asian-Pacific equities were mainly stronger on Thursday: the Hang Seng (+0.71%), the Kospi (+0.30%), the ASX 200 (+0.07%), the CSI 300 (+0.69%), while the Nikkei (-0.69%), was lower.

Currencies

The US Dollar Index was consolidating in low ground this morning and was recently quoted at 91.21, for now holding above Tuesday’s low of 90.85.

The other major currencies were also consolidating this morning: the euro (1.2024), the Australian dollar (0.7727), sterling (1.3858) and the yen (107.92).

Key data

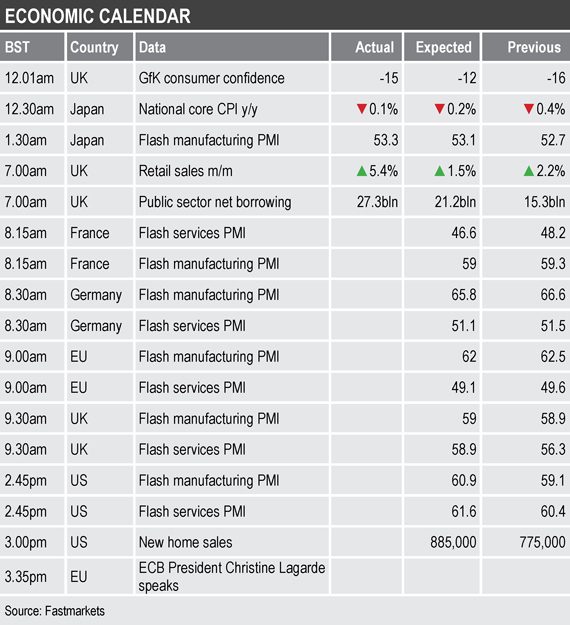

Friday’s economic agenda is busy with flash PMI data on manufacturing and services. Japan’s manufacturing PMI climbed to 53.3, from 52.7 in March, while the country’s consumer price index dropped by 0.1% year on year in March, after a 0.4% fall in February.

Other data already out showed United Kingdom’s GfK consumer confidence indicator fall to -15 in April, after a -16 reading in March, the country’s retail sales climbed by 5.4% month on month in March, after a 2.2% gain in February and the UK’s public sector net borrowing requirement climbed to £27.3 billion ($37.9 billion) in March, up from £15.3 in February.

Later, in addition to PMI data out across Europe and the United States, there is US data on new home sales. European Central Bank president Christine Lagarde is also scheduled to speak.

Today’s key themes and views

The picture across the LME metals has not changed much this week; aluminium has been able to push the envelope on the upside, copper and tin are perched just below recent highs, zinc and nickel remain entrenched in sideways channels and lead is consolidating in mid-range.

With Wall Street likely to be nervous ahead of Biden’s tax plans, which may be announced early next week, and with the dollar and US treasury yields consolidating, the metals may well remain rangebound for longer, that is unless the PMI data surprises the market. Copper seems to be looking for an excuse to break higher, but if it fails to do so then the risk of stale long liquidation could increase, especially if Wall Street gets jittery.

Gold prices are consolidating this morning, which after the strong gains of late is a constructive development, it does not seem to be showing nervousness, unlike bitcoin that has fallen back below $50,000 per BTC.