Buyers were holding back from acquiring material due to the summer holiday slowdown and uncertainty about the price trend. Domestic prices have remained high despite a slight correction lower while buyers, who have sufficient stocks for a couple of months, preferred to hold back from trading.

Credit lines have also been exhausted over the past several weeks due to high prices and long lead times, limiting the purchasing ability of distributors.

Most mills across the EU were offering HRC for fourth-quarter delivery, with some even sold out until the end of the year, sources said. So only a handful of suppliers from Italy and mills from Central Europe have been active in the market.

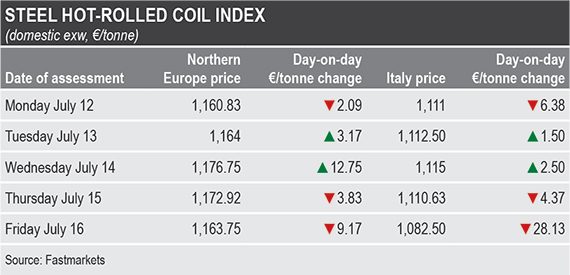

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe, at €1,163.75 ($1,373.75) per tonne on July 16, up by just €0.83 per tonne week on week and up by €28.75 per tonne month on month.

The index was based on offers heard at €1,170-1,200 per tonne ex-works and market participants’ estimates at €1,140-1,200 per tonne ex-works.

The severe floods in Germany had no negative effect during the week on flat steel production, sources said. But the floods and the high level of water in the River Rhine will probably disrupt deliveries of finished steel and raw materials from this week onward.

“At this moment, it is difficult to judge the consequences of the flood, because the most badly affected regions are still trying to get an overview of the damage. I guess there will be effects, not only for cities such as Hagen and Dortmund, but in general due to the high water, particularly in the Rhine,” a German distributor said.

“The level of the Rhine is quite high and will increase due to all the small rivers which [feed into it]. Vessel traffic will be limited, which will have an effect on the transportation of goods such as raw materials to mills,” he added.

Some sources also said that German producers have had production issues with their downstream lines due to the floods.

ArcelorMittal and Salzgitter said that their production and shipments have been unaffected by floods, but ThyssenKrupp did not reply to a request for comment.

Fastmarkets calculated its daily steel HRC index, domestic, exw Italy, at €1,082.50 per tonne on July 16, down by €34.88 per tonne week on week and down by €50.83 per tonne month on month.

The index was based on achievable prices heard at €1,040-1,110 per tonne ex-works and offers reported at €1,040-1,100 per tonne ex-works.

At the end of the week, import offers from Japan and Thailand were heard at $1,180-1,200 per tonne cfr Southern European ports.

Turkish HRC was on offer to southern European ports at €1,020 per tonne cfr. And one Russian mill was heard offering September-shipment HRC at €830 per tonne cfr to Italy – although the price did not include the imminent $115 per tonne export duty to be imposed by Russia, or EU anti-dumping duty of €96.50 per tonne.

On July 14, the European Commission adopted a package of proposals to make the EU’s climate, energy, land use, transport and taxation policies fit for its greenhouse gas emissions targets.

The proposed measures include a Carbon Border Adjustment Mechanism (CBAM) designed to level the carbon costs of imported products, including iron and steel, with those of EU steelmakers.

The EU authorities have also proposed stricter targets for emission cuts in a review of the Emissions Trading System (ETS).