The taxes are supposed to take place from June 1, but there has been no official statement by China’s Ministry of Finance so far and market participants are in disagreement about whether these taxes will come into force. Yet some sources say the rumors are growing stronger, which they take to be a sign the policies will be enacted.

Alongside the possible steel export taxes are more cancellations in export rebates for other flat steel products such as cold-rolled coil and hot-dipped galvanized coil.

The global ferrous industry typically looks to China for price guidance, including billet sellers in Turkey and the Middle East, as well as iron ore producers in Europe and Brazil.

Flat steel in focus

Market sources in China said the main target of the export taxes is hot-rolled coil, which has been a red-hot commodity in recent months.

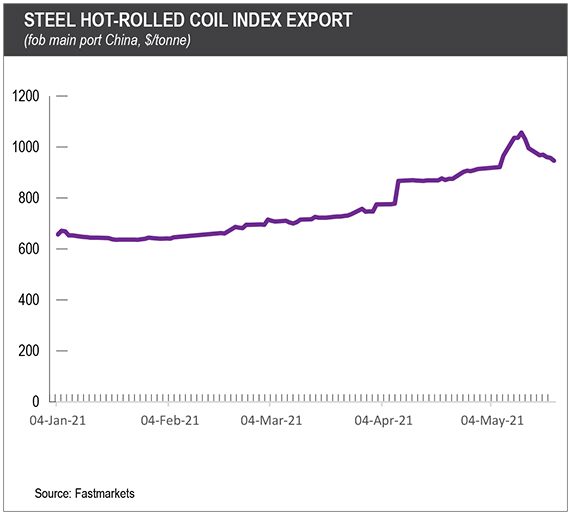

Fastmarkets’ steel hot-rolled coil index export, fob main port China has been on a meteoric rise this year, peaking at $1,062.37 per tonne on May 12, compared with an intra-year low of $639.53 per tonne on January 20. It stands at $952.08 per tonne as of Friday May 21.

“Some of my customers are concerned about whether the export duty will increase because they want to book product before the duty increases,” a trader in eastern China said.

Vietnamese galvanizers have been keeping a sharp lookout for hints of the possible new export taxes, in part because they are also acutely aware of the possibility that Indian HRC supply will be affected by the Covid-19 pandemic ravaging the country.

“This could be bad news for us if there is no Chinese or Indian supply, and buyers in southeast Asia have to rely on domestic and east Asian HRC,” a source at a major Vietnamese galvanizer told Fastmarkets on Friday.

Indian steel mills have been keeping offers high at $1,070-1,100 per tonne cfr Vietnam for re-rolling grade HRC, optimistic that any steel export tax in China will be in their favor because importers will turn to India.

While the export tax could keep more HRC in the local Chinese market, it is unlikely to cause local prices to go on a downward trend because domestic demand is strong, a second trader in eastern China said.

Naysayers say China brought in changes to the ferrous tax regime on May 1 that have just been enacted and any new export taxes are unlikely.

That said, one trading source in Shanghai conceded that in the long term, more increases in export taxes could be implemented to reduce steel exports and maintain sufficient supply in the domestic markets.

A possible export tax on long products would have a conversely minimal impact on the Chinese rebar industry, a rebar trader in China said.

“The export duty change will not influence the domestic supply of rebar because no one has been purchasing Chinese rebar due to the high prices compared to the international markets,” the trader said.

Fastmarkets’ steel reinforcing bar (rebar) domestic, ex-whs Eastern China price peaked at 6,000-6,030 yuan ($931-936) per tonne on May 10, compared with 4,260-4,280 yuan per tonne on January 20. It remains above January prices at 4,900-4,920 yuan per tonne on May 24.

By comparison, the steel reinforcing bar (rebar) import, cfr Singapore price hit a year-to-date high of $790-800 per tonne cfr on a theoretical weight basis on May 17, from an intra-year low of $610-620 per tonne cfr on February 8. It stands at $775-780 per tonne on May 24.

This means rebar from Singapore was more attractive to buyers already and a possible export tax on Chinese material will only reinforce this position.

Cooling measures

The possible new export taxes on steel products comes at a time of recent policy announcements and cooling measures to curb commodity price increases by the Chinese government.

A Chinese steel mill source said any new export taxes would have a negative impact on steel demand and pricing because the cost of exporting steel products increases.

“[And] if steel is not performing well, iron ore will be affected,” he added.

A source at a major blast furnace-based steel mill in Malaysia told Fastmarkets that the continued involvement of China’s government in cooling commodity prices has had a big impact on regional markets.

“We’ve had to revise our offers for wire rod down by a large amount this week because of the constant price downtrends in China,” the source said.

Meanwhile, an iron ore trader based in Singapore said these cooling measures will have a bigger impact on iron ore prices.

Iron ore prices have adjusted sharply downward amid warnings by the central government that commodity prices were too high.

Fastmarkets’ iron ore 62% Fe fines, cfr Qingdao, index has fallen to $200.72 per tonne on May 21 from a peak of $237.57 per tonne on May 12, while the iron ore 65% Fe Brazil-origin fines, cfr Qingdao index ended at $235.70 per tonne on May 21 after peaking at on $267.80 per tonne May 12.

This has also been exacerbated by falling downstream steel prices in the past two weeks.

For the Chinese steel market, the export taxes could cap mill margins for domestic steel mills, a Singapore-based buyer warned.

“This could led to Chinese steel mills seeing weaker demand and more supply in the domestic markets, and cause further deterioration in their margins,” the steel buyer told Fastmarkets.

At the same time, some market sources do not believe the export tax will completely halt the flow of Chinese supply overseas, especially if overseas capacities continue to run at reduced capacities and restarted ones struggle to keep up with current demand.

Major steel mills in Italy, France, Belgium, Germany, United Kingdom and Poland had shut capacities temporarily in 2020 during lockdown measures to control the spread of Covid-19. While most have restarted, a number are facing technical difficulties, sources told Fastmarkets.

“Overseas buyers will still attempt to purchase Chinese steel if domestic prices are high or if there is limited supply,” a third steel trader in eastern China said.

This is especially so with countries in Europe importing Chinese flat steel in large quantities despite anti-dumping taxes of 15-25%. At least two or three major Chinese steel mills have been shipping cold-rolled coil recently to countries such as Italy and Spain to fulfil demand, including at least one 40,000-tonne cargo, in May.

Export statistics from China for this period is not yet available, but China exported 7.97 million tonnes of finished steel in April, up 5.7% month on month and 26.2% year on year, according to preliminary Chinese customs data.

“Although steel prices are volatile in recent weeks in China, steel export prices with [the potential] tax are still lower than the equivalent prices in ex-China markets, which could support the steel prices in China and avoid further decrease,” the third steel trader added.

Join our industry experts for an exciting forward look into Asia’s evolving steel market at the Singapore Steel Forum on July 14. Register today at https://events.fastmarkets.com/singapore-steel-forum