This article is part of a special report on the Lithium Triangle. You can read the other two parts here and here.

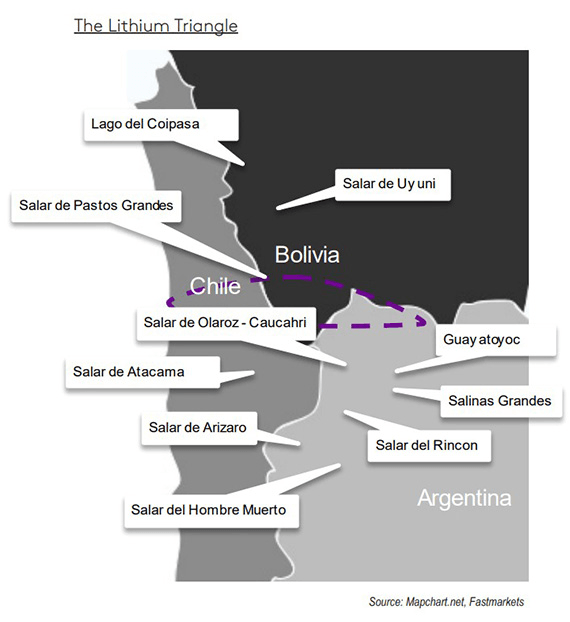

The countries that comprise the Lithium Triangle currently control more than 50% of global lithium resources, with production concentrated in the salt flats regions of Argentina, Chile and Bolivia, where there are lithium brine deposits.

Mineral Commodity Summaries by the US Geological Survey in January 2024 showed that the world’s lithium resources have increased substantially and now total 105 million tonnes.

You can see how/where the Lithium Triangle is located in the image below:

Currently, according to Fastmarkets’ research team, Argentina has 85 lithium projects at different stages of exploration and construction. These are mainly in the most arid areas of the country – Catamarca, Jujuy and Salta – with seven operations working.

Chile, on the other hand, has 19 projects between exploration and construction, with two operations working and one expected to begin production in 2025.

Bolívia has no active lithium projects at the moment.

The tables below show the operational and advanced projects that are filtered and used to create Fastmarkets’ long-term forecasts.

For more information on our long-term price analysis of the global lithium market, see Fastmarkets’ lithium 10-year long-term forecast.

Production forecast

Fastmarkets’ updated 10-year production forecast for the three countries that form the Lithium Triangle are as follows:

Argentina

Argentinian production was expected to increase at a compound annual growth rate (CAGR) of 15% between 2024 and 2034, to reach 355,200 tonnes per year.

Although brine production was a relatively low cost procedure, new projects and further expansion in the country were likely to be delayed or halted in the current price environment.

Despite the near-term challenges, Fastmarkets expects Argentina to become an increasingly significant participant in the global lithium market. But many projects are focusing on direct lithium extraction (DLE) as opposed to traditional processing routes, so there is additional risk to the downside.

Chile

Chilean production is forecast to increase at a CAGR of 3.6% between 2024 and 2034, to reach more than 371,000 tpy.

Given the scale of the lithium resources in Chile and the cost-competitiveness of the industry, Fastmarkets expects more Chilean projects to be established over the next decade.

SQM plans to expand its production capacity in the Salar de Atacama to 300,000 tpy from about 200,000 tpy. Chile’s National Mining Company, ENAMI, intends to start construction on its first lithium project in the country as early as 2027.

The country is also turning its attention to increasing lithium hydroxide production, which is set to grow to 50,160 tonnes of LCE in 2034 from 22,000 tonnes of LCE in 2023 – a 128% increase.

Bolivia

Bolivia has awarded the rights to develop projects in the Uyuni and Oruro salt flats.

State-owned producer Yacimientos de Litio Bolivianos will play a central role in the project that intends to create two lithium plants, each producing as much as 25,000 tpy of battery-grade lithium carbonate. The operation intends to produce 100,000 tonnes by 2028 using DLE.

Bolivia has also entered into an agreement with Russian state-owned company Uranium One Group to build a DLE pilot plant that is expected to commence operations in 2025, producing 1,000 tonnes of battery-grade lithium carbonate in its first year.

The Bolivian government is clearly much more amenable than in the past to international partnerships, which bring significant investment and development expertise. But given that much of the planned production is based on DLE, there is significant technical risk to achieving the announced production targets.

Current lithium pricing

Fastmarkets assessed the lithium hydroxide monohydrate LiOH.H2O 56.5% LiOH min, battery grade, spot price, cif China, Japan & Korea, at $8.50-10.00 per kg on Thursday November 21, up by 5.71% from $8.00-9.50 per kg the previous day.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot prices, cif China, Japan & Korea, stable on Thursday at $10.80-11.40 per kg, unchanged since Tuesday.

This article is part of a special report on the Lithium Triangle. You can read the other two parts here and here.

If you’re interested in learning more about Argentina’s mining sector, fill out the form here to access our recent webinar replay. This comprehensive session provides in-depth insights and expert opinions, offering valuable information for anyone looking to explore this burgeoning market.