Specialty grains have blossomed into a multi-billion-dollar business as consumer tastes for organic products continue to grow. The conventional grain sector has benefited from robust risk management tools. In contrast, until recently, specialty grain farmers have been unable to reduce their exposure to volatile market prices.

Fortunately, farmers can now take advantage of elevated specialty grain prices. With organic corn prices near $12 per bushel mid-West, farmers are using these high prices to hedge their organic corn exposure.

Several organic corn hedges have been transacted through financial solutions provider, Stable, where consumers were looking to lock in their exposure to rising or falling organic corn prices. Many have decided to mitigate their risks by hedging during the most volatile periods.

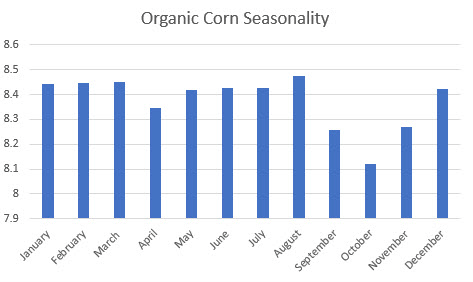

Seasonally, the Q3 and beginning of Q4 can be the most challenging for organic grain market participants.

Seasonally, the market climbs in price in the second quarter, usually peaking in August and then dropping ahead of the new crop organic corn marketing year.

Seasonally, the market climbs in price in the second quarter, usually peaking in August and then dropping ahead of the new crop organic corn marketing year.

More recently, growers have hedged their exposure to falling organic corn prices using Fastmarkets’ organic corn data ahead of the volatile new crop season.

How farmers are hedging their organic corn

Organic corn hedging is facilitated through a market maker that will provide you with a financial solution that derives its payout through Fastmarkets’ organic corn mid-West price data. Growers concerned about falling prices could use put options to mitigate downside risks.

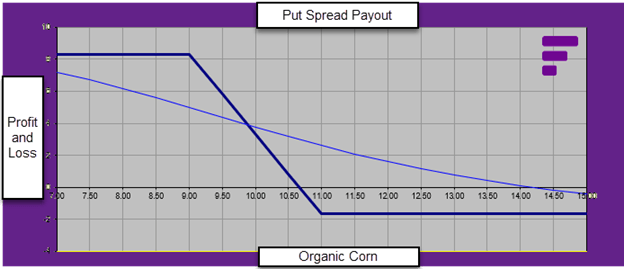

A put option on organic corn is the right but not the obligation to sell organic corn at a specific price on or before a particular date. For example, a farmer might be concerned that the value of organic corn falls in September just ahead of the harvest of new crop corn. A put spread option caps the amount you can receive if the price of organic corn drops. A put spread is created by purchasing one put option and simultaneously selling another put option with a lower strike

You can see in the payout profile of an $11-$9 organic corn put spread that you generate revenue from the put spread as the price of organic corn falls below $11. Once the price hits $9, the gains are capped. At any price at $11 or above, your put spread expires worthless. The upshot is that growers are starting to take advantage of risk mitigation tools. Using a put spread, you can hedge a portion of your organic corn exposure using financial products based on the prices reported by Fastmarkets agriculture.

The upshot is that growers are starting to take advantage of risk mitigation tools. Using a put spread, you can hedge a portion of your organic corn exposure using financial products based on the prices reported by Fastmarkets agriculture.

A grower can use this strategy to protect organic corn currently in storage, on a field, or before planting. You can customize the financial trades to match the period you want to reduce your physical organic corn price exposure.

What to learn more? Talk to us about risk management and commodity hedging.