Automotive

Your guide to commodity market trends, pricing dynamics and the automotive raw materials supply chain

Our automotive customers get access to in-depth price data and short- and long-term forecasting and analysis for the following raw materials

- Agriculture: Biofuels, hides and leather

- Forest products: Paper packaging, pallets

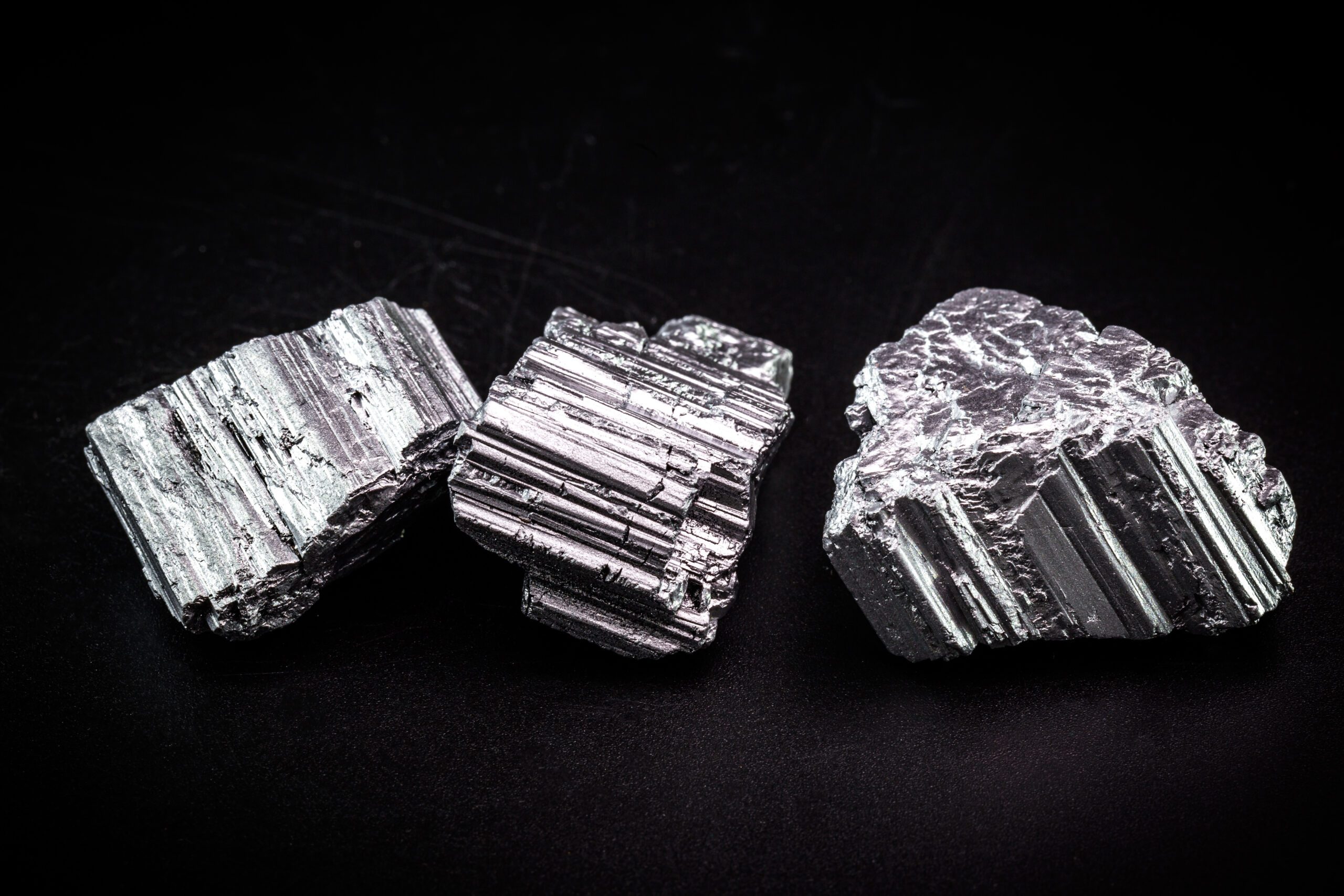

- Metals and mining: Base metals, battery raw materials, rare earths, steel, scrap

Our battery raw materials analytics include a Battery Recycling Outlook and Battery Cost Index. We continue to expand our coverage as the global automotive market evolves.

Learn more about the products and services that make up Fastmarkets’ automotive suite:

Breaking news and market-reflective commodity prices, even when markets are at their most volatile.

Commodities covered: Steel, scrap, base and minor metals, ores and alloys, industrial minerals, pallets, rare earths, packaging, biofuels, hides and leather

Analysis of the forces moving your markets and how they’ll play out over the next 1-2 years.

Commodities covered: Steel, scrap, base and minor metals, ores and alloys, industrial minerals, rare earths, packaging

5- and 15-year forecasts underpinned by deep industry expertise, macroeconomic analysis and 50 years of historical data.

Commodities covered: Battery raw materials

Leave your details and we’ll call you back.

Volatile prices

Price volatility is nothing new for procurement professionals familiar with the vagaries of global commodity markets. And yet, recent price volatility is straining material management processes and supplier relationships.

Fastmarkets helps automakers anticipate and hedge against price risk and put in place more robust pricing practices.

Opaque markets

Market complexity, dependence on imports from distant shores, supply insecurity, accessing new subsidies driven by the Inflation Reduction Act and the EU Battery Directive, unanticipated changes in regulation, recycling mandates and imperatives — it’s a lot to juggle.

Fastmarkets gives automakers access to a network of expert price reporters and analysts, deeply immersed in their markets. Our news and analysis services bring their insights to you in real time.

Supply chain uncertainty

Every link of the automotive supply chain has been tested to its limits in recent years. When the business turns to the planning and strategy team to predict the market’s next move, that team turns to Fastmarkets.

Fastmarkets equips automakers with up-to-date market analysis, coverage of the latest news and trends moving the market and access to experts. Our in-depth analysis of the EV value chain includes cost differentials as well as prices, forecasts and subsidy impacts for the US, Europe, China and the rest of Asia.

Looking for a specific price? Search our database for one of our 5,500+ prices.

Automakers have long relied on Fastmarkets’ price data, news and analysis to inform their procurement strategies and manage risk for traditional automotive raw materials such as leather, steel and aluminium. Automakers now also partner with Fastmarkets to inform their electrification and sustainability strategies, leveraging our expertise in battery raw materials and rare earths, green metals and more.

- Fastmarkets has more than 100 years’ experience in analyzing and pricing commodity markets.

- We hold benchmark prices in lithium, iron ore, aluminium and many other key materials.

- We’ve got more than 600 team members worldwide, with price reporters on the ground in key markets, as well as analysts and editorial teams who are researching and reporting on shifting market dynamics.

Download the product brochure to learn more.

Our team of commodity market experts and price reporters provide weekly prices and market analysis for the automotive industry.

The US-Ukraine mineral partnership deal has stalled due to security concerns, leaving future negotiations uncertain despite Ukraine’s critical role in global mineral supplies. Meanwhile, President Trump has imposed tariffs on Canada, Mexico, and China and launched a copper import investigation to address national security risks and reduce reliance on foreign resources.

Trump’s steel tariffs aim to boost the US steel industry by taxing imported steel and encouraging domestic production. The goal is to make U.S. steel more competitive globally while addressing national security and trade concerns. However, the tariffs have caused international tension, reshaping trade ties and raising questions about costs for U.S. businesses relying on steel imports.

Here are the key takeaways from market participants on US ferrous scrap metal prices, market confidence, inventory and more from our January survey.

US President Donald Trump’s address to Congress on Tuesday March 4 contained key strategic policy objectives that will have a direct impact on global metals markets. Fastmarkets takes a high-level view of the key strategies below: “They tariff us…we will tariff them.” The Trump administration will introduce reciprocal tariffs on all countries that levy duties […]

Tariffs on steel and aluminum will raise US car prices, increase production costs, and squeeze profit margins. Smaller car companies may struggle to compete, while retaliatory actions could disrupt the global auto market, reshaping manufacturing and trade industry-wide.

Trump’s tariffs on Canadian and Mexican metals have introduced significant instability to the U.S. metals sector. The 25% tariffs, coupled with retaliatory measures from Canada and Mexico, have fuelled price volatility, supply chain disruptions, and operational uncertainty across multiple industries. These trade policies are reshaping global market dynamics as stakeholders brace for long-term impacts on steel, aluminium, copper, and other metal commodities.

The Indian steel industry faces challenges as coking coal demand grows amid supply issues. Insights from Coaltrans India 2025 highlight India’s reliance on Australian coal, rising met coke imports, and strategies like blending domestic coal with high-quality options.

Iron ore markets face major shifts as an oversupply looms in 2025, driven by weak demand from Chinese steel mills and changing pricing trends. Key players like Vale and Rio Tinto are tackling challenges such as fluctuating shipments, blending practices in China, and a competitive global market.

ACE Green is revolutionizing the battery recycling industry by focusing on LFP recycling through innovative, modular, and low-capex technology.

Download this checklist help you create effective procurement strategies.

Whether you’re interested in learning how to become a customer from our sales teams or looking to get in touch with one of our reporters, we’re here for you.

Navigate uncertainty and make business decisions with confidence using our price data, forecasts and critical intelligence.

Metal Bulletin • American Metal Market • Scrap Price Bulletin • Industrial Minerals • RISI • FOEX • The Jacobsen • Agricensus • Palm Oil Analytics • Random Lengths • FastMarkets and more