With the quota exhausted, importers who wish to continue bringing the material into the country via import licenses will now be subject to a 25% duty, compared with the 10.8% tariffs previously charged.

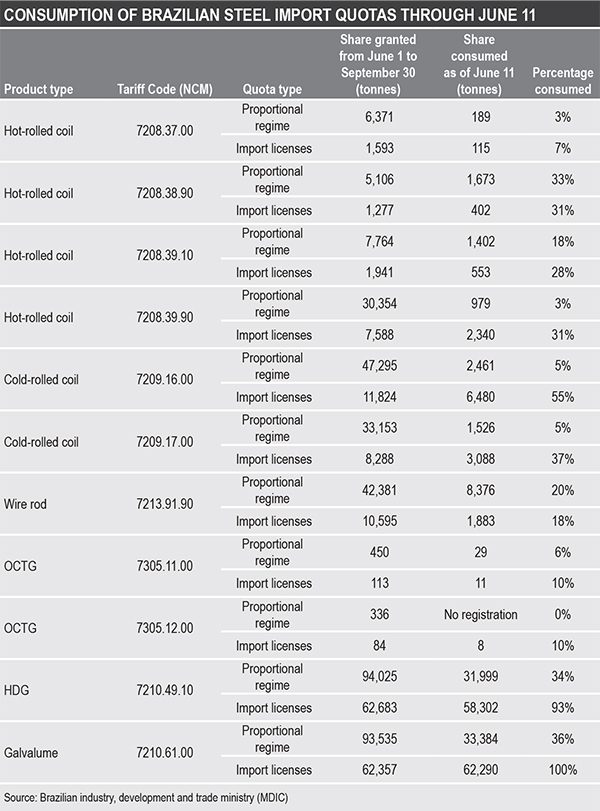

Meanwhile, the portion of the Galvalume quotas reserved for larger importers, subject to a different regime than import licenses, was 36% consumed by June 11. The ministry recorded 33,384 tonnes brought to Brazil for these participants, out of the allowed total of 93,535 tonnes, as shown in the table below.

“We may see now two price levels on the market, with a difference of more than 10%, since the portion of quotas reserved for larger importers [submitted to a proportional regime] has not yet been consumed,” an import source said.

Although the arrival of quotas in June caused some apprehension in the flat steel import market, Galvalume prices were practically stable.

Fastmarkets’ weekly assessment for steel coil Galvalume import, cfr main ports South America was $780-810 per tonne on Friday June 7, widening from $785-805 per tonne on May 31.

The Brazilian import quotas came into force on June 1, after the local industry spent months requesting a duty barrier that could contain steel imports, mainly from China, arguing that these competitors were using predatory pricing practices and discouraging investments in the country.

As a response, the government has established two different ways of coordinating the steel import quota, depending on the size of the importer.

For larger importers, a proportional regime was defined, depending on that buyer’s volume history of acquisition. For the smaller importers, a minor portion of the quotas was reserved, which would be distributed in order of request for import licenses.

The national annual quotas were defined by adding 30% to the 2020-2022 average of imports, and this volume was then divided into four-month periods: June 1 to September 30; October 1 to January 31; and from February 1 to May 31.

The volumes designated for each period should be sufficient to cover steel imports for at least a few months. But, since the import modality via import licenses is released by order of requisition, some market participants stated that there was a rush in issuing orders.

Starting on Monday June 10, importers began telling Fastmarkets that some of their import licenses were rejected by the government, particularly for Galvalume. But some of them were still unsure whether the refusal indicated an exhaustion of quotas or an error in filling out the order.

In addition to Galvalume, MDIC’s data shows that the hot-dipped galvanized import license portion of the quotas has been 93% used as of June 11, with 58,302 tonnes consumed out of the 4-month quota of 62,683 tonnes reserved for the material.

Cold-rolled coil is another product that was significantly acquired via import license in the 10 days since the measure came into force, with 55% of the reserved quotas consumed; of the total 11,824 tonnes, MDIC recorded the purchase of 6,480 tonnes.

According to MDIC, the Foreign Trade Secretariat (Secex) will publish a weekly update of the previous table, with the consumption of the tariff quotas for steel imports, on the Integrated Foreign Trade System (Siscomex) website.

Galvalume® is a registered trademark of BIEC International.

We provide more than 250 steel prices, including industry benchmarks from across the globe. Fastmarkets’ steel price data combines the intelligence of industry-leading brands such as Metal Bulletin, American Metal Market, Scrap Price Bulletin and Industrial Minerals. Talk to us about our steel price data options today.