At the end of last week, ArcelorMittal again increased its official offer prices for all steel coil products in Europe – by €20 per tonne for HRC and by €50 per tonne for downstream products. Its new offers for HRC were heard at €1,020 per tonne ex-works.

Some other mills were also reported to have increased their official offers.

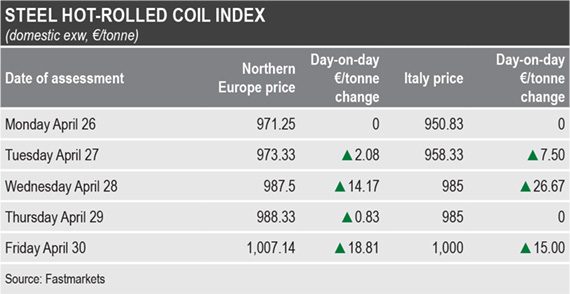

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe, at €1,007.14 per tonne on April 30, up by €35.89 per tonne week on week and up by €171.14 per tonne month on month.

Friday’s index was based on achievable prices estimated by market sources at €1,000-1,010 per tonne ex-works and offers reported at €1,005-1,020 per tonne ex-works.

Fastmarkets calculated its corresponding daily steel hot-rolled coil index, domestic, exw Italy, at €1,000 per tonne on Friday, up by €49.17 per tonne week on week and up by €176.67 per tonne month on month.

The index was based on achievable prices estimated by market sources at €980-1,010 per tonne ex-works.

Market sources believed that further price rises were likely because mills have the upper hand in pricing negotiations due to the current material shortage, strong demand and limited access to imports.

Demand has remained strong due to there being low stocks at both distributors and end-consumers, market sources said. In addition, coil imports have been restricted by European safeguard measures, and offers available in the market have been at high prices, comparable to those from domestic mills.

Lead times from the majority of both European and overseas suppliers have been for late-third-quarter or fourth-quarter delivery, market sources said.

In addition, buyers have been avoiding making deals with Liberty Steel due to risks related to delayed shipments or cancelled orders, market sources said.

Liberty Steel Dudelange-Liege has been cancelling orders and shipments to customers that had agreed deals for cold-rolled coil and hot-dipped galvanized coil. Liberty’s Dudelange-Liege unit comprises three production sites – at Flémalle and Tilleur in Belgium and at Dudelange in Luxembourg – each producing CRC, HDG and tinplate.

Liberty Steel has been said by market sources to have been struggling to maintain a steady supply of hot-rolled coil, which is the feedstock for downstream coil products. Liberty currently has less capacity to make HRC than it has for downstream processing, and traditional suppliers have been asking the steelmaker to provide upfront payment before they would ship HRC to it.

Trade unions at Liberty’s Ostrava plant in the Czech Republic were considering further industrial action and even legal proceedings after news emerged that the plant’s EU emissions allowances had been sold to another Liberty-owned steel mill in Romania. According to a statement from trade union OS KOVO, the unions were “preparing for legal proceedings” but no details have yet been revealed.

As a result, the scheduled restart of a blast furnace (BF) in Italy was unlikely to help to solve the shortage problem in the short term, market sources said.

Acciaierie d’Italia, formerly known as ArcelorMittal Italia, planned to restart BF No4 in June this year and expected crude steel output of 15,000 tonnes per day.

Ukrainian steelmaker Metinvest was considering the construction of a flat steel rolling plant in Trieste, in the north of Italy, with capacity for 2.5 million tonnes per year, Italian equipment producer Danieli said.

The project will include rolling mill facilities but no meltshop, so the slab feedstock will come from Metinvest’s plants in Ukraine. The company expected the plan to be approved this summer, market sources said, and no specific deadlines for the project will be set until that time.

Access to overseas material has been limited by effects of the EU’s safeguard and anti-dumping measures, market sources said. In any case, rising global prices have made imports less attractive while some traditional suppliers have been focusing on exports to the United States, where they were able sell coil at higher prices.

European buyers have exhausted both country-specific and supplementary second-quarter import quotas for India-origin HRC. As a result, any volumes that arrive before June 30 from the country will be subject to a 25% tariff.

The latest offers of HRC from Turkey were heard at €1,000 per tonne cfr Italian ports.

The European Commission (EC) was planning to set definitive anti-dumping duties on Turkish HRC that would be marginally lower than the preliminary tariffs, it said in a letter sent to interested parties. The EC calculated definitive duties at 4.70-7.30%, down by 0.10-0.50%.

The definitive anti-dumping duties were scheduled to come into effect on July 13 this year, when the EC publishes the notice in the Official Journal of the EU.