- Battery-grade lithium hydroxide prices in Asia were steady against a backdrop of rising spodumene costs.

- Trader restocking supported the domestic Chinese lithium carbonate price at current levels.

- Spot lithium prices in Europe and the United States remained broadly steady, with technical-grade lithium hydroxide making gains.

Battery-grade lithium hydroxide prices in both domestic Chinese and seaborne Asian markets were firm amid tight availability, while a rising spodumene price continued to fuel the sentiment.

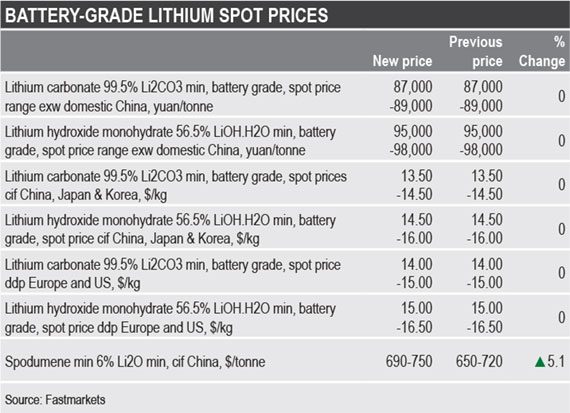

Fastmarkets’ weekly assessment for the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea was $14.50-16.00 per kg on Thursday, unchanged from previously.

Fastmarkets’ weekly assessment for the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price range, exw domestic China was also steady week on week at 95,000-98,000 yuan ($14,658-15,121) per tonne on Thursday. The assessment was based on spot activities for coarse units.

Meanwhile, sales prices for micronized units were generally over 100,000 yuan per tonne, according market participants who anticipated the lithium hydroxide market to be further supported as a result.

Battery cathode materials producers continued to flag tight availability of lithium hydroxide, partially resulting from supply constraints of spodumene, the upstream feedstock for most lithium hydroxide producers in China.

Fastmarkets’ monthly assessment for spodumene 6% Li2O min, cif China was $690-750 per tonne on June 30, up by $35 per tonne, or 5.11%, from $650-720 per tonne one month ago. The price has risen by over 80% so far this year from $390-400 per tonne on December 30, 2020.

“The driver for the lithium complex is mainly the bottleneck in upstream supply,” a consumer said. “And demand from the downstream nickel-cobalt-manganese (NCM) battery sector is steady.”

Upside in technical-grade lithium carbonate

In the lithium carbonate complex, the domestic Chinese technical-grade lithium carbonate price rose amid active trader restocking.

Fastmarkets’ lithium carbonate 99% Li2CO3 min, technical and industrial grade, spot price range exw domestic China edged up to 79,000-80,000 yuan per tonne on Thursday, up by 1,000 yuan per tonne (1.27%) from 77,000-80,000 yuan per tonne one week ago.

The buoyant technical-grade price strengthened overall sentiment in the lithium carbonate complex. Fastmarkets’ price assessment for lithium carbonate 99.5% Li2CO3 min, battery grade, spot price range exw domestic China was stable week on week at 87,000-89,000 yuan per tonne on July 1.

“People are restocking lithium carbonate again, therefore the prices have definitely bottomed out,” a trader said. “But we might need to worry about whether those units currently in traders’ hands will flow to the spot market together at a certain point.”

Europe, US hydroxide grade finds support

Spot lithium prices in Europe and the US were broadly steady over the seven days to July 1 with the exception of the technical-grade lithium hydroxide price that increased due to a shortage of units, mirroring the more liquid seaborne Asian markets.

Fastmarkets’ assessment for the lithium hydroxide monohydrate min 56.5% LiOH.H2O technical and industrial grades, spot price DDP Europe and US edged up to $14.50-16.00 per kg on Thursday, from $14.50-15.50 per kg a week prior.

Meanwhile, the battery-grade price continued to be supported by the tight availability of technical-grade compounds and shipping delays.

The lithium hydroxide monohydrate 56.% LiOH.H2O min, battery grade, spot price ddp Europe and US stood at $15.00-16.50 per kg on the same day, stable week on week after an increase in the previous session.

“Increases are holding ground, while demand keeps increasing and there is not enough feedstock available; we expect prices to keep rising, since there is generally a bullish sentiment,” a trader in US said.

Battery-grade lithium carbonate in the region also remained steady over the past seven days, with producers and traders maintaining their offer levels.

Fastmarkets’ weekly price assessment for lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US stood at $14-15 per kg on Thursday, stable week on week, with offers heard at the midpoint of the range.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China includes all trades, bids and offers reported to Fastmarkets.