Fastmarkets has identified the need for more transparency in the seaborne market for nickel sulfate, a key component in nickel, cobalt, manganese (NCM) lithium-ion batteries, which is a battery chemistry of growing importance for the EV market.

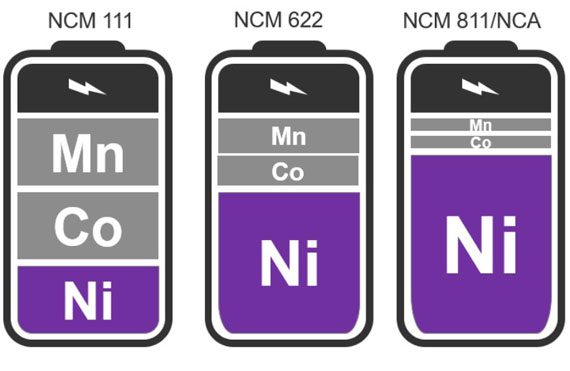

Lithium-ion battery chemistry is evolving quickly, with an increased focus from the automotive sector on nickel-rich cathodes due to their superior power density. As nickel-rich cathodes continue to increase their market share in the EV space, the transparency needed in terms of pricing for nickel-related battery products will grow.

Fastmarkets will, accordingly, publish two monthly reference prices for nickel sulfate on a cif China, Japan and Korea basis, one an all-in price incorporating the London Metal Exchange nickel cash price, plus a premium for processing costs and freight, and the other reference price reflecting only the premium element.

The new reference prices will complement the existing Fastmarkets China domestic price for nickel sulphate, published on a weekly basis: MB-NI-0244 nickel sulfate, min 21%, max 22.5%; cobalt 10ppm max, exw China, yuan per tonne

The spot market for nickel sulfate is currently immature. A substantial proportion of nickel sulfate production is sold on a long-term contract basis to battery makers, which are usually negotiated annually, while buyers are similarly incentivized to lock in battery raw materials supply to protect the supply chain to the end-user market.

Typically, the LME cash price for nickel is a component in contract pricing.

Although spot market liquidity is low for now, Fastmarkets thinks the spot market will evolve while producers bring new capacity online to meet global vehicle electrification targets.

New nickel sulfate production is already scheduled to come onstream in 2021-2022 in Europe, Australia and Asia, with numerous projects in planning. An increase in supply, demand and the number of market participants in the supply chain is also likely to encourage more spot activity.

Around 70% of the world’s nickel production goes into the manufacture of stainless steel, where global demand remains consistently high. Stainless steel production uses both Class I and Class II nickel in the production of nickel pig iron (NPI) and ferro-nickel.

Only around 5-7% of global nickel production is used in battery manufacturing but this percentage is bound to rise. The cost of production against the selling price for the finished product are potentially problematic for producers of nickel sulfate and for the EV supply chain.

Supply disruptions related to Covid-19 in the past year have highlighted the challenges in an industry that does not have ready access to spot molecules.

“We’ve seen this [past] year complicated with Covid-19-related issues and market disturbances, and when there’s no transparent, liquid spot market there are problems in the value chain,” one nickel sulfate producer said.

As in other battery raw material markets, demand for price transparency throughout the supply chain has been mounting. The price volatility of nickel sulfate products over the short to medium term should create a rift between the underlying metal price – traditionally due to end-use applications associated with the stainless steel industry – and battery-specific products.

Fastmarkets expects nickel use in lithium-ion batteries to increase from 115,000 tonnes in 2020 to around 580,000 tonnes in 2025. As demand for a battery-specific product grows, Fastmarkets is positioning itself to capture this value for battery applications.

By closely monitoring changes in supply and demand, and scrutinizing pricing mechanisms as they evolve, Fastmarkets will play a part in increasing transparency across the supply chain.

The reference prices that Fastmarkets plans to launch are outlined in a pricing notice here.

The first reference prices will be published on April 1, 2021, and then on the first working day of each succeeding month. The potential to change the frequency of pricing, specifications and location parameters will be under constant review.

Fastmarkets is committed to reflecting the open and competitive market for commodities using our independent position as a price reporting agency (PRA) to provide robust, reliable and consistent assessments and indices.

To view all Fastmarkets MB Non-Ferrous Methodology and Price Specifications, click here.

Jon Mulcahy and William Adams in London contributed to this article