Global supply chains have been in disarray since the onset of the Covid-19 pandemic. The forest products market is no exception.

Labor shortages and logistics disruptions are a worldwide forest products market issue, especially in the US and Europe. It’s affecting the entire global supply chain from timberlands to mills to box plants and transportation and distribution centers. Box makers can’t keep enough workers on the corrugator plant floor. Low inventories at wood products mills are slowly growing to catch up with demand but are vulnerable to falling behind again if Covid rates flare up. Warehouses and distribution centers are closed or at capacity and truckers are in short supply.

Though some logistical issues existed in the forest products supply chain before 2020, the pandemic was an unexpected variable that cut into the labor force. Retailers, wholesalers, consumer packaged goods companies (CPGs) and other forest products buyers are feeling the downstream effects and hoarding more inventory.

Future Covid-19 waves and shifting worker behaviors influenced by the pandemic could have further impact on labor markets, restraining mill output and distribution capacity, pulling supply out of balance with demand. Solutions may include unforeseen costs like higher wages, more expensive transportation alternatives and more. It’s become even more critical to watch labor trends.

Here are the key areas where labor issues are compounding supply chain challenges:

- Mill labor shortages and downtime

- Box plants and converter labor challenges

- Trucker and transport limitations

Mill production ramping up, but the pandemic could disrupt again

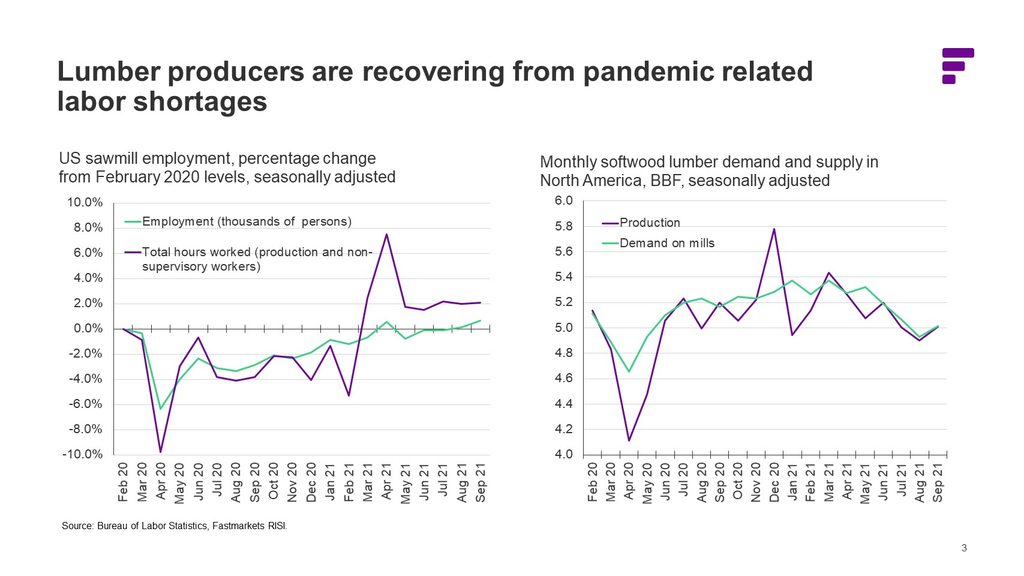

When the pandemic hit, mill workers across grades faced furloughs and layoffs. Some opted to retire instead. For labor-intensive mills like sawmills, where a strong employee base is critical, fewer workers meant aggressively curtailed output, low inventories and mill downtime.

Coupled with a house-buying and a DIY boom, this caused North American wood products prices to skyrocket. Wood products buyers like lumber yards and consumer retailers like Home Depot and Lowes were pressed for inventory and consumers faced higher retail prices.

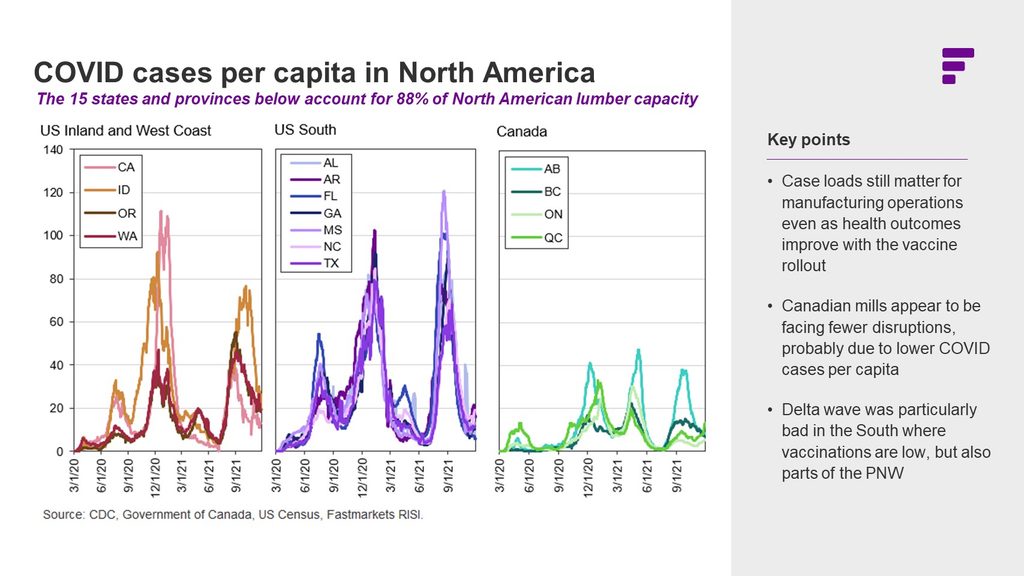

Vaccination, herd immunity and seasonal effects likely all contributed to the downward shift in Covid-19 cases. According to economist Dustin Jalbert, this made it easier for mills to finally ramp up output and increase overtime and shifts in the summer. Some sawmills are offering higher wages and increased incentives to attract more workers. Some sawmills report offering more an hour in hopes of returning the labor force to pre-pandemic levels.

New covid variant spikes could affect pockets of mill output again, especially coupled with other ongoing supply challenges like trucking shortages, flooding and policies. Vaccination and covid case volumes in the mill community especially can impact production. For instance, in the US state of Idaho, a covid spike in local communities in September through November caused production disruption in mills in that area.

In the US wood products market, about 3.504 BBF of soft yellow pine (SYP) has been announced to start up by 2023. But mill labor shortages, on top of equipment shortages, will slow the ramp-up of these operations. Economist Dustin Jalbert even suggests that it won’t come online fully until 2024 or even 2025.

Supply chain issues pushing up prices

Prices cooled down and dipped to more expected levels in the fall of 2021. But persisting supply chain issues like mill worker and truck driver shortages have combined with record flooding on road and railways in British Columbia to drive up prices. Lumber prices have increased more than 120% since August.

Lance Lambert of Fortune says, “The dynamics driving this current lumber run, including flooding in British Columbia, are very different from the supply and demand issues that drove the spring lumber run. That said, the reason lumber prices were susceptible to this latest run is because of the lingering pandemic dynamics—elevated demand and worker shortages—that continue to bog down the overall supply chain.”

Dustin Jalbert says wholesalers and retailers are looking to secure more supply and increase their inventory so they do not come up short again like they did last spring.

Lumber inventories rose to a 6.2 dealer rating, up from 5.9 the previous month and well above last year’s level of 5.7. Panel inventories rose to 6,0 from 5.7, far ahead of last year’s level of 5.4.

Box makers lag behind as they struggle to staff plants

Paper and packaging supply chains face a more desperate situation as we head into the winter holidays. Already faced with depleted inventories from 2020’s pandemic-driven production delays, box plants (where papers are combined into corrugated and converted to boxes) are struggling to make and deliver enough boxes to their customers.

US box makers report their box lead time is increasing because:

- There are not enough workers at the box plant to keep up with the needed output

- Trucker shortages have decreased the number of possible shipments from containerboard mills to box plants

Containerboard mills have been less effected by labor issues because production requires less workers. However, box plants require more people -power. Because of this, box plants have been unable to keep pace with the incoming box orders driven by strong e-commerce business, despite climbing US containerboard mill inventories in the second half of 2021.

To attract workers back into the plants and ramp up production, some US box makers report they are offering wages as high as $30-45 per hour, including double pay for weekend workers. Typical pre-pandemic wages ranged from approximately $18-25 per hour.

Now retailers are feeling the downstream effects. Disruptions in box making from lack of labor is creating a pain point for retailers and adding to their own supply chain bottlenecks. Containerboard boxes and packaging materials for household goods, electronics, and grocery are especially scarce.

With e-commerce stronger than ever, retailers are stockpiling boxes. Amazon and other big retailers especially have hoarded boxes to fulfill more online orders.

Transportation delays and logistics challenges add to the problem

Warehousing, trucking and distribution delays are increasing on top of rising diesel prices. While railroad operations are 24/7, the distribution centers and warehouses are not. Warehouses are lacking the space and labor size to handle the volume of product.

Truckers are in short supply

The trucking labor force was challenged before the pandemic and has only got worse since. Truck driver shortages impact every function of the supply chain, right down to the retailer.

The American Trucking Associations (ATA)estimates that in 2021 the truck driver shortage will hit a historic high of just over 80,000 drivers.

UK’s Road Haulage Association (RHA) Richard Burnett warned UK Prime minister Boris Johnson in July that the country was facing an estimated shortage of 100,000 heavy goods vehicle drivers, a number already strained by Brexit. Now it’s been made worse by the pandemic because many international drivers with visas have left the country to quarantine in their home countries. Many aren’t expected to return.

According to the Financial Times and their Germany-based source Steven Bork, the European truck driver shortage was made even worse by the increased economic activity after covid restrictions were eased. Higher workload on trucking employees even lead to resignations.

It’s clear the covid pandemic put a strain on the transport labor force, resulting in supply chain delays. But the pandemic has possibly even accelerated the labor force’s shifting behavior and departure. Global driver employment trends show some employees are opting to retire early while others are leaving the industry for other employment. Additionally, fewer people are willing to take long-haul trucking routes, which is the main source of transportation for so many regional forest products.

According to Craig Fuller, CEO of Freightwaves, the US Congressional bills, in particular the Infrastructure Bill, will have an exponential impact on capacity. The big risk in the Infrastructure Bill for the trucking industry is that it will create a lot of demand for domestically sourced construction products and materials. The labor force required to do this work is the same group of people that could be truck drivers – so there would be a resource grab between trucking and the construction/manufacturing industry. There is also the risk that people that are truck drivers today could find better paying or more desirable work in other industries and will end up leaving the trucking industry, causing further labor shortages.

Out-of-the-box transport solutions

Trucking is an especially worker-intensive way of transport, compared with railroads which one driver can carry a larger load. Some trucking industry leaders are looking for solutions, investing in increased wages, looking into unexplored demographics for employees and even exploring new trucking technology.

The BBC reported in October that the UK transport industry is still looking internationally, introducing 5,000 temporary visas for lorry drivers. Some US trucking companies are doing the same, recruiting as far as South Africa.

But what if the supply chain could reduce dependency on driver hires? Craig Fuller, CEO of Freightwaves, says we’re still nearly 10 years away from autonomous trucking but some trucking start-up activities suggest it could be sooner. According to TechCrunch, self-driving truck companies are already testing. TuSimple reports they are just months away from testing their self-driving trucks on public roads without a safety operator. Embark is targeting commercial driver-out operations by 2024.

If autonomous trucks could be introduced for long-haul routes, it could lessen recruiting concerns and lower the impact on supply distribution.

Watch key indicators to stay ahead of the market

Labor shortages can negatively affect forest product supply, mill and factory output, and influence inventory levels. Supply chain chaos will continue until the labor force stabilizes. We can conclude:

- Watch virus spikes in local mill communities to see impact on downtime and output.

- Production and distribution companies will incur more expenses, such as increased wages and stored inventory costs to combat supply chain unknowns.

- The pandemic accelerated trucker shortages and worker behavior shifts. Less people want to take long-haul trucking routes. Self-driving trucks could be one possible out-of-the-box solution.

- Retailers, wholesalers, CPGs and other end-use forest products buyers need a larger inventory to stay ahead of supply chain delays.

Tracking trends affecting supply shifts is essential. Stay ahead of the market with thorough near- and long-term forecasting that looks at how the labor market plays into your price.

Take a look at the near-term forecasts and prices for lumber and containerboard for North America and Europe to better understand how supply chain challenges connect to inventory and price.