By Amanda Luhavalja, price reporter, vegetable oils

Chicago Board of Trade soybean oil futures spiked in June 2021 to a record all-time high, more than doubling from levels seen a year ago. At the same time, cash basis for Central Illinois crude/degummed and refined/bleached/deodorized (RBD) soybean oil blew out to historic levels.

Although some in the market believe the US could ‘run out’ of soybean oil by year’s end, the real supply crunch and another price rally could occur in the first quarter of 2022. This is when demand from the biodiesel industry ramps higher due to an expansion of domestic renewable diesel capacity.

To read more about the expansion of domestic renewable diesel capacity in the US, download a free copy of our latest report.

Tightening supplies

Currently, many US renewable diesel plants use food-grade oil to produce biodiesel since the facilities do not have pre-treatment capacity on-site. Since refined soybean oil is also in demand from the food sector, supply has tightened dramatically. As a result, cash basis for Central Illinois refined soybean oil surged during the first week of July to above 40 cents per pound, which briefly widened its spread to Central Illinois crude/degummed to nearly 30 cents, according to our agriculture analysts.

High soybean oil prices have made it much more profitable for crushers to process increased volumes of soybeans.

“It is so much more valuable to sell bean oil to [renewable diesel producers] than it is to run our own biodiesel plants,” a crusher said. “Demand will be there if the price is right, but [our plants] will be at extremely reduced rates the rest of the year.”

Surge in oil share

In May, soybean oil futures’ share of the value of the soybean crush revenue, which has typically ranged between 30% and 35% in recent years, spiked to a level not seen since February 2012 and remains in the 45% to 48% range. Our agriculture analysts believe the surge in oil share could continue through the end of this year since rising demand from renewable diesel producers will require crushers to match crushing volumes to soybean oil demand rather than meal demand. In saying this, crushing appears to have slowed down.

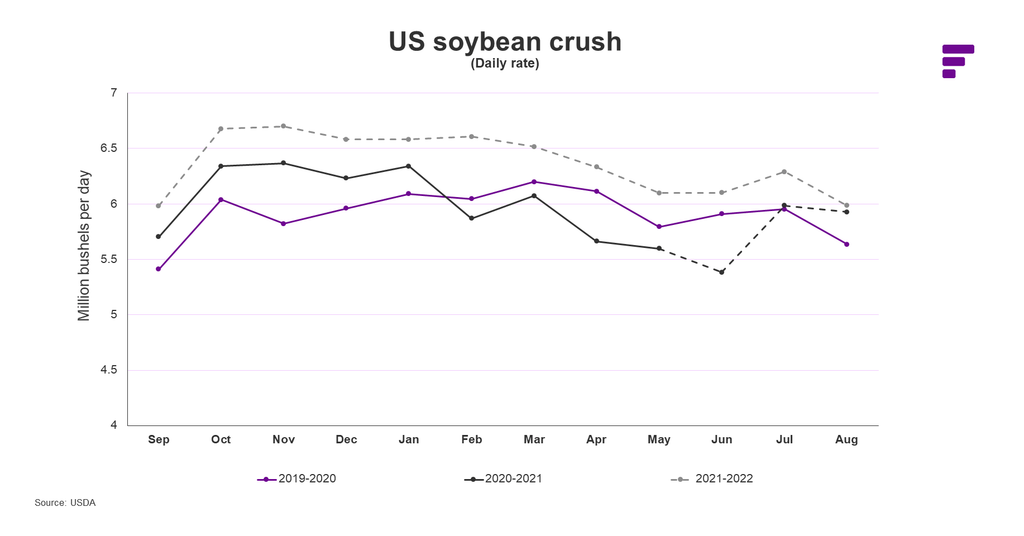

The National Oilseed Processors Association (NOPA) on Thursday July 15 said US soybean crushing volumes in June fell 6.8% on the month to their lowest level in two years to 152.41 million bushels. Soybean oil stocks among NOPA members dropped to the lowest level in eight months to 1.54 billion pounds, down 8% from May. To account for this slowdown in crushing, US Department of Agriculture (USDA) cut its 2020-21 marketing year US crush forecast by five million bushels.

The chart above shows the US soybean crush. The data from June 2021 onward is a forecast, represented with a dotted line for June to August of 2020-2021 and the entirety of 2021-2022.

Will supply start to ease off?

According to an independent consultant, soybean oil supplies will remain tight over the next year or two and could start to ease as renewable plants add ‘pre-treat’ capabilities and are able to use a wider variety of feedstocks. For example, the US could see increased imports of canola oil from Canada, the consultant said.

However, considerable dryness in the Canadian Prairies right now is expected to limit the size of this year’s canola crop. As a result, reduced supply of canola seed available for crushing will further tighten vegetable oil supplies in North America, according to our agricultural forecasting director.

With US soybean prices so elevated, US exports should continue to decline and could end 2021-22 near 1.4 billion pounds, about half of the 2019-20 level, the consultant added. “We continue to decrease exports and potentially could become a net importer of soybean oil in the US.”

Several other factors could further exacerbate the soy oil supply problem, including the expansion of California’s Low Carbon Fuel Standard program to other states, and an increase in Renewable Volume Obligations (RVOs) from 2020 levels by the US Environmental Protection Agency. Still, biofuel demand will likely depend more on expanding renewable diesel capacity than on the RVOs, according to our agriculture analysts.

The USDA in its monthly World Agricultural Supply and Demand Estimates (WASDE) report, lowered its 2020-21 US soybean oil ending stocks forecast by 15 million pounds to 1.79 billion pounds, 258 million pounds above our forecast of 1.52 billion pounds.

This article, by Amanda Luhavalja, was first published to thejacobsen.com on Tuesday July 20.

Stay up to date with the critical forces influencing price and market movements across the agriculture market. We look forward to regularly sharing more insights, trends and trade news with you on the Fastmarkets oilseeds and grains insights hub.