If production methods do not evolve, CO2 emissions from the steel industry are likely to increase substantially in the coming years and continue to do so through 2050.

This scenario poses a significant challenge to meeting international climate targets of limiting global warming to well below 2°C above pre-industrial levels.

The projected rise in emissions underscores a critical gap in current sustainability efforts.

To align with the Paris Agreement, the steel industry must achieve a roughly 90% reduction in CO2 emissions by 2050. This ambitious target necessitates a comprehensive, multi-faceted strategy.

1. Accelerated adoption of green technologies

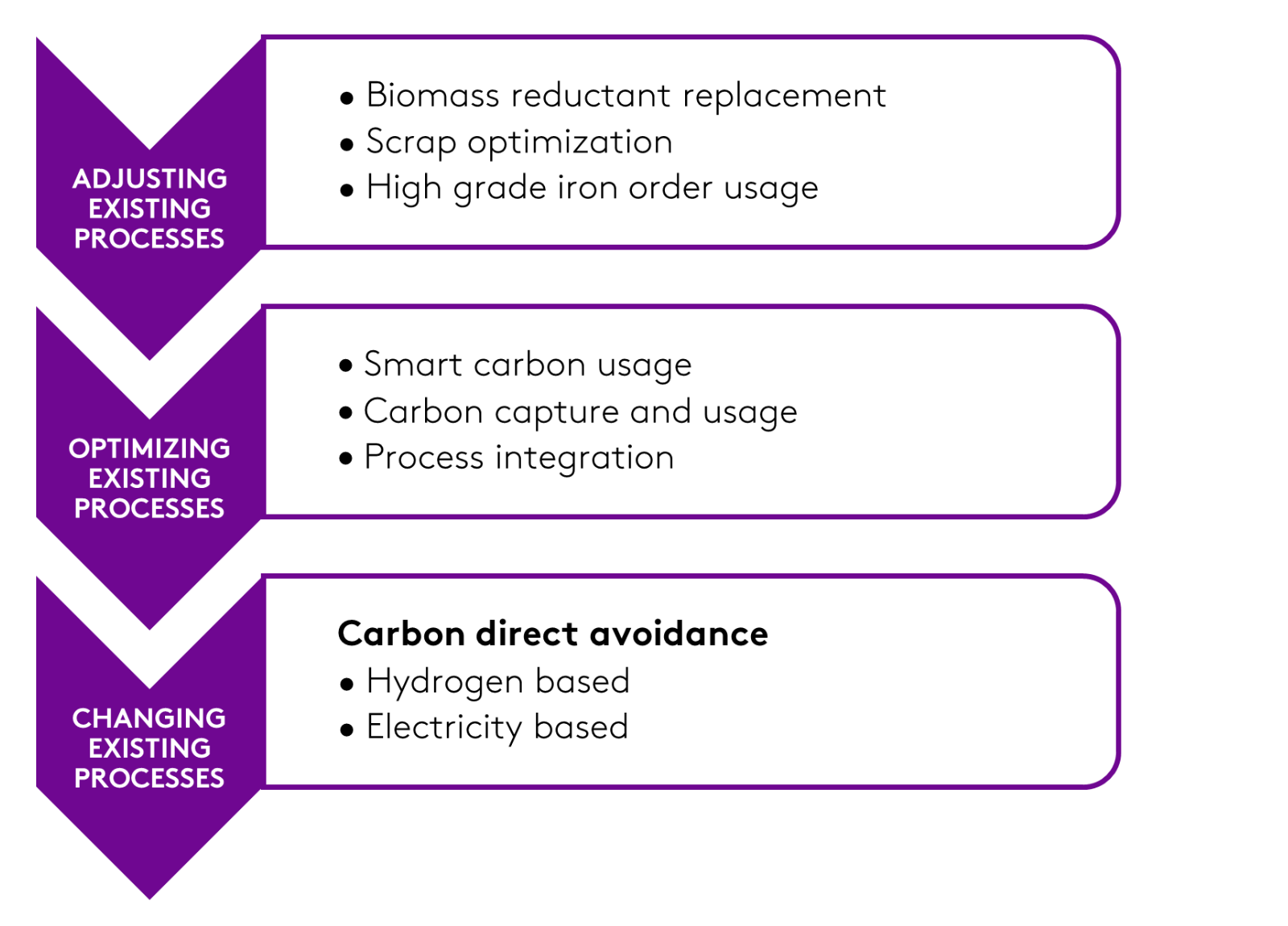

To meet climate goals, it’s crucial to accelerate the adoption of green technologies such as hydrogen-based direct reduction, carbon capture and storage and increased use of electric arc furnaces powered by renewable energy.

Meanwhile, readily available technologies like increasing efficiency, maximizing scrap utilization and exploring alternative reductants are lower-hanging fruit which offer immediate implementation opportunities.

2. Policy and regulatory support

Stronger policies, including carbon pricing, subsidies for low-carbon technologies and stricter emissions regulations, are essential to drive industry-wide change.

3. Global collaboration

International cooperation is vital to ensure that technological advancements and best practices are shared and implemented globally, especially in developing countries with growing steel demand.

The coming decade will be crucial in determining whether the steel sector can pivot towards sustainability and play its part in global climate mitigation efforts.

Achieving the scale needed for green steel and hydrogen projects requires robust policy support and innovative financing solutions.

Providing market intelligence for a low-carbon future

Fastmarkets is dedicated to supporting the steel industry’s transition to a low-carbon future with comprehensive market intelligence on steel, scrap and iron ore.

We analyze supply chain dynamics, assess market trends and publish prices to provide insights that help steelmakers optimize their sourcing strategies and navigate the evolving market landscape.

The steel research team’s services include both short-term and long-term forecasts of steel and steel raw material prices, along with our steel capacity database available to clients.

By quantifying the value of low-carbon steel, we create financial incentives for producers to invest in sustainable practices. This market-driven approach is crucial for facilitating the adoption of green technologies and achieving emission reduction targets.

These goals are essential not only for mitigating climate change but also for ensuring the long-term viability and competitiveness of the steel sector.

Discover how our suite of green steel prices can support your ‘green’ investment decisions while bringing transparency to the industry. Talk to our experts today.