There is no way around it, the “R” word is on everyone’s mind these days. The Federal Reserve’s increasingly hawkish stance as it grapples with the highest inflation since the 1970s raises the probability that another business cycle is about to be squashed by the central bank as it pulls the punch bowl away. Adding to the worries, real GDP plunged into negative territory in the first quarter and preliminary indications are that the second quarter could follow suit. While two consecutive quarters of negative GDP is a rule of thumb for identifying a recession, the ultimate determination falls to the National Bureau of Economic Research (NBER) in the US. Given that many of the underlying data points that would normally fall in a recession remain in positive territory (e.g., employment, household consumption), whether the US is in, or about to enter, a recession remains fairly ambiguous at the moment.

Whether the broader economy is entering another recession is a debate for another day, but it does help frame the bearish sentiment that has permeated the wood products industry. Housing is directly in the line of fire as the Federal Reserve raises interest rates to crush inflation, which will clearly have a negative impact on wood products demand.

Lumber prices are already reflecting the rapidly changing market conditions: after peaking at an average of $1,275/MBF in March and challenging the prior record high of $1,479/MBF set in May 2021, the Random Lengths Framing Lumber Composite Price (FLCP) tumbled to an average of $618/MBF in June.

Prices are still extremely volatile by historical standards but continue to trend downward off the all-time highs last year. A pricing correction is only natural now given that the supply side of the market is clearly seeing improvements as Covid-related disruptions subside, but there are now bigger concerns about the current state of demand.

We are now over halfway through the year, and there are several leading indicators that can help us gauge where demand is going. So, what do they tell us? The most straightforward to address is the state of new residential construction, which is pretty clearly facing a sudden slowdown in activity.

New home sales reported by the US Census and the NAHB’s Housing Market Index (HMI) are reliable signals of future new construction activity, and both have seen aggressive corrections following the tremendous demand-driven rally in 2020 and 2021. In fact, both indices have more or less returned to 2019 levels based on the latest monthly data. And after looking at even more timely data points, such as the Mortgage Bankers Association’s reported home purchase applications (down by over 20% since the beginning of the year), they are likely to move lower. Even just observing the more detailed subcomponents of the HMI survey, builder sales expectations for the next six months have plummeted to a rating of just 61 after hovering consistently at or above 80 for the last two years. June’s reading was also the lowest since May 2020 (46) at the outbreak of the pandemic.

Just eyeballing how far construction activity could fall to mirror what we have observed in new home sales and the HMI, it seems very likely that single-family starts could trend closer to 800-900 units (SAAR) in the coming months.

While the outlook for single-family homes looks challenging in the near term, one potential moderating factor on wood demand is the historic number of homes under construction. A whopping 1.67 million homes (SAAR) were under construction in May, surpassing the prior record set in 1973, when actual housing starts were trending well over 2 million actual starts! This leads us to believe there could be a little more stickiness in wood demand in the short term even if housing starts swoon in the third quarter; the volume of construction put in place will continue to be elevated as many homes are still months away from delivery and cycle times for single-family homes remain at 8-10 months until completion.

However, the massive buildup in unfinished home inventory is a double-edged sword. As home sales continue to cool in the face of the historic interest rate shock, home builders are pivoting their strategy: rather than continuing to break ground on new homes at a torrid pace as they have over the last two years, builders will instead throttle new starts and focus their energy on quickly buttoning up the substantial backlogs of homes under construction.

Optimizing cashflow given the high uncertainty for demand months down the road will be paramount for home builders now. New homes started from here forward will be at a high risk of margin compression as building material costs continue to press higher while the price of new homes that are not already locked into a sales agreement face serious downward pressure. At some point, the decline in starts will feed through into decreased demand for framing material demand and trickle downstream into other items, like molding and millwork, that come later in the build cycle.

What about repair and remodeling? As we’ve said before, R&R remains a tale of two markets in 2022. Contractor-driven renovation remains robust and faces a very large backlog of projects with high dollar spend like home additions, kitchen renovations, etc. The key constraints on physical renovation construction are labor and building materials, much like what we see in new construction. Still, this is a positive, stabilizing force for lumber demand, which the current high-frequency data seems to indicate will remain resilient.

The data on the DIY side of the R&R market is more difficult to assess due to the less formal data points on the market, but there are a few interesting indicators, which we at Fastmarkets like to follow to help clue us in to what is happening.

First, Google Trends searches for key lumber-intensive home projects, after soaring to unprecedented levels in 2020, have been on a path of correction since the beginning of 2021. Despite some more promising data in June, search interest in key categories like decking, fencing and general interest for home renovation activity were down year to date in the first half of 2022.

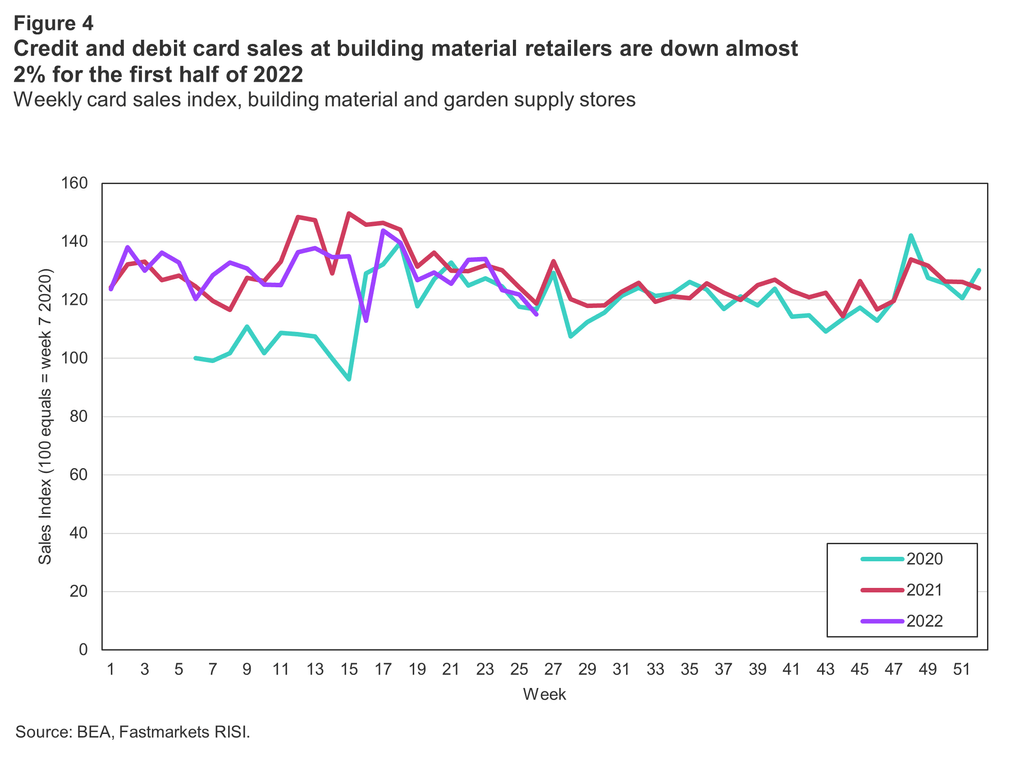

The other key DIY indicator we look at is credit and debit card spending in building material and garden supply stores. While this broad metric, which comes from an event study from the Bureau of Economic Analysis (BEA), measures sales beyond just lumber and wood products, card spending data has the advantage of being a better gauge of home center/DIYer spending as it excludes ACH transactions that tend be more heavily driven by professional builders and contractors. The data is also reported weekly, so while not necessarily being a forward-looking indicator, it provides a close to real-time signal of spending activity in the DIY/home center channels.

Figure 4 shows that the dollar spend from credit cards has been consistently trending down year over year since March. Year to date, dollar sales are down 1.8% through week 26. This is not a terrible performance at a first glance, especially given the scale of stimulus that hit household checking accounts in the first half of 2021, but note that these are dollar sales, not unit sales; when adjusting for inflation, actual transaction volumes are probably far more negative given building material costs are easily up by double digits year over year. Corroborating this observation, Home Depot and Lowes revealed on their first quarter 2022 earnings calls that while dollar sales were respectable year over year, transaction volumes for the quarter were deeply negative (-8.2% and -13.2% year over year, respectively).

It is pretty clear to us that the DIY portion of R&R, which is substantial, is down once again this year, and while there are some glimmers of hope that a late over-the-shoulder season could materialize given improving weather and lumber prices correcting hard, recession fears and summer travel returning with a vengeance leads us to believe the boat has sailed on this category recovering its losses for the year.

Cutting to a more wood-products-specific view, the very timely Random Lengths Dealer Survey supports this more negative outlook for both new construction and renovation-driven lumber demand. The Dealer Survey polls lumber building material retailers nationwide and specifically asks respondents to rate sales expectations for lumber and panels over the next three months. When applying a seasonal adjustment to the data, we can see in Figure 6 that sales expectations are once again falling rapidly, this time from the peak of 7.8 in November 2021. In fact, June’s sales expectations were the lowest measured since July 2021, when market conditions turned as well, coinciding with the crash in lumber prices last year. Unusual seasonal demand trends are certainly contributing to some of the volatility in the data, especially looking at 2021 when demand expectations cratered but bounced back entering the winter months. However, given that other sentiment indicators discussed earlier are also falling rapidly, this seems more than just a statistical fluke. Recall as well, that residential construction (both new construction and R&R) accounts for about three-quarters of softwood lumber demand in the US. The signal is clear from building material dealers: demand conditions in residential construction are slowing rapidly.

So, to address the title of this article, does the bearish economic data mean a lumber market recession is a slam dunk? Although the headwinds in our view are clear, it is probably too soon to make that call. Our current forecast is for US softwood lumber consumption to be down by 1.4% from 2021, or about 700 MMBF. While declining consumption in a given year should be the obvious first prerequisite for making that assessment, the drop in demand is modest by historical standards.

Additionally, the demand declines in 2021 and 2022 followed an unexpected burst of consumption that sent demand levels above trends levels during the outset of the pandemic. Demand is now correcting back closer to trend levels, rather than falling well below trend in a typical downturn. So, while a demand decline is a necessary prerequisite to declare an industry recession, it is probably not sufficient alone to make that call.

What happens on the capacity side of the market will probably give us a more complete view to assess the economic pain being felt within the industry. A good recent example of this was 2019: while the drop in lumber consumption for the year was modest, the deterioration of market conditions drove layoffs and the closure of about 2.5 BBF sawmill capacity, or about 3% of the North American market. Low market prices that persistently dragged across the top of the cash cost curve for much of the year was clearly painful for high-cost producers in British Columbia, where the bulk of the closures occurred. This kind of permanent capital destruction would almost certainly meet the spirit of a true industry recession.

For now, we are holding off on making that determination, but if we see sawmill capacity closures at a similar level to 2019, it will be safe to say that the volatile Covid-19 boom and bust in demand has caused another recession in the lumber sector.