Below, Fastmarkets senior analyst Andy Farida looks at London Metal Exchange copper price movements on May 17 and discussed in his report to subscribers if the bullish momentum will continue in the coming months or not.

Interested in a forward-looking view of the base metals market to boost your business strategy? Get a free sample of our base metals price forecast today.

A new all-time high for London Metal Exchange (LME) copper was well within reach on Friday, May 17, which confirms our overall bullish bias on the red metal. While we maintain this bullish view, we’re also mindful that the momentum is getting a tad frothy and this is a gentle reminder that nothing will move in a straight vertical line without some technical consolidation along the way.

To use a running analogy, when training for a marathon, stamina management and knowing when to let your body regulate are the key differences between an individual completing the marathon or struggling to reach the finish line.

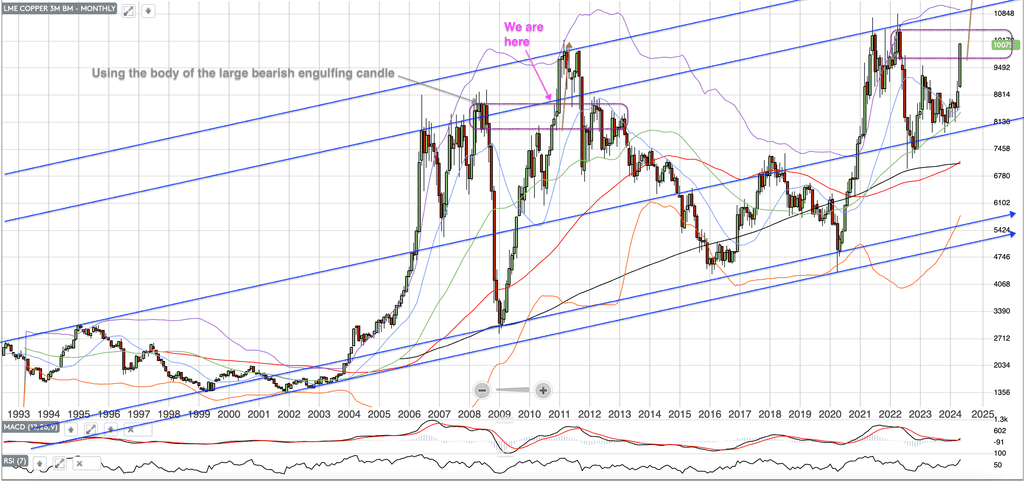

As outlined in the LME copper weekly chart (see below), we are focusing on the price structure last seen in November 2010. This was when the copper price moved above the 2008 all-time high and then produced a sharp weekly pullback before resuming its upward tack to reach much higher prices.

We now think the copper space is overdue such a scenario, where profit taking and a mini shake out of weak longs will emerge. This could potentially last for the next two to four trading weeks and the dip at the end of the correction should attract dip-buying to enter the copper space again.

Bullish monthly outlook for LME copper

The bulls are in charge in LME copper and that supports the mainstream theory that a new all-time high is more a matter if when and not if.

If this bullish play continues – and assuming that copper’s price action resembles that of November 2010 – we can deduce that LME copper may not produce a sizeable pullback at all in May. Rather, it could a sharp, but very mild, correction as discussed above.

Instead, there is likely to be a run toward the 2022 all-time high first, with perhaps just the chance of a shallow pullback in May, but with a firm monthly close above $10,000 per tonne.

Going into June, the bullish momentum will continue from the latter half of the trading month, taking copper to another all-time high by August and/or tagging the upper blue channel at around $12,000 per tonne.

Sustained bullish momentum

We now expect the bullish momentum in copper prices to be sustained over the coming months and view any technical pullback in May to June to be a temporary, but necessary, move for the bulls to regroup. We envisage that while the LME copper price will trade toward the record high seen in 2022, it will subsequently produce a technical pullback that could see the price of the red metal dip below $10,000 per tonne again. But it will be vital that the LME copper price does not produce a bearish monthly close of below $9,500 per tonne because that would negate the bullish narrative.

CME speculators are aggressively long

According to the latest data from the US Commodity Futures Trading Commission (CFTC), non-commercial traders raised their net long positions in CME copper by 4,720 contracts in the week ending May 7 to 62,176 contracts, representing 16% of the open interest. This was the fifth consecutive week of net buying.

The speculative community is not at +74% of its historical max net long position, compared to -4% of its historical max net short position at the start of the year, showing the clear reversal in the market sentiment/positioning.

Speculators are usually trend followers, suggesting that they will continue to add to their long positions as prices continue to rise. Conversely, if prices start to weaken, speculators would exit their positions, potentially intensifying the sell-off. We remain of the view that this scenario is plausible in May-June, especially after the remarkable rally in April.

LME funds at fresh all-time high

LME fund managers were bullish on copper in the week to May 10 with the fresh buying of 4,207 lots. That was the sixth consecutive week of buying and brought LME copper’s net long fund position (NLFP) to a new all-time high of 63,589 lots. The bullish sentiment among funds corroborates this bullish price action and LME copper produced a positive weekly close above the key psychological price level of $10,000 per tonne in the week to May 17.

We remain firmly bullish on the red metal, but we are also mindful that the current rally is a tad overbought. We therefore envisage that the copper space could well do with a short-term mini shake out – a sharp correction for the next two to four trading weeks – and the dips buying will then resume again. We expect any pullback to be short-lived and that a resumption to the upside will be seen in the latter half of June, with a new all-time high of around $12,000 per tonne possibly logged by August this year.

All trades or trading strategies mentioned in the report are hypothetical and for illustration only and do not constitute trading recommendations.

Inform your base metals strategy with metals price forecasts and analysis for the global base metals industry. Get a free sample of our base metals price forecast today.