With less than eight months to go before the implementation period for the European Deforestation Regulation (EUDR) ends on December 30, concerns are mounting in the pulp, paper and printing industries over the potential threats that the legislation poses to European companies.

The regulation, which came into force on June 29, 2023, and which gave stakeholders 18 months to implement the new rules, aims at minimizing the EU’s part in deforestation and forest degradation worldwide, as well as reducing its contribution to greenhouse gas emissions and global biodiversity loss. The scope of the regulation includes commodities, namely cattle, cocoa, coffee, palm oil, rubber, soya and wood, as well as relevant products including pulp, paper and printed products.

According to the regulation, relevant commodities and products shall not be placed or made available on the European market or exported, unless they are deforestation-free, they have been produced in accordance with the relevant legislation of the country of production and are covered by a due diligence statement.

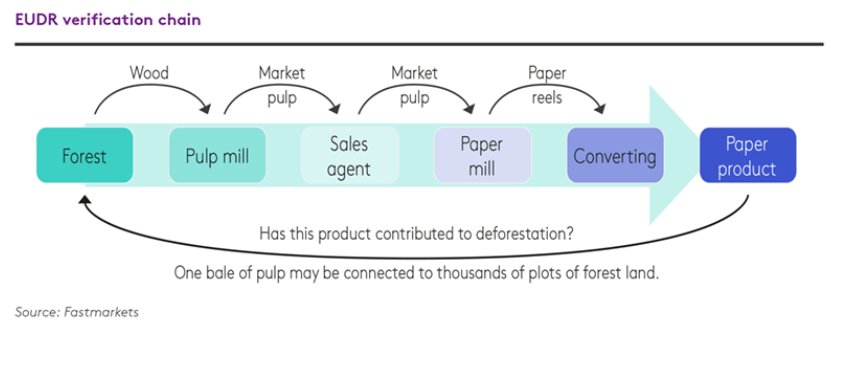

The due diligence obligation is actually one of the pivotal points of the EUDR: every company trading one of the listed products in or out of the EU must ensure traceability back to the specific plot of land where the fibers originated. The due diligence statement requires the collection of the exact geographic coordinates for each plot involved plus other information, documents and data which demonstrate that the relevant products are deforestation-free. The due diligence also includes risk assessment and risk mitigation measures.

While industry bodies and firms recognize the importance of the regulation in fighting deforestation and therefore protecting the environment, they are worried that an excess of bureaucracy and lack of essential and suitable tools for implementation could create issues for European companies that buy pulp, paper or printed products comprised of virgin-fiber material originating outside the EU, but also within.

Need for due diligence fine-tuning

The pulp, paper and printing industries are concerned about the implementation of the regulation because they say the European Commission still needs to provide a working due diligence information system, while some legal provisions still require clarification, and they still do not know which geolocalization tool can be used.

“Companies may not be able to comply [with the EUDR], considering the fact that the European Commission will not provide the IT tools needed to process the due diligence statements until shortly before the deadline of application and that many legal provisions of the legislation still require clarification,” Laetitia Reynaud, policy advisor at Intergraf, the association representing the European printing industry, told PPI Europe. She added: “Once the tools are in place and the legal requirements are clear, it will be a matter of adapting to administrative work required by the legislation. The smaller the companies are, the more challenging the compliance work will be because the legislation implies a significant administrative burden – even when trading within the EU. There is also a risk Member States will not be ready [to meet] their own obligations. At this stage, 11 Member States have not appointed a competent authority [to oversee the regulation’s application].”

Jori Ringman, director general of the Confederation of European Paper Industries (Cepi), shares similar worries. “A pilot testing of this IT tool by several companies has revealed serious technical issues. With only eight months remaining until the compliance deadline of December 30, 2024, the information system is still under development, leaving companies uncertain about how to proceed,” he told PPI Europe. “It is clear now that we will not know until a very late stage – potentially, until the very last day of the transitional period – how the information system established by the European Commission actually works in detail. How can we then be expected to comply with the EUDR? This is just one example, but there are many more,” he added.

Industry players expressed concerns as well. “The challenge with the EUDR is that it most likely will create enormous amounts of administrative work, while not really benefiting forests. Currently, many of us are somewhat nervous, and this is mainly linked to a lack of transparency and information from the European Commission. Once the question marks have been resolved and we have a clearer path forward, I do think we will manage this somehow,” a market participant said.

In a joint letter to German government ministries, five German printing and publishing industry associations also expressed their concerns. “The associations demand clear legal terms with no room for interpretation so that the resulting obligations can be implemented in a legally secure manner throughout the entire supply chain,” the associations said.

Industry associations also highlighted the fact that the lack of clear benchmarking rules is a problem. According to the regulation, a benchmarking system will classify countries under three categories – high, standard and low risk – according to the risk level of producing in the countries commodities that are not deforestation-free. Shipments from high-risk countries will be subject to enhanced scrutiny from competent authorities and a high-risk classification will entail a specific dialogue with the European Commission to address jointly the root causes of deforestation and forest degradation. When the regulation came into force on June 29, 2023, all countries were assigned a standard level of risk. The risk level might change once the assessments by the European Commission are made public by the end of 2024.

“These rules were expected to incentivize operators to shift their sourcing from ‘high-risk countries’ or regions to ‘low-risk countries,’ while also reducing the regulatory burden for those sourcing from low-risk countries or regions,” Cepi’s Ringman commented. He added: “One would expect low-risk countries to include those located in Europe and many other parts of the world. Without the benchmarking system, the effectiveness of the regulation during its implementation is compromised.”

Another cause of concern is geolocalization. According to the German printing and publishing associations, it is currently still unclear which tools can be used for geolocalization of the commodities and the products produced. “The associations are calling for clarification as to which tools are classified as suitable for legally secure geolocation and assessment of the risk of forest damage and deforestation. This clarification must be made well in advance of the entry into force of the resulting obligations for companies,“ they said.

According to Fastmarkets’ director European packaging and graphic paper Alejandro Mata, the EUDR Regulation could be very disruptive to the European pulp and paper (P&P) industry. “The fibers contained in every piece of paper will need to be traced back to the forest they came from by going through the various converting processes, back to the parent rolls and the paper machine that produced that paper. But the challenge does not stop there – the fibers used by the mill will need to be traced back to the pulp bales used in the fiber mix for that parent paper reel. Each parent reel can be associated with multiple pulp bales. And each pulp bale can relate to thousands of plots of land, if not more,” Mata told PPI Europe. He added: “If companies cannot provide evidence that the products they are selling or producing in Europe are deforestation free, they will not be allowed to distribute their products in Europe, or even sell EU-made products abroad.”

P&P imports to fall?

Some European market participants fear that difficulties complying with the EUDR might disrupt European imports of pulp, paper and printed products by third countries. “If, in the end, the administration around EUDR becomes too excessive, I can clearly see some producers actively avoiding the EU market and instead targeting other regions such as Asia,” one market source told PPI Europe. He added: “To be honest, this will not have a huge impact for standard softwood [pulp] grades, as imports are already at low levels. But the EU market is highly dependent on imports of standard hardwood [pulp] and softwood fluff [pulp]. [There are] big challenges for these segments.”

According to Reynaud, imports of printed products could also be affected. “It will all depend on the level of preparedness of non-EU paper suppliers and on the benchmarking of the importing country, as there is a significant difference in terms of obligations when you are importing from a low-risk country, which implies only data collection – or from a standard – or high-risk country, whose obligations include, in addition, risk assessment and risk mitigation,” she commented.

Meanwhile, Cepi noted that most of the burden of the EUDR will be borne by European producers, because it will have implications for both domestic deliveries and exports to global markets.

The regulation also poses concerns for some of the EU’s partners. “The US pulp and paper industry is not linked to global deforestation and forest degradation. As such, the EUDR – in its current form – poses significant concerns for our country. The rule presents severe compliance challenges, would disrupt sustainable supply chains, and imposes unwarranted and costly requirements for doing business with the EU,” American Forest & Paper Association (AF&PA) president and CEO Heidi Brock said in March when commenting on a bipartisan US Senate effort urging the country’s trade representative to engage with the European Commission on the challenges posed by the EUDR.

According to PPI Europe’s sister publication PPI Latin America, a Brazilian delegation led by the Brazilian Tree Industry (Ibá) and including the Brazilian Paper Packaging Association (Empapel), travelled to Brussels at the beginning of March with the aim of discussing with EU representatives its points of concern over the regulation.

In order to address the fundamental flaws in the regulation and to be better prepared for the implementation, several EU industry bodies, including Cepi, as well as some EU Member States, have asked the EU Council to postpone the enforcement of the EUDR. “The paper industry is against deforestation, as our industry, our investments and our future depend on healthy forests. We have a strategic interest in having an EU Deforestation Regulation that works. Tackling deforestation is too important to be hindered by an unpracticable regulation,” Ringman said.

Despite the many doubts, not everyone is worried about what will happen from December 30, and some even see the glass half full. “For a European pulp producer owning or controlling large areas of forest land, managing their forests extremely well, with good control of their fiber supply, a high level of self-sufficiency and high-quality assets, the EUDR will most likely bring some competitive advantages – if played cleverly,” a market source said.

Want to learn more about price movements in the global pulp market? We provide a range of market intelligence, including short-term forecasts, price data and market coverage to keep you one step ahead of the market. Speak to our team and find out more today!