CT Asia 2025

Power, Policy and Progress: Coal's Geopolitical and Economic Influence in the Global Energy Transition

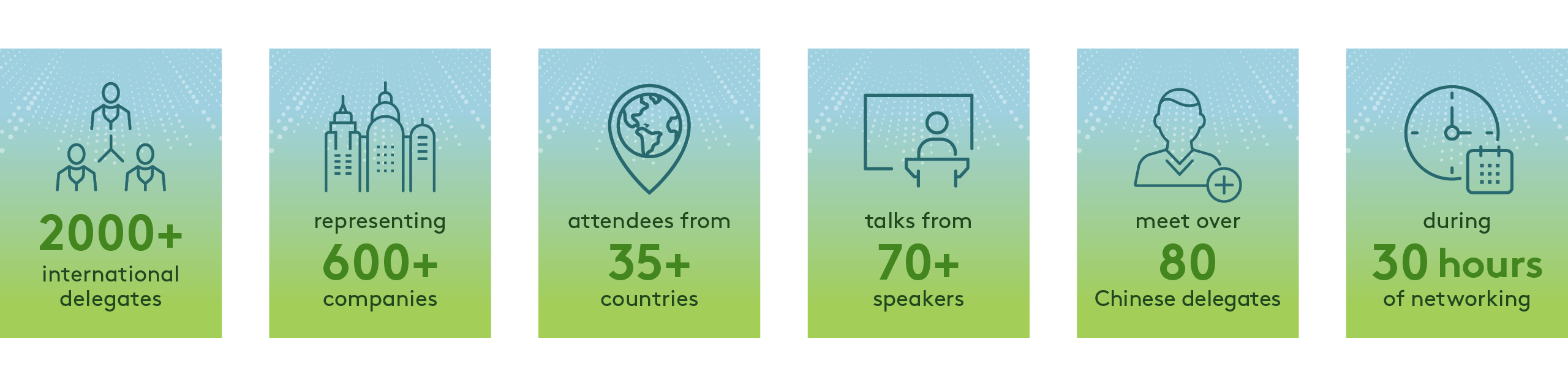

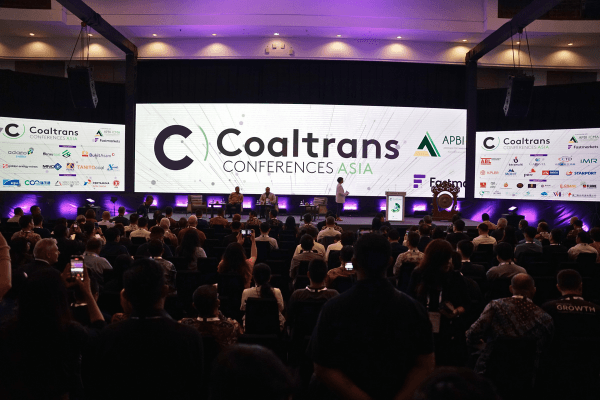

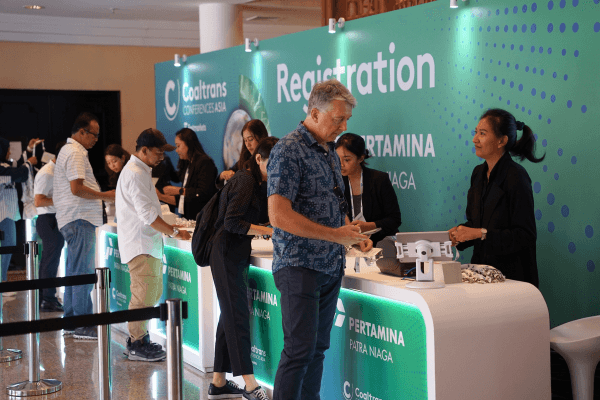

For three decades, Coaltrans Asia has been the best known and longest-running for the global coal industry - bringing together visionaries, decision-makers, and key players to shape the future of coal. Join more than 1,000 of your peers in Bali this September.

As Coaltrans Asia celebrates its 30th anniversary, join us in celebrating this achievement and in ringing the changes. We are looking forward to meeting old friends to share stories from the last 30 years and to welcoming many new attendees to embrace the future of coal.

Coaltrans Asia will always be the longest-running must-attend event in the region for everyone invested in the coal sector’s future but, as the industry diversifies in order to bring about the energy transition, we too will broaden our coverage and so our new name CT Asia reflects that change in focus.

As many of our regular attendees will be aware, we have outgrown our venue in Bali so we are delighted to announce that the 2025 edition will be held at the Intercontinental Bali Resort on the beautiful shores of Jimbaran Bay. We will be able to unite the coal community under one roof in a bespoke setting and are expecting ‘000s of attendees to join us over three days.

Our new venue has enabled us to rethink the look and feel of the event. We have united our very popular meeting areas with our growing exhibition space to create a hub for networking and doing business. The conference and ministerial addresses will take place behind closed doors allowing VIP delegates to focus on key messages as well as spending time on the exhibition floor and in business meetings.

Whether you attend CT Asia to do business, to learn from expert speakers, to rub shoulders with government ministers, to negotiate and trade in person, to make new connections or to catch up with old friends, we have got you covered. Choose from a VIP Access All Areas pass or a Networking pass: we want everyone to get the best outcomes.

Proud to be in association with the APBI-ICMA

Founded on 20th September 1989 as to response to the challenges of coal mining industry in Indonesia. The APBI-ICMA is a non-government, nonprofit and non-political organization that embraces both upstream (exploration and exploitation) and downstream (marketing the distribution, utilization and mining services) aspects of coal industry in Indonesia.

✅Returning for 2025 – Met Coal Forum

A half-day programme delving into coking coal pricing, the met coal landscape in Asia, navigating regulatory hurdles, insights from Australia and the US, together with a panel of steelmakers.

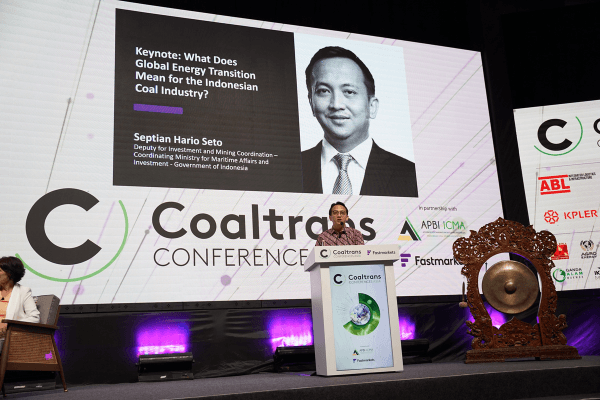

✅Economic and geopolitical forces

How are geopolitical tensions and trade realignments impacting Asia’s coal imports and supply chains?

✅Energy markets in focus: regional insights

Focussed presentations from countries on their plans, how much coal they need to add to their power generation and what the mix would be, together with how they are responding to social and environmental issues.

✅Domestic key issues

Reflecting on the past 30 years of coal and coming right up to date hearing from government, producers and key stakeholders on the latest updates and challenges affecting the Indonesian coal sector.

✅Freight, shipping and logistics

Looking at the supply chain and transportation around South East Asia in our ever popular freight and shipping session

✅Global coal market dynamics

From Global thermal coal supply and demand outlooks, the Trump Effect, navigating the economic slowdown to market analysis on China, Indonesia and India.

✅Coal’s competition

What are coal’s main competitors in Asia’s evolving energy mix and how do they stack up in terms of scalability, reliability and cost?

✅Looking to the future: the next 30 years

From financing the future, capital flows and funding markets through to adapting to a changing world. What role will coal play in the future?

🔥 Unparalleled Networking: Meet industry leaders, decision-makers, and new market entrants in an exclusive setting.

🔥 High-Impact Discussions: Gain insights from top experts on coal’s evolving role in the global energy transition.

🔥 Exclusive 30th Anniversary Celebrations: Honouring the industry’s journey and charting the course for the future.

Join us in Bali, Indonesia, in 2025 as we set the stage for the next chapter of the coal industry. Secure your place now—because this year’s event will redefine the future.

“The greatest event for coal in the world”

“Where the pulse of the industry is!”

“A must visit for coal industry and logistics professionals”

Showcase your brand & expertise

Raise your profile and secure your 2025 branding and sponsorship package by speaking to

Elsie Lim

elsie.lim@fastmarkets.com

Tel: +65 6994 8397

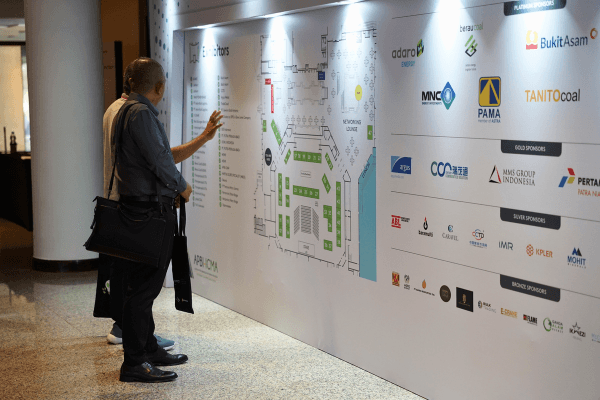

Platinum Sponsors

Mohit Minerals Limited is one of the leading Indian Group predominantly trading in imported coal and domestic coal. The Group has an excellent presence across all the Indian ports and has emerged as one of the largest supplier of coal to power plants and stock and sale markets with a customer base of more than 700. It has long-term contracts and enjoy strong relationship with miners/traders in Indonesia/South Africa/Australia/US which makes it one-stop solution for supplying coal from various origin on end to end basis from mine to plant. The Group is poised for further growth and diversified into other businesses such as iron ore trading, metcoke production, ferro alloy production, commercial mining of Indian coal blocks, coal washeries etc to name a few. It has earned its reputation and various accolades from leading power plants and various industrial groups due to the unmatched dedication and service across various sectors, with the motto of giving the best service and keeping customer-centric approach, the Group is relentlessly working to improve the supply chain logistics and ensure that best quality coal is supplied with utmost reliability and in most cost effective manner.

PT Pamapersada Nusantara (“PAMA”) provides comprehensive mining services to mining owners. PAMA delivers services that cover various aspects of mining production, starting from mine design, exploration, extraction, hauling, barging and transporting commodities.

PAMA consistently managing ESG aspects, applies good mining practices and upholds operational excellence, efficiently managing capital expenditure and maintains growth by selectively acquiring targets. Facing the global commodity fluctuation, PAMA focuses on achieving operational excellence through several initiatives; Improvement of mine design accuracy and increase in cost efficiency through resource optimization programs and also digitalization in each work area as well big data implementation.

RWood Resources is a leading coal trading company strategically headquartered in Dubai, UAE for ease of access to Asia, Middle East and Europe. RWood has a full-fledged operational subsidiary in Indonesia (with presence in Jakarta & East Kalimantan) to focus on procurement and domestic sales, as well as representation in China, India, South Korea, Singapore and Vietnam.

RWood has developed its niche and expertise in sourcing and marketing of Coal by offering wide range of products from established producers of Indonesia varying from 3400 GAR to 6500 GAR.

RWood has nurtured strong relationships with leading power producers, industrial consumers and trade partners globally. Taking advantage of our global presence and by adopting a customer centric approach, we have been consistently performing strong trading volumes year after year to meet customer satisfaction.

Tanitocoal is one of Indonesia’s most prominent and longest-standing producers. It is widely recognised as an industry pioneer and the first private investor in the Indonesian coalfields, having been involved in coal mining since the 1970s. The majority of Tanitocoal’s 10 million tonnes per annum production comes from the Group’s publicly listed company, PT. Harum Energy TBK. Tanitocoal owns concessions in East and Central Kalimantan, supported by the Group’s vertical integration with downstream infrastructure in place of 20 million tonnes per annum capacity. Tanitocoal’s annual production will grow in the short to medium term with the development of a new mine in Central Kalimantan.

www.harumenergy.com | marketing@tanito.co.id

Xcoal Energy & Resources is a leading, worldwide supplier of U.S.A. origin metallurgical and thermal coals. Xcoal supplies low, mid and high volatile hard coking coals, semi soft coking, PCI and anthracite coals to steel customers and thermal coals to electric utility and industrial customers, globally.Innovative logistical processes support Xcoal’s nearly 11 million metric tons of metallurgical and thermal coal exports; specifically, the internationally recognized ‘top off’ operation maximizes vessel efficiencies demonstrating the long term sustainability and competitiveness of U.S.A. origin coals in the global market place. We take pride in our record of providing customers with reliable service, stable quality, and consistent supply

Gold Sponsor

Century Commodities Solution Pte. Ltd. was established in 2011 and owned by CCS Supply Chain Management Co., Ltd which listed on Shanghai Stock Exchange (Stock code: 600180). Century Commodities Solution Pte. Ltd. (CCS International) focuses on global commodity supply chain services, providing one-stop procurement, sales and logistic services for our clients. Our commodity includes but not limited on coal, oil, agricultural products, new energy products. We always conduct the business in a professional and responsible manner, 3 GTP licenses by International Enterprise (IE) Singapore and BUMN award by Indonesia Minister of State-Owned Enterprises are the proof that we are trusted company and will always growth to support our clients.

MMS Resources (MMSR) stands as MMS Group Indonesia (MMSGI)’s business pillar which provides integrated mining management services encompassing all aspects from upstream to downstream. The coal main assets managed by MMSR are located in East Kalimantan, Indonesia. These assets are MHU (Multi Harapan Utama), GBU (Gunung Bara Utama) and Pari Coal. Leveraging its end-to-end expertise in coal mining, MMS Resources also provides mining services encompassing engineering (mine planning to exploitation), HSE management as well as legal and finance & accounting services to 3rd party. MMSR prides itself in its ability to turn around mining assets profitably and helping to supply energy for Indonesia to grow sustainably.

Silver Sponsors

Argus is the leading independent provider of market intelligence to the global energy and commodity markets. We offer essential price assessments, news, analytics, consulting services, data science tools and industry conferences to illuminate complex and opaque commodity markets.

Headquartered in London with over 1,400 staff, Argus is an independent media organisation with 30 offices in the world’s principal commodity trading hubs.

Companies, trading firms and governments in 160 countries around the world trust Argus data to make decisions, analyse situations, manage risk, facilitate trading and for long-term planning. Argus prices are used as trusted benchmarks around the world for pricing transportation, commodities and energy.

The Caravel Group is a diversified conglomerate headquartered in Hong Kong SAR with three verticals: Commodities, Maritime and Investment Management. Within Commodities, the Group is engaged in the trading and logistics of industrial dry bulk raw materials, namely iron ore and thermal coal. Within the Maritime vertical, the Group is focused on third-party ship management, and as well ship ownership – managing operating and/or owning more than 700 sea-going vessels across the dry bulk, chemical and gas tanker, and container segments.. Within Investment Management, the Group is primarily focused on direct investments in global liquid markets including public equity and credit, across all industries. In addition, the Group invests in alternative investments – mainly private equity and hedge funds – to diversify risks and sustain long-term returns.

IMR Metallurgical Resources (IMR) continues to drive world trade by supplying raw materials to the Steel and Power Industry. It specializes in the trade of Thermal & Coking Coal, Metallurgical Coke, Scrap, Ferrous & Non Ferrous Ores, Pig Iron & Ferro Alloys.

To complement its core trading activities, the IMR group has invested in Upstream & Downstream assets in Indonesia, India, South Africa, Mexico and China therein further strengthening its footing in the global markets not only as a trader but also as a producer.

With over 25 years of trading experience & financial expertise, IMR has positioned itself as a leading global commodity partner, continually supporting and meeting the dynamic requisites of suppliers and buyers worldwide.

Kpler is a fast-growing data and analytics company on a mission to facilitate sustainable and efficient trade, to meet the changing needs of our world. From numerous disparate and unstructured sources, Kpler creates data and analytics that bring transparency in dynamic markets characterised by opaque and incomplete information, such as commodity markets. Kpler delivers its unique offering through technology solutions built in an agile and inventive way, enabling market professionals to make informed and timely trading decisions.

Headquartered in Brussels, Kpler employs over 200 people across the world. In 2022, world-leading private equity firms Five Arrows and Insight Partners invested over $200 million in Kpler (minority stake). The company’s recent acquisitions include ClipperData (2021) and JBC Energy (2022).

SUCOFINDO specializes in providing comprehensive inspection services tailored for the coal and mineral mining industry. With extensive experience and a commitment to excellence, we ensure safety, quality, and regulatory compliance in mining operations. Our services encompass safety inspections, quality control, environmental assessments, and supply chain management. Leveraging advanced technology and industry expertise, we support sustainable development and responsible practices. Trusted by mining companies and regulatory agencies, SUCOFINDO are your reliable partner for safeguarding the integrity of coal and mineral mining operations in Indonesia and beyond.

Bronze Sponsors

Aditya Birla Global Trading ( formerly Swiss Singapore ), is a part of the $ 60 Billion Aditya Birla Group and a commodities trading house moving industrial raw materials and food products to over 10,000 clients across 80+ countries worldwide for more than 43 years .

Incorporated in Singapore in 1978, we have grown to achieve an annual turnover of over US $7 billion and physical trading volume in excess of 35 million tons per year.

Powered by a strong professional team of 350+ employees spread across 23

geographies, we have the reach and scale to service our clients across the globe.

Aditya Birla Global Trading sources and supplies Coal, Sulphur, Fertilizer, Pulses, Grains, Rice, Iron Ore, Steel, Petroleum products and Tea globally and provide international logistics.

E-Crane is your proven partner for offering solutions to the coal handling industry in ports and river terminals. Customized solutions are offered for stationary and mobile equipment, floating cranes, as well as transhippers with capacities of up to 3,000 TPH.

Our main objective is always to provide high-end coal handling solutions built around the E-Crane, which offer a reliable and long-term operation with the lowest possible OPEX combined with the highest crane availability in the industry. This is accomplished by offering a high level of customization while, at the same, offering in depth training for operators & maintenance personnel.

We are a subsidiary of FLAME SA established in Singapore in 2014. We are part of an international trading and shipping group and we focus predominantly on Indonesian sourcing and flows to Asian markets.

We take pride in our nimble and diverse team of experienced traders who is always up to the challenge of serving the requirements of our ample customer base.

Oza Holdings (www.ozaholdings.com) invests in mining and manufacturing assets. Its flagship, Ikwezi Mining serves metallurgical and thermal coal customers located in over twenty-five countries, across Africa, Asia and Europe.

With a resource base exceeding 400 million tons and annual sales volume of about 3 million tons, operations in South Africa’s Kwa-Zulu Natal province include three open-cast and two underground mines, wash plants across three locations, rail load-out facilities and a calcination plant to produce calcined anthracite products. Ports of Richards Bay and Durban are used for export of coal products.

Oza owns Cemza, cement industry leader in Eastern Cape province of South Africa, offering its customers high-quality cement products.

At Light Energy, we are not just a coal trading company—we are a trusted partner, ensuring industries across Asia have reliable energy supplies. With years of experience, integrity, and a focus on sustainability, we help businesses grow.

Operating from Dubai and Jakarta, we are positioned at the heart of Indonesia’s coal industry. Dubai’s global business hub allows us to connect markets efficiently.

We specialize in sourcing, trading, and distributing Indonesian coal, maintaining strict quality and reliability. Our family-style approach builds long-term partnerships with producers and clients.

At Light Energy, we don’t just trade coal—we build relationships, create value, and power industries forward.

McCloskey by OPIS, a Dow Jones company, delivers essential coal, metals and mining industry capabilities to help clients understand market dynamics, inform strategic planning, and position their company for success leveraging knowledgeable insight and advisory support from McCloskey experts. Our coal services include reliable and independent market news, reporting and analysis, strategic outlooks and robust forecasting, and detailed coal price indexes, data and industry analytics. We support industry participants by helping them to: understand the context of supply and demand changes by market; identify arbitrage opportunities with analysis of coal’s economic standing against competing energy or steelmaking raw materials products; assess competitiveness of suppliers and benchmark purchasing strategy; track global trade flows by quality and final industry use to inform trading and selling strategy.

McCloskey was previously the coal, metals and mining service under IHS Markit, but was recently acquired by Dow Jones as part of its purchase of OPIS, a highly profitable and growing digital data, analytics and insights provider. For more information, and to see how we can support your business with integrated coverage across the coal, metals and mining value chain, visit: www.opisnet.com/coal-metals-mining

Founded in 2015, Netbulk is the forward-thinking Singaporean trading house driving the future of commodities. As an energy transition company, we deliver a comprehensive portfolio of steam coal, metals, bulk alloys, and greener fuels, all backed by our world-class risk management system and the expertise of a team with over 150 years of combined experience. Navigate the global market with confidence and presence in multiple countries, ensuring seamless transactions. Join us in building a sustainable future. Netbulk is committed to Singapore’s vision of net-zero emissions by 2050, and we’re here to help you achieve your own sustainability goals. Contact Netbulk today to unlock a world of opportunity.

Founded in 2004, PT Virema Impex has established itself as a prominent player with over 20 years of experience in bulk commodity trading, specializing in Indonesian Coal, Nickel Ore, and Manganese ore. Headquartered in Indonesia and having offices in Dubai and Singapore, we have cultivated relationships with customers in more than 10 countries, earning trust as a committed supplier. Virema consistently delivers 5 million metric tons of coal each year, demonstrating its commitment to quality and reliability. Renowned for its high professionalism, reliability, and exceptional service, the company has built a strong reputation in the international market as well as domestic market.

Welhunt is an Asian focused trading company with 10 country offices present around the world. Established in 1992, Welhunt trade volume exceeded 17 million tons of physical commodity with steam coal as predominant product in 2021, improving supply chain to long term clients and optimizing the arbitrage in the ever-dynamic market where origination and destinations of traded products cover more than 15 different countries worldwide.

Exhibitors

globalCOAL provides an online physical trading platform for standardised thermal and metallurgical coals, based on SCoTA terms, as well as a fully bespoke brokerage service for non-standardised coals.

The online coal trading activity provides real-time objective price data for determining the gC indices, against which futures contracts are settled.

The Liebherr Group is a family-run technology company with a broadly diversified product programme, which includes a total of 13 product segments.

Originating in Germany, the key characteristic is our commitment to innovation and quality, producing high end engineered products. Liebherr maintains a strong global presence, with numerous production sites and sales and service companies across the world.

Liebherr sees itself as a pioneer. It is with this pioneering spirit that the company makes a decisive contribution to the history of technology in many industries and already dedicates itself today to challenges that customers will face tomorrow.

Scantech has been a leader in online analysis technology for over 40 years, delivering proven solutions for real-time coal quality monitoring. Since the 1980s, COALSCAN has set the standard for on-conveyor coal analysis, evolving into the most comprehensive range of analysers available. Designed for blending, sorting, and process optimisation, COALSCAN helps operations improve feed and product quality, reduce unnecessary processing, and enhance resource utilisation. COALSCAN has helped operations process coal more efficiently, maximising productivity and operational control.

Shanghai Peiner SMAG Machinery Co., Ltd is a German-invested company established in 1995. Specializing in the design, development, and manufacturing of lifting, transportation, loading, and unloading machinery, the company holds the renowned “PEINER” grab technology and trademark under license. Its operations and management are aligned with those of its parent company, PSLT, part of the SMAG group in Germany. As a prominent domestic producer of grabs, the company is distinguished by its robust technical capabilities, state-of-the-art processing equipment, comprehensive quality assurance system, and full suite of inspection facilities. Key personnel across design, production, quality control, and sales have all undergone professional training in Germany.

Media Partners & Supporters

Petromindo.Com has been actively supporting Indonesian petroleum, mining and power sector by providing them with information through our website : www.petromindo.com

Our extensive network and experience in the industry has enabled Petromindo.Com to stay ahead in delivering news and information. We understand the industries and are willing to support them in doing their works more efficiently by providing them with quality news and information.

Petromindo.Com also publishes directories such as Indonesian coal mining, minerals mining, oil and gas, and electricity industries in Indonesia, including Coal Metal Asia Magazine a premier English magazine which is focused on the coal and mineral industries.

Djakarta Mining Club will be fostering of bilateral business but will have as its primary function to promote sustainable minerals production through the education of the masses, through promotion of ongoing exploration and through planned and ongoing dialogue between stakeholders in the mining industry conducted in a non-threatening Safe and conducive environment.

TAMBANG magazine make the best effort to present various information related to the mining & energy world, with the deep review but easy to read presentation. In addition, TAMBANG magazine is also trying to deliver mining & energy information with the simple, popular wording style that would be accepted by many people.

globalCOAL provides an online physical trading platform for standardised thermal and metallurgical coals, based on SCoTA terms, as well as a fully bespoke brokerage service for non-standardised coals.

The online coal trading activity provides real-time objective price data for determining the gC indices, against which futures contracts are settled.