Read on for the highlights of our macroeconomic outlook for Latin America for 2021 and 2022 by Rafael Barisauskas, Latin America economist

The lost decade

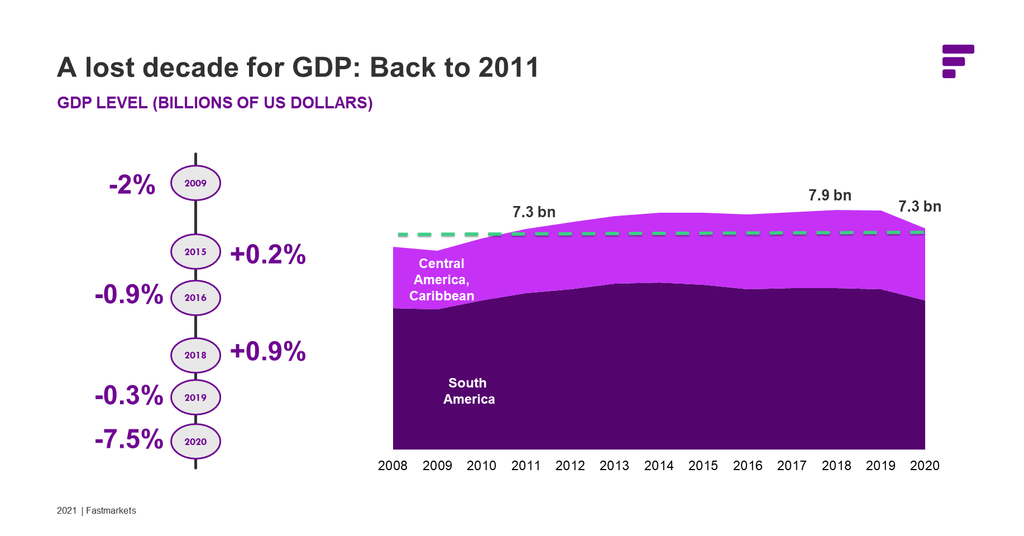

Covid-19 hit the Latin America economy particularly hard. GDP levels at the start of 2021 fell back to levels not seen since 2011. Latin America lost a full decade of economic progress.

Total Latin America GDP fell by 7.5% in 2020. The GDP loss was similar across South America and in the Central America and Caribbean sub-regions. Compare that to global GDP, which fell by around 3-3.5%.

The pandemic was the straw that broke the camel’s back, coming at the end of ten years of stagnant economic growth.

A decade of GDP stagnation

Alternating declines and timid growth caused GDP to stagnate.

- In 2009, GDP fell 2% after the subprime crisis, but soon recovered

- It grew by only 0.2% in 2015 and fell by 0.9% in 2016

- In 2018, GDP grew only 0.9% and decreased by 0.3% in 2019

- Finally, in 2020, GDP plummeted by 7.5% because of the pandemic

Working less, earning less, spending less

Rates of unemployment and underemployment increased significantly when comparing 2020 to the final quarter of 2019, compounding a problem ten years in the making. Latin America lost more working hours than any other region of the world, saw more than double the global average loss of income, and was responsible for almost a third of all jobs lost globally.

- 41 million jobs lost in Latin America

- 114 million jobs lost globally

- 19.3% lost income from employment in Latin America

- 8.3% lost income from employment globally

The data above speak to official employment. But 12 out of the 18 selected countries in Latin America have more informal workers than registered employees. The problem of unofficial employment affects more than half of the working population in key markets such as Mexico and fast-growing nations like Peru, Ecuador and Colombia.

Brazil, Argentina and Chile, important economies in South America, have between 40% and 47% of their working population off the books.

Being in unofficial employment means you have none of the protections of a registered, such as paid medical leave and redundancy pay, and you can lose your job at any time. Informal employment also burdens the young, who may be supporting older generations who don’t have a safety net of pensions and savings.

Unstable jobs and unprotected workers combine to constrain present and future spending, slowing the recovery from Covid-19 and economic growth overall.

No visitors

Latin America relies heavily on tourism – it contributes more than 15% of GDP in many countries in the region, with Mexico and Uruguay at the top of the list.

Total arrivals in Latin America fell by an average of 70% last year, with higher drops in Central and South America. The Covid-19 vaccine rollout is slow in the region, which is deterring international travelers looking for “Covid-safe” destinations. If Covid-19 cases remain high and the rollout remains slow, tourism isn’t expected to recover until 2023 or 2024, so a significant share of GDP recovery is unavailable for the next 2-3 years.

Healthy demand for Latin American exports is a double-edge sword

Agriculture helped to offset losses in other sectors in 2020, and it’s contributing to the recovery in 2021 and 2022.

Latin American agricultural exports to China jumped 5.4% last year, while exports to the US grew roughly 5%. Exports to all other countries dropped 3.5% in the same period.

Brazil, Mexico and Argentina are the biggest exporters of food to developed countries, shipping everything from grains and fruits to beef. Other major producing countries as Uruguay, Ecuador and Paraguay and are expected to enjoy higher exports as well, though they’ll remain small compared to Brazil, Mexico and Argentina.

The region’s dependence on agricultural exports is a double-edged sword. Soaring global commodity prices, including grains, beef, and food in general, have stimulated the region to increase exports. But the health of the agriculture industry and other commodities is not leading to an equivalent increase in employment rates, because so many of the jobs lost were in other sectors such as hospitality. The exception is Mexico, which is increasing exports of manufactured goods to the US.

Nor is agriculture industry growth leading to an increase in income levels.

Latin American incomes are stalling. In the past seven years, the Purchase Power Parity (PPP) per capita stagnated while it grew in all other regions, including emerging economies in Asia.

In the past two years, inflation-adjusted minimum wages increased by only 1% in the region, mostly driven by gains in Mexico and Chile. Brazil and Argentina have seen a stagnation and a decrease, respectively, of their inflation-adjusted minimum wage.

In other words, Latin America is stuck in a moment in time. Latin American buyers can buy roughly as much today as they could in 2013.

Higher global commodity prices cause domestic supply shocks

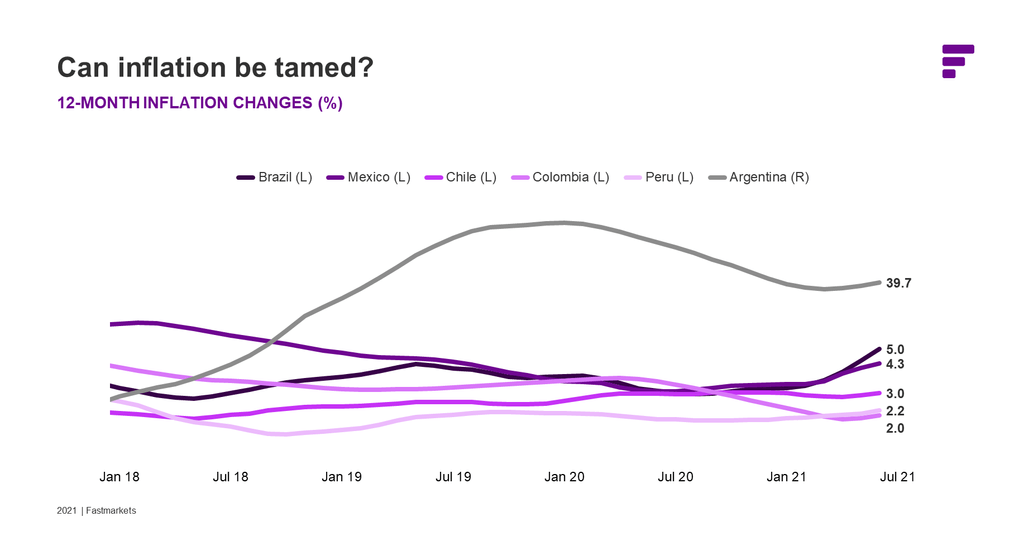

Inflation is no stranger in Latin America, but the current conditions are unique. Higher public spending in 2020 and higher global commodity prices in 2021 are driving up prices while unemployment levels remain high and purchasing power stagnates.

Higher global commodity prices push up local prices in two ways. First, producers are often better off exporting their goods and earning US dollars, rather than selling the food domestically in local currencies. Second, critical imports are more expensive, including manufactured and industrial intermediate goods such as packaging, two markets where Latin America is heavily reliant on imports.

As a result, the 12-month average inflation rates in Latin America are at or above the local central banks’ targets.

You may also be interested in:

- Brazil to open up for US GMO corn imports

- How the oilseeds market emerged as the global driver of agriculture markets, its role in wider food price inflation

- Latin America: A forest products market in transformation

In Brazil, inflation was at 5% in the 12-month average by June, while the month’s year-on-year result is more than 8%. In Mexico, inflation is also close to 5% year-on-year. The situation in Argentina is highly problematic; inflation there is near 40% year-over-year. And Suriname and Venezuela have three- and four-digit inflation figures.

Can inflation be tamed?

Inflation is a risk to future growth in the region. The one-million-dollar question: Can inflation be tamed? Cutting government expenditure, reforming taxes and increasing interest rates could help. The problem here is that there is little room for further fiscal reforms or spending cuts that would not also hinder GDP recovery.

Do governments have a choice but to cut spending? Without cuts, inflation will continue skyrocketing, leading to calls from the public for subsidies and price controls. This could lead to an investment withdrawal from the region, reducing reserves and pushing up inflation even more. It’s a tough challenge ahead.

Cash-strapped governments will struggle to respond

The response to the Covid-19 pandemic as a share of GDP was far lower than the share seen in developed countries such as the US and in Europe. And because much of the aid provided by Latin American governments was not budgeted for, it led to higher rates of inflation and short-term debt levels. Brazil, Argentina, Peru and Colombia are the most affected.

That has left most Latin American governments penniless – they are not now in the financial position to stimulate demand though aid and investment. Exchange rates and the end of the commodity upcycle also pose a threat to recovery.

What’s the outlook for Latin America?

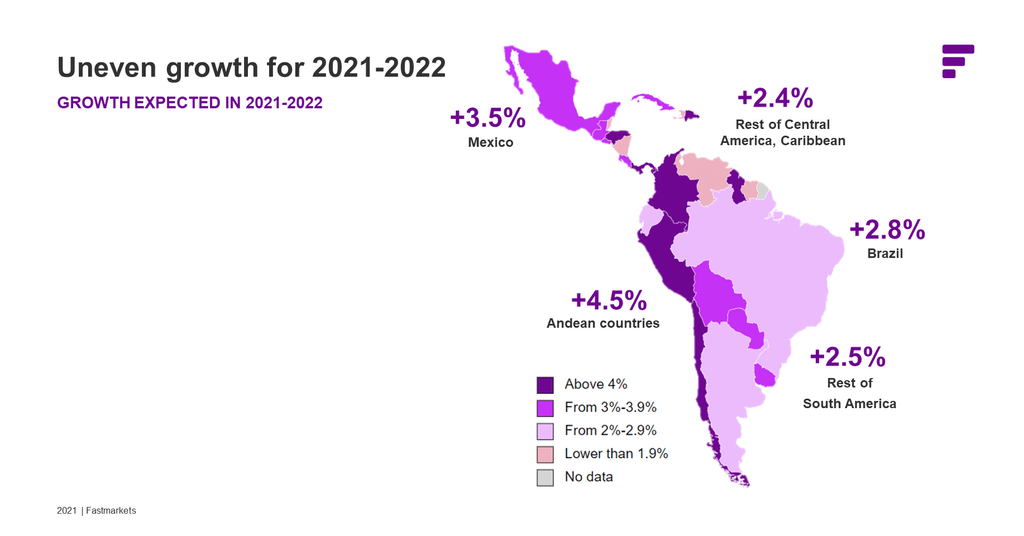

Growth in Latin America will be lower than the global average.

We expect to see Latin America get back to the pre-pandemic levels in three years, growing 3.5% on average in 2021 and 2022.

All sub-regions, South America and Central America and the Caribbean, will recover at a similar pace, boosted by commodity exports and some economic reopening. But the growth rate is uneven on the country level. Chile, Columbia and Peru come out on top, with Mexico close behind.

Economist Rafael Barisauskas presented a detailed Latin America macroeconomic outlook for 2021 and 2022 at our recent our Latin American forest products conference. Learn more about that event here.