Rare earth magnets, which are essential for the world’s net-zero transition by 2050 through their use in electric vehicle (EV) engines and in offshore wind turbines, attracted increasing attention in 2023.

Before Christmas, China prohibited the export of rare earth production technology and machinery, formalizing existing export restrictions.

In December, the US Congress suggested to introduce tax credits for domestic rare earth magnet production.

Existing US regulation includes the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA), both signed in 2022.

The IRA provides tax incentives to source critical materials domestically within the US or from free trade partners, while the BIL is a source of investment into the supply chain.

China is currently responsible for approximately 90% of the global rare earth magnet production, the US Department of Energy (DOE) estimates, with the rest coming mainly from Japan.

Such measures find support in the industry, in addition to direct investments for magnet makers.

E-VAC Magnetics – US subsidiary of German privately-owned magnet manufacturer VAC Group – has concluded an agreement with the US Department of Defense (DOD), which will provide $94.1 million for the purchase and installation of manufacturing equipment, technical infrastructure and the engineering of production lines.

“VAC is thankful for the support of the US DOD… and encouraged by the availability of additional investment incentives through the BIL and IRA,” a VAC spokesperson told Fastmarkets.

The VAC spokesperson added that tax credits for rare earth magnet manufacturing are critical to ensure that US-produced magnets remain competitive in the global market.

“Fresh capital is needed to ensure that the industry is able to close the gap compared to the already mature investment and industry base in Asia,” a spokesperson for UK magnet maker GKN Powder Metallurgy – now a part of UK-listed company Dowlais – said.

E-VAC Magnetics’ plans for Sumter, South Carolina

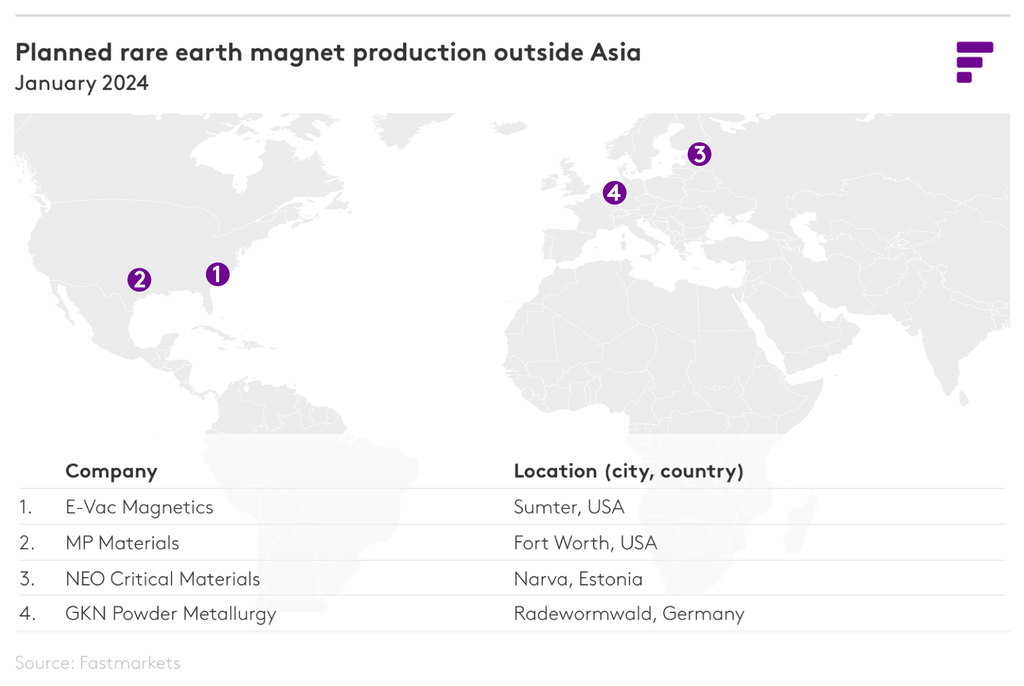

Shortly before Christmas, e-VAC Magnetics announced plans to build a sintered neodymium iron boron (NdFeB) rare earth magnet plant in the city of Sumter, South Carolina.

The plant is expected to be operational in late fall 2025, with planned capacity yet undisclosed.

The Sumter plant will supply US carmaker GM under a binding long-term supply agreement concluded in January 2023.

According to a previous statement from VAC, the US plant will use “locally sourced” raw materials to manufacture permanent magnets for a portfolio of EVs.

Locally sourced materials from the US rare earth mines are mostly light rare earths.

For high-performance sintered NdFeB magnets, four rare earth elements are essential: neodymium, praseodymium, dysprosium and terbium.

Heavy rare earths are crucial for these magnets to maintain performance and efficiency at higher temperatures.

In response to Fastmarkets’ query about their sources of heavy rare earths, the VAC spokesperson referred to “numerous mining projects in various stages around the world,” without commenting on their confidential supply agreements.

US regulation might help procure heavy rare earths: in the National Defense Authorization Act for Fiscal Year 2024, signed in December, section 1080 expands the definition of a “domestic source” to include the UK and Australia.

A UK junior miner planning to supply dysprosium and terbium is Rainbow Rare Earths, which develops the Phalaborwa project in South Africa.

Australia’s Lynas Rare Earths – the largest rare earths producer outside China – is now building a heavy rare earth separation plant in Seadrift, Texas, using a $258 million grant from the US government.

MP Materials building Fort Worth, Texas

Another project is coming from US company MP Materials, which owns and operates the Mountain Pass light rare earth mine in California.

MP Materials began construction of a sintered NdFeB magnet plant in Fort Worth, Texas, in April 2022. First-phase production capacity will be 1,000 tonnes per year.

1,000 tonnes of NdFeB magnets per year is around 1% of current worldwide production, the DOE estimates.

“Our first major piece of processing equipment has been installed in the factory, and we expect a lot more progress in the coming months,” MP Materials’ CEO James Litinsky said in an investor call in November.

Neo and GKN initially focused on Europe

In July, Canada-headquartered advanced materials producer Neo Performance Materials began its construction of a permanent rare earth magnet facility in Narva, Estonia, the company said.

The facility is on track to start commercial production in 2025, with an initial capacity of 2,000 tonnes per year of NdFeB magnet block, enough to supply approximately 1.5 million EVs, a company spokesperson confirmed to Fastmarkets.

A second phase is expected to increase the company’s capacity to 5,000 tonnes per year, supplying 3-4 million EVs.

In 2023, the company also acquired UK-based advanced magnetic component and assembly manufacturer SG Technologies.

In 2024, Neo is aiming to complete the construction and startup of its Estonia sintered permanent magnet facility to the specifications of European and American original equipment manufacturers (OEMs), in which consumers are already expressing interest, the spokesperson said.

“We are already seeing EV motor OEMs asking for a ‘local for local’ supply chain offering for permanent magnets in their new platform procurements,” they said.

Another European project starting belongs to GKN Powder Metallurgy, a part of a UK listed industrial company Dowlais.

GKN Powder Metallurgy is planning to establish a total capacity of 4,000 tonnes per year of rare earth magnets across Europe and North America, the company told Fastmarkets in late December.

“We are launching a low-scale pilot plant in Radevormwald, Germany, which will be ready to operate early 2025,” a company spokesperson told Fastmarkets.

They will proceed with expansions in Europe and North America based on customer order intake, the spokesperson added.

GKN Powder Metallurgy is not yet disclosing developing partnerships with the automotive sector.

In October, GKN Powder Metallurgy signed a memorandum of understanding with German motion technology company Schaeffler, aiming to support it with permanent magnets for automotive and other industries.

In April, GKN Automotive, GKN Powder Metallurgy and GKN Hydrogen businesses were demerged from UK industrial company Melrose Industries PLC into the standalone company Dowlais.

Non-European companies may also eye an expansion to global markets.

POSCO, Star Group Industrial eyeing the US

Korean companies POSCO International and Star Group Industrial are planning to build a permanent magnet factory in the US, with an initial production capacity of 3,000 tons a year. The location might be in Texas, Tennessee or Arizona, Fastmarkets understands.

Both companies’ magnet experience includes supplying Vietnamese EV startup VinFast with traction motor permanent magnets, POSCO said in 2023.

“We are currently in the process of reviewing the matter,” a spokesperson for POSCO International told Fastmarkets about the US factory, adding that no specific details have been finalized.

Discover our rare earths prices and insights to stay ahead in this volatile market

Find out more about the launch of Fastmarkets’ rare earths prices and discover further insights here.