- Friday’s United States employment report is in focus because it could prompt Federal Reserve to change tack

- Dow Jones Industrial Average sets new highs after US initial jobless claims fell below 500,000 on Thursday for the first time since Covid-19 struck

- Federal Reserve warns asset valuation “may be vulnerable to significant declines should risk appetite fall”

Base metals

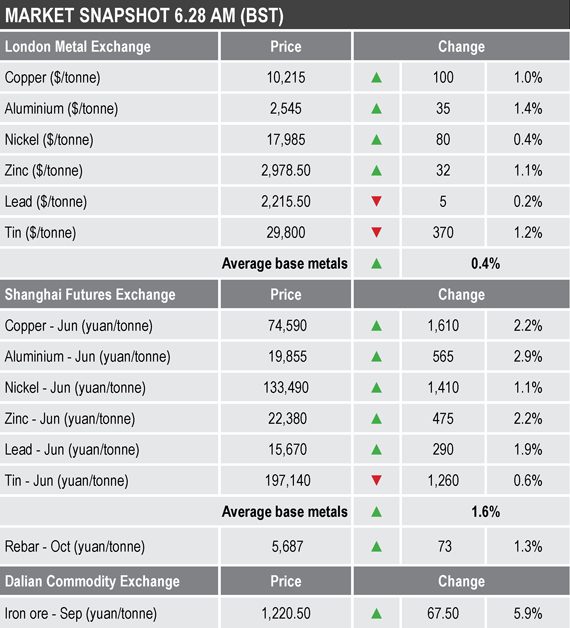

LME three-month copper ($10,215 per tonne), aluminium ($2,545 per tonne) and zinc ($2,978.50 per tonne) led on the upside this morning, with gains of between 1% for copper and 1.4% for aluminium. Nickel ($17,985 per tonne) was up by 0.4%, while lead ($2,215.50 per tonne) and tin ($29,800 per tonne) were down by 0.2% and 1.2% respectively.

At 6.28am London time on Friday, a total of 10,422 lots had been traded on the LME, compared with 9,307 lots at a similar time on Thursday.

The most-active base metals contracts on the SHFE were mainly stronger, with the exception of June tin that was down by 0.6%, while the rest were up quite sharply, with gains averaging 1.6%. June aluminium led with a 2.9% gain and June copper was up by 2.2% at 74,590 yuan ($11,524) per tonne.

Precious metals

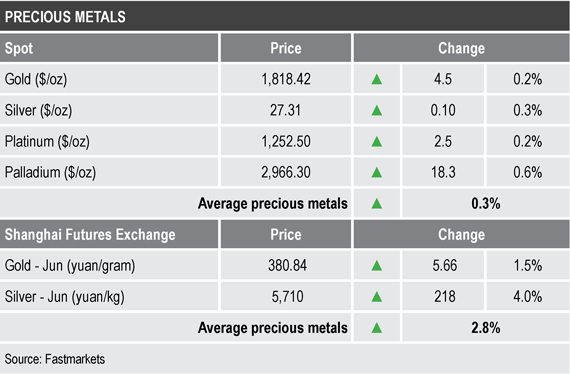

Palladium led the precious metals higher with a 0.6% rise to $2,966.30 per oz, while the rest were up by between 0.2% and 0.3%, with gold up by 0.2% at $1,818.42 per oz – this after having broken higher on Thursday when prices climbed above $1,798 per oz.

Wider markets

The yield on US 10-year treasuries was at 1.57%, unchanged from a similar time on Thursday.

Asia-Pacific equities were mainly firmer on Friday: the ASX 200 (+0.27%), the Hang Seng (+0.05%), the Nikkei (+0.09%) and the Kospi (+0.57%), while the CSI 300 (-0.7%) was weaker.

Currencies

The US Dollar Index’s downward trend paused on April 29. It rebounded but encountered resistance around 91.45 and then started to weaken again on Thursday. It was recently quoted at 90.92, after 91.27 at a similar time yesterday.

With the dollar off its lows, the other major currencies were generally consolidating off recent highs: the euro (1.2057), sterling (1.3905), the Australian dollar (0.7766) and the yen (109.17). Despite roaring commodity prices the Australian dollar remains capped, no doubt on the back of a political standoff with China.

Key data

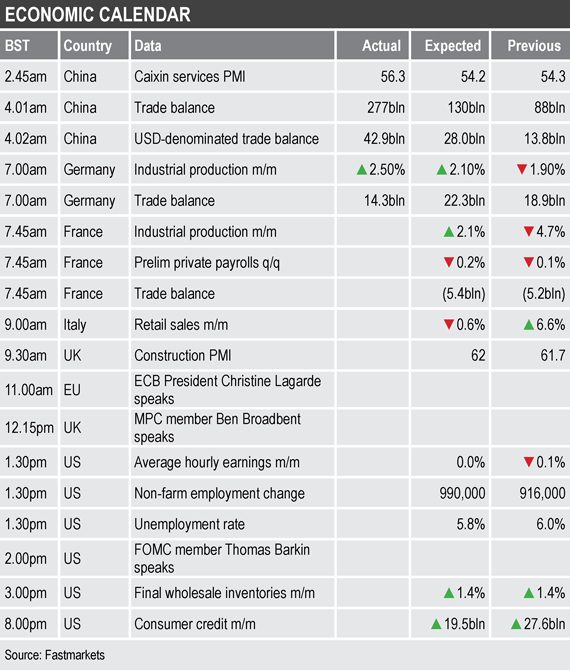

Friday’s economic agenda is busy; key data already out shows China’s Caixin services purchasing managers index (PMI) climbed to 56.3 in April, from 54.3 in March, and its exports rose by 32.3% and imports surged 43.1% in April, compared with a year ago – needless to say off low bases. German industrial production rose 2.5% in March, after a 1.9% fall in February.

Later, there is data French and German trade balance, France’s industrial production and private payrolls, Italian retail sales and the United Kingdom’s construction PMI.

US data is focused on the employment report, with other data on wholesale inventories and consumer credit.

In addition, the Bank of England’s Monetary Policy Committee member Ben Broadbent, European Central Bank President Christine Lagarde and US Federal Open Market Committee member Thomas Barkin are scheduled to speak.

Today’s key themes and views

Some metals pulled back to consolidate on Wednesday, but once again dips were limited and short-lived and most metals were push higher again this morning, all of which suggests the underlying tone remains bullish.

Bond yields are not screaming inflation, US employment is recovering and as a result sentiment in equities remains bullish. The Federal Reserve’s recent comments, quoted above, state the obvious, and at some time a correction will unfold and will probably be triggered when the market feels the US central bank will change tack – hence today’s US employment report will be watched closely.

While we are signed-up members of the super-cycle club and expect higher prices over the medium to long term – especially given all the infrastructure-spend promises – we are also wary when prices go up in straight lines for too long.

Given all the stimulus packages, the recovering economic growth and how the expected infrastructure spending could boost commodity prices, we are wary about inflation. This, combined with stretched valuations in other markets, could all boost interest in gold.