Have you ever visited the supermarket and looked at organic chicken and turkey prices and wondered why they are expensive relative to conventional poultry prices? The cost to raise, feed and nurture organic poultry and dairy cows is a function of many of the rules listed by the USDA National Organic Program.

Besides creating a different living environment, the rules associated with feeding these animals are stringent. The majority of the ingredients in organic animal feed are organic soybean meal and organic corn.

Organic soybean meal sets the standard for the protein used in feed rations for organic livestock in the United States and Europe. Organic soybean meal has some of the highest crude protein levels as a percent of feed product.

For example, most of the organic soybean meals used by feed mills have between 40-48% crude protein. For comparison, organic canola meal contains between 38% and 40% crude protein.

A case study: Organic soybean meal volatility surges

Organic soybean meal has been the benchmark for protein in organic animal feed for a least the past decade. As consumer tastes for organic poultry, eggs, and dairy rose, the demand for organic animal feed increased.

Unfortunately, the United States imports more than 50% of the organic soybean meal used in animal feed. Most soybean meal crushed in the United States comes from genetically modified soybeans which do not meet organic feed standards.

The reliance on imported organic soybean meal has created challenges for livestock consumers in the last couple of years. Recently, a duty was placed on imported organic soybean meal from India, eliminating the largest supplier to the United States. The lead-up to the import duty generated a sharp rally and a surge in organic soybean meal volatility to 60%.

How can you mitigate your organic soybean meal risk

It would be nice if feed mill procurement management or livestock producers could reduce their exposure to organic soybean meal with a futures contract. Agribusiness has a long history of using futures contracts, and many farmers, traders, and feed mills are familiar with these instruments.

Unfortunately, the movements of CME soybean meal futures contracts and organic soybean meals are uncorrelated. There is no observable connection between the returns of organic soybean meal and CME soybean meal. The 5-year correlation is zero.

Market makers who have licensed Fastmarkets data are now offering financial products that allow you to hedge your organic soybean meal exposure. The products are similar to insurance policies that pay off if organic soybean prices rise or fall. The financial products, referred to as vertical call or put spreads, are financially settled versus the daily average price of Fastmarkets Organic Soybean Meal mid-West assessment.

A call spread combines call options where you purchase a lower strike call and simultaneously sell a higher strike call option. A put spread combines a put option where you buy a higher strike put option and simultaneously sell a lower strike put option.

How are organic soybean meal options traded?

You can buy or sell organic soybean meal option products in the over-the-counter (OTC) market. If the product you want to hedge is not on a futures exchange, like organic soybean meal, you can ask a market maker for a price for a premium that you pay upfront for protection in the future. Only cash will change hands, and you will never receive or deliver organic soybean meals.

What does the payout of a call spread look like?

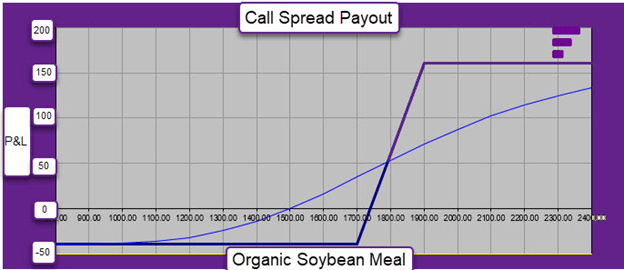

A simple way to visualize a call spread is to look at a payout profile. In this example, a feed mill ingredient purchaser could buy insurance where the company is protected if the price of organic soybean meal rose above $1,700 per short ton, up to $1,900 per short ton.

It’s important to understand that the most you can lose from purchasing a call spread or a put spread are the premium you pay.

For a call spread, your break-even price is the lower strike price plus the premium you paid for this insurance.

You can see from the diagram that you have an unrealized loss until the price of organic soybean meal rises above your breakeven level. You would then experience unrealized gains on your call spread until $1,900, where your insurance would cap out.

The most you can earn on this commodity hedge is the difference between the two strike prices ($1,900 – $1,700) minus the premium you pay for the insurance.

Summary

The bottom line is that using a financial product to protect yourself from rising organic soybean meal prices is to trade a financial derivative such as a call spread or put spread. If you cannot transact the product you want on an exchange, you can work with an OTC market maker to transact an over-the-counter call or put a spread to protect yourself from volatile organic soybean meal prices.

You can also use techniques to determine how much commodity risk exposure is inherent in your business and the prudent amount to protect.

If you are interested in learning more about how you can protect yourself from volatile price changes, please reach out to our risk solutions team.