Fastmarkets takes a look at the differences and similarities in the market situations of 2008 and 2020.

Domestic prices for both flat and long steel products increased dramatically in the second half of 2020. One of the main drivers was a shortage of both domestic and imported steel products after demand started to recover.

Due to Covid-19 lockdown measures across Europe in the first half of last year, a number of steelmakers had to idle capacities to balance supply with sharply declined demand. While electric arc furnace (EAF)-based long steel producers were quick to restart their facilities, blast furnaces remained shut for longer.

Availability of imports has also been limited due to trade protection measures in place combined with a global price recovery. Market sources claimed that traditional non-European Union suppliers preferred to divert material to alternative markets because although prices in Europe recovered, growth was slower compared with other regions.

Most market sources believe that, following rapid rises in 2020 and early 2021, prices will fall. They discussed two possible scenarios: prices will decrease substantially but the price level should remain high compared with the previous year; or that prices will collapse mimicking the 2008 situation.

Flat steel

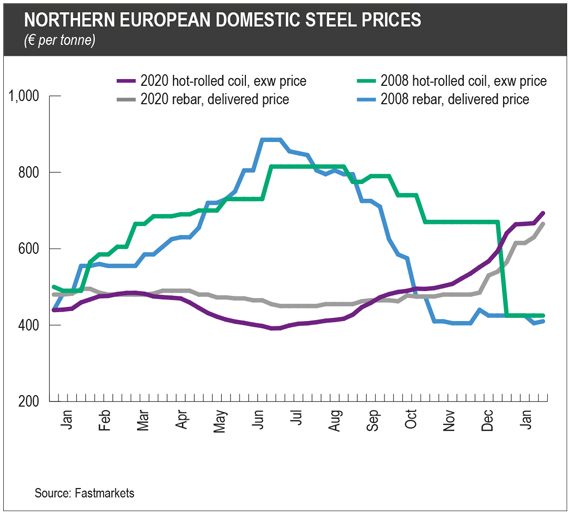

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe at €691.25 ($840.90) per tonne on January 13, up by €67.92 per tonne month on month and up by €278.75 per tonne since August 3, when the recovery started.

In 2008, the HRC index hit a high of €800-830 per tonne ex-works on June 18, before plunging to a low of €320-400 per tonne in April 2009.

Production cuts

A number of European producers temporarily idled blast furnaces in the first half of the year in response to the pandemic-related demand fall.

Although producers started to announce restarts of their idled furnaces in the autumn of 2020, this did not immediately ease a shortage of flat steel in Europe. In Germany, for example, blast furnace production in the January-November period trailed 2019’s output by 15%, according to German steel federation WV Stahl. Market participants estimate that production should increase further in late first quarter-second quarter of 2021 as restarting blast furnaces and achieving normal production rates takes about two to three months.

Delivery time

Because of reduced domestic production and a limited availability of imported material, delivery times at mills have lengthened significantly.

Coil producers in both the north and south of the EU sold out of first-quarter rolling coil in October 2020 and have been offering second-quarter production material since then.

Delivery time, however, is likely to shorten when utilization rates increase and the backlog of demand from the automotive industry eases, market sources said.

Automotive industry

Strong demand from the automotive segment was one of the key factors behind domestic coil price rises across Europe. Market participants, however, believe that high buying activity from car manufacturers was mainly driven by a backlog of demand after most car production was stopped during the lockdown. As a result, demand will soon moderate, participants said.

Long-term contracts settled in the fourth quarter of 2020 were reported at about €100-200 per tonne below current spot prices. In addition, long-term buyers have been complaining that they have been struggling to get agreed volumes from mills.

This situation prompted concerns among some market sources that mills could break long-term contracts, which is what happened in 2008 when domestic prices rose rapidly. Although sources confirm they have heard speculation of this, the majority of them believe it to be only rumors. Many, however, do believe producers could switch to shorter-term contracts in the future, a repeat of what happened in 2016 when raw material costs had risen rapidly.

Safeguards, anti-dumping

Unlike in 2008, imports have been limited by a number of trade protection cases.

In the specific case of HRC, last year the European Commission replaced yearly country-specific quotas with quarterly ones. This change left independent European buyers with fewer sources of overseas material, forcing them to turn to domestic suppliers.

In January 2021, the EC set provisional anti-dumping duties at 4.8-7.6% on HRC originating from Turkey, which is one of the main suppliers to the EU market.

The combination of trade measures has left European buyers with limited access to overseas coil.

But market sources believe the safeguard measures will be either removed or replaced with a milder alternative at the end of the second quarter. These changes should increase the availability of coil and reduce supply-side support for price rises.

Outlook

Despite the current price uptrend, the mood in the market is getting more bearish.

“Buyers are getting increasingly concerned about a possible overheating. Prices went up too fast too high. Many buyers, however, have covered demand until July and [are going to] just lean back and wait and see. Others are in panic as they did not cover or lost tonnage due to mills’ default,” a German distributor said.

“Generally, the feeling is that this rally is short-lived, and will last at maximum until end of the second-quarter delivery. Once supply and demand are in balance again, prices will drop. At least main buyers fear this and are acting carefully.”

But unlike the situation in 2008, demand should remain strong this year, supported by an expected expansion in output at all major steel consumers, such as automotive, domestic appliances and metal goods, according to Fastmarkets research analysts.

Fastmarkets analysts also pointed to a return in investment in new machinery alongside resumed business confidence and, in the longer term, an increased interest in automation and robotics as supporting flat steel demand in the region.

According to their analysis, flat steel prices will peak in the first quarter of the year, when supply tightness eases and buyers rebuild their inventories that were depleted during 2020. After this, prices should follow the downward trend through the rest of 2021. But thanks to buoyant demand, flat steel prices are still likely to remain at historically high levels, avoiding the 2008-like crush scenario.

Long steel

The price of rebar in the north of Europe has been rising continuously since late November 2020, and on a monthly average basis since August 2020, supported by surging scrap costs, solid demand and tightness of supply of both finished steel and raw materials.

Fastmarkets’ weekly price assessment for steel reinforcing bar (rebar), domestic, delivered Northern Europe surged to €660-670 per tonne on January 13, up by €30-40 per tonne and the highest since August 2008.

By comparison, the steel rebar price in 2008 peaked at €885 per tonne in June, an all-time high, before dropping by almost €100 per tonne to €795 per tonne in July, and touched its annual low of €410 per tonne in October.

At the time of writing, the market had not yet fully restarted after the festive season, and producers in Northern Europe said they expect rebar prices in the first quarter to be in the range of €670-680 per tonne delivered.

Construction industry

The construction sector, the major rebar consuming industry, performed relatively well in most EU states in 2020 despite the pandemic, proving largely resilient to its effects.

“Construction always reacts more slowly to economic earthquakes, being more flexible than the other sectors,” one source said.

In its latest market outlook report published on October 28, 2020, European steel association Eurofer said it expected construction output to have declined in EU states by 3.6% in 2020, while output in the automotive sector, the major flat steel consumer, was expected to be the worst affected among steel end sectors over the course of 2020, with an estimated annual slump of 20.6% – the largest decrease on record.

While both forecasts have been revised up since August, the effect of Covid-19 restrictions on the construction industry remains far less than that on automotive. In Eurofer’s report published on August 5, construction output was expected to drop by 5.3% and automotive output by 26%. The outlook for construction has become more optimistic due to better than expected performance across the EU mostly driven by public sector projects.

One of the reasons behind rebar prices tumbling in 2008 was that construction sector output in Germany – the major EU economy – was already falling since 2006, prior to the crash in 2008, according to market sources.

Inventories and production

Demand has outpaced supply in the EU long steel market over the past couple months, helping to push prices up and also supporting the wider spread over scrap costs.

Based on German steel stockholders federation Bundesverband Deutscher Stahlhandel (BDS) information on German inventories at stockists as of November 2020, stocks levels were at their lowest on record since at least 2007, possibly in part because supply was increasingly tight due to output cuts and/or stoppages while stockists have largely been wary of building up inventories amid market uncertainty.

This is in contrast to 2008, during which inventories of long steel at stockists peaked when prices rose. Stockists were likely holding on to long steel to take advantage of rising prices but were subsequently hit by the fall in prices.

In terms of production levels, output from EAFs – which is mainly used in the production of long steel products – in Germany was down by 4% year on year in first 11 months of 2020, according to German steel federation WV Stahl, due to output cuts in the first half of 2020 during lockdowns to curb the Covid-19 pandemic.

In 2008, EAF output in Germany actually increased by 1.22% from 2007 levels, according to WV Stahl. This suggests tighter supply is more of a driver of rising prices now than it was in 2008.

In Italy, long steel production over the first 11 months of 2020 was also down year on year, also due to Covid-19-related shutdowns. Similarly to in Germany, EAF output had been up year on year in 2007 and much of 2008 in Italy, also indicating that supply is tighter now in comparison with 2008.

Outlook

Market sources have drawn parallels between the current price rises and the situation in 2008. In the earlier scenario, prices collapsed after a similarly sharp price increase. Yet despite the similarity of the upward price trajectories, sources do not believe there will be a sharp crash in 2021 comparable to 2008.

“The way prices are moving is similar to 2008; when there’s a bubble there are concerns over how big the burst will be. Prices will correct but we are not anticipating a massive correction; there is China [imports], Russia [export duty]; these are new factors, which are changing the environment. In 2004-2008 prices went up with no fundamental change in environment,” one mill source in the EU said.

The outlook for the long steel sector in 2021 is uncertain. On the one hand, firm prices are being supported by costlier scrap, tight supply, and good demand; and market sources say this is likely to remain in the first quarter of 2021.

“New prices will certainly be higher, considering that there is a shortage of everything – scrap and rebar,” one trader said.

On the other hand, the market’s prospects are unclear beyond this and there are questions about the sustainability of the current elevated price levels.

“The market is overheated, it cannot last long,” another trader said.

Yet demand from construction, the key long steel consumer, is not expected to crash like it did back in 2008, according to industry sources. Oxford Economics forecasts eurozone construction sector output to reach pre-Covid-19 levels by the fourth quarter of 2021, in stark contrast to the nosedive and prolonged recovery that took place in 2008.

Fastmarkets’ research team expects rebar prices in Europe to remain above 2020 levels for much of 2021, supported by healthy demand from the construction sector.

For both flat and long steel in Europe it appears that the similarities to 2008 are superficial and that, while price corrections are indeed expected, healthy underlying demand will support the markets at historically high levels over the coming year. Nevertheless, the view of Fastmarkets research is that the repercussions of the Covid-19 pandemic will continue to reverberate in the steel industry, bringing uncertainty and price volatility in what could be another rollercoaster year.