Demand for green steel to rise swiftly in 5-10 years, supply to remain tight

Demand for green flat steel is expected to increase to around 49 million tonnes in 2030, Guido Kerkhoff, chief executive officer at Klöckner & Co SE said during his presentation, quoting BCG data.

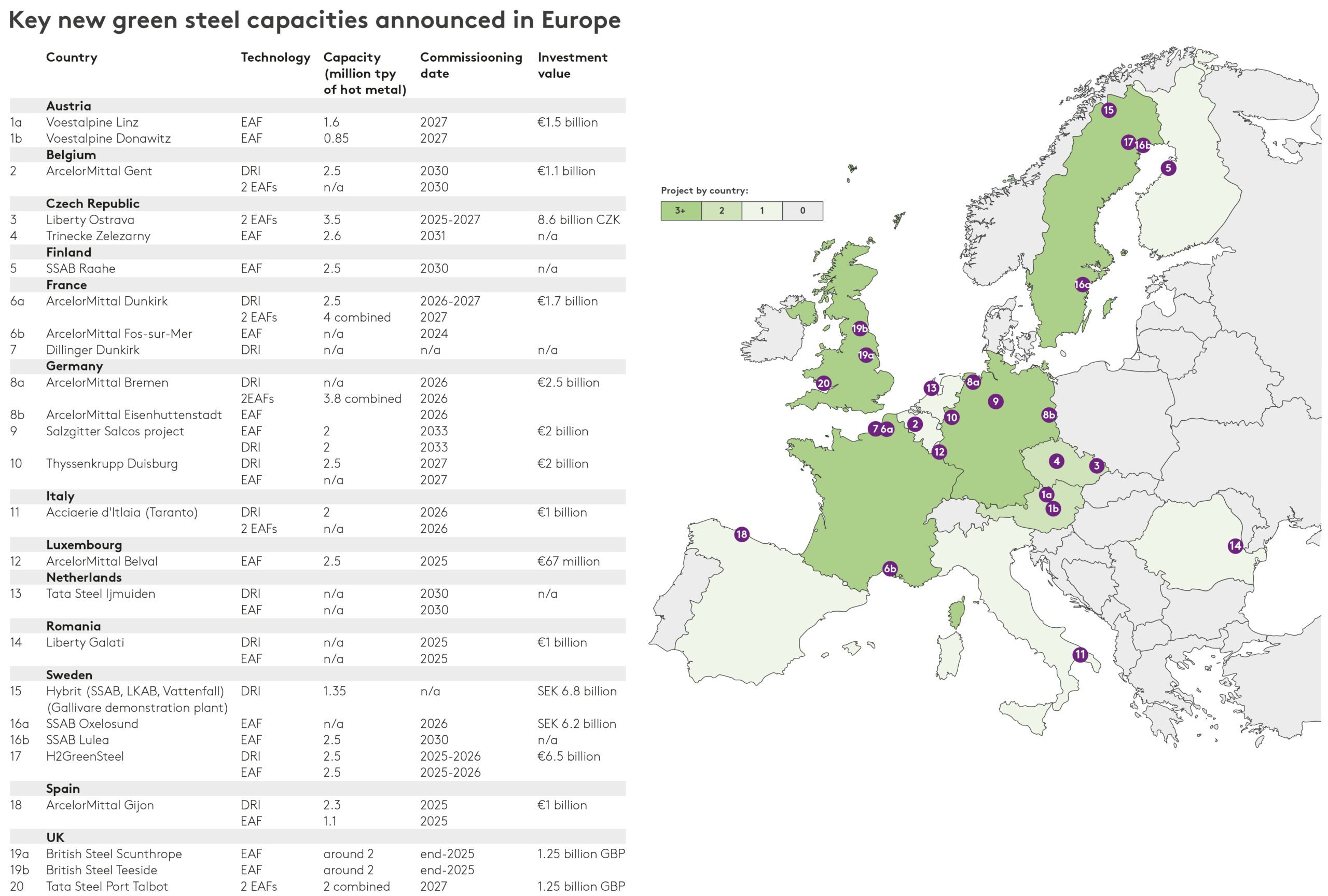

Over 45 million tonnes of new green steelmaking capacities – via electric-arc furnace (EAF) or EAF-DRI (direct-reduced iron) production — are expected to come online in Europe in 2025-2030, however, a delay of about 15 million tonnes in capacity expansion in expected until 2030.

“Customers’ willingness to pay makes the difference in tight markets,” Kerkhoff said.

Industry sources estimated that green steel volumes traded in Europe were below 100,000 tonnes in 2023, with most estimations coming at around 50,000-70,000 tonnes.

Very few suppliers were able to offer “physically-produced green steel, with emissions proved by Environmental Product Declarations [EDPs] below 1 tonne of CO2 per 1 tonne of steel [for Scope 1,2,3],” according to one distributor.

“One can reach net-zero [emissions] with [carbon] offsets, but some buyers refuse to deal with such steel, claiming it has been ‘green-washed’,” a second distributor said.

Premiums for EAF-produced green steel with emissions for Scope 1,2 and 3 carbon emissions below 0.8 tonnes per 1 tonne of steel were reported at €200-350 ($217-381) per tonne in the week to Friday May 17.

Buyer sources estimated tradeable values for such steel at €100-150 per tonne.

Fastmarkets’ weekly assessment of the green steel domestic, flat-rolled, differential to HRC index, exw Northern Europe was €150-250 per tonne on Thursday, stable week on week.

Transparency is a decisive criteria in green steel sourcing

In the past several year, European steel producers have accelerated their decarbonization efforts, and the new market for steel with a reduced carbon footprint has emerged.

Major suppliers are offering their own green steel brands with lower carbon footprint – XCarb, Arvzero, SSAB Zero, Bluemint, Greentec, etc. – however, there is no common standard for green steel in the industry yet.

“Product Carbon Footprint (PCF) is the only criterion for comparability in order to meet growing customer demand for transparency along the entire values chain,” Kerkhoff said.

“We need a coordinated approach from the entire sector, a simple approach that is applicable to all members,” Andreas Steffes, executive manger at Handel Schweiz, said during his presentation.

PCF Declaration is set to create transparency on emissions in the supply chain, tracking emission under Scope 1 and 2 (direct emissions generated by an entity or its subsidiaries and indirect emissions from energy used by an organization) and upstream Scope 3 (indirect emissions that occur from sources beyond a company’s control) as well.

“With a PCF declaration, no more emission estimates are required from customer side… [PCF declarations] include emissions from raw material extraction to [the material’s] arrival at the customer’s factory gate,” Kerkhoff added.

Customers become more demanding

Customers’ requirement for carbon footprint in steel products are “steadily increasing.”

For example, automaker BMW aims to be climate-neutral no later than 2050, with the share of recycled content in their products set at a minimum 95% and the approach “use EAF steel whenever possible,” Stefan Feichtinger, senior manager ESG corporate technology at Swiss Steel Group, said during the meeting.

For Volvo, the goal is to have 25% recycled and bio-based content in the new car models by 2025 and 35% by 2030.

Currently, 40% of European steel is produced from scrap (EAF-route), with a steel footprint of around 700 kg CO2 per tonne. Mainly long steel products are being produced via such route.

Around only about 1% comes from from DRI-EAF (1.3-1.4 tonnes of CO2 footprint) while the rest of steel is produced by conventional blast furnace-basic-oxygen furnaces (BF-BOF) (2-2.3 tonnes of CO2 content), and the majority of flat steel products are produced via BF-BOF.

Fastmarkets has recently launched consultations to lower the threshold for the carbon emissions content for its weekly green steel premium and daily inferred green steel price in Europe, to lower the upper threshold for both assessments, following feedback from the market.

Fastmarkets proposes to change the maximum carbon emission content to 800 kilograms per 1 tonne of steel, down from 1 tonne previously.

Raw material supply challenges

The gradual shift from conventional BF-BOF route to either EAF or EAF-DRI poses many challenges for the steel sector.

DRI-EAF route requires high-quality iron ore, with a high Fe percentage and low impurities, and less than 5% of global iron ore supply is suitable for production, Stefan Feichtinger said, quoting iron ore supplier BHP.

The solutions could be:

- Development of mines

- Further processing of existing ores to improve the grade

- Technological solutions: DRI-ESF-(electric-smelting furnace)-BOF, fluidized bed reduction that allows for lower grade ores

Another big challenge could be increased demand for scrap to feed new EAF capacities. To feed new flat steelmaking capacities, companies would need to buy high-quality scrap grades with lower impurities that are suitable for flat steel production.

EU is the largest net scrap exporter in the world. Scrap export volumes from the bloc were 18.5 million tonnes in 2023, a 7% increase vs 17.4 million tonnes a year before.

Starting in 2025, the export of ferrous and non-ferrous metal scrap to non-Organization for Economic Co-operation and Developed (OECD) countries will require consent by obtaining formal approval from non-OECD countries to export ferrous and non-ferrous scrap. These recipient countries must also demonstrate their ability to manage the scrap effectively, ensuring responsible handling and recycling.

This change could transform the EU from a net scrap exporter to an importer within five years.

Steel is not part of the problem, but part of the solution

Steelmaking generates approximately 8% of the worldwide carbon emissions, according to the World Steel Association.

However, the carbon footprint of steelmaking is still lower compared with other industries — such as carbon fiber with around 20 tonnes CO2 per 1 tonne of carbon fiber, and aluminium, with 5-8 tonnes of CO2 per 1 tonne.

In addition, steel is a recyclable product and remains in the material’s cycle.

With modern technologies, environmentally friendly “green” steel can be produced and used by different industries. The use of green steel only pushes up the price of the end-product marginally, Guido Kerkhoff said.

Notably, for the automotive industry, the use of green steel products would only push the car price up by 0.3-0.7%, and by 1.7-3.6% for home appliances. For onshore and offshore wind towers, the costs would rise by 1.6-3.4% and by 2.6-5.5% respectively.

“Steel is part of the solution [in decarbonization journey] and contributes significantly to the decarbonization of the value chain in many industries,” Guido Kerkhoff said.

Follow the low-carbon steel discussion and keep up-to-date with the developments influencing the decarbonization of the steel industry. Learn more.