One of our senior economists, Steven Honeyman, breaks down the recent Global and North American boxboard market, with commentary on market trends and forecasts.

The current global boxboard market

Over 90% of global demand, production and capacity are concentrated in three regions: Asia, Europe and North America. To varying degrees, worldwide boxboard demand is still recovering from Covid.

However, in terms of global supply and demand, there are strong signs that the global boxboard market overall is growing.

After a 3-year decline, both production and capacity grew in 2021 and capacity looks to be expanding globally in 2022 as it is currently up (year on year) by 4.6 million tonnes.

Production will also continue to grow, but not as quickly as capacity, and global operating rates will fall over the forecast.

Promising growth – despite struggles

This growth exists, despite the numerous worldwide challenges. Chinese capacity and exports are soaring despite domestic struggles, and there are new projects in Europe, but some delays have been announced.

In addition, the Latin America market sees inflation erode consumer budgets, therefore limiting boxboard growth.

As per the chart above, however, the gap between production and capacity signifies that there may be an excess, which has the potential to oversupply the market.

Boxboard market trends

As the world returns to work, it’s clear that consumer trends have evolved and are impacting the market.

The “work from home” policy is here to stay for many companies, and this has changed behavior. As more people are working from home than prior to the pandemic, we are seeing an increase in spending on pre-packaged foods and less spending at restaurants for work lunches and coffee.

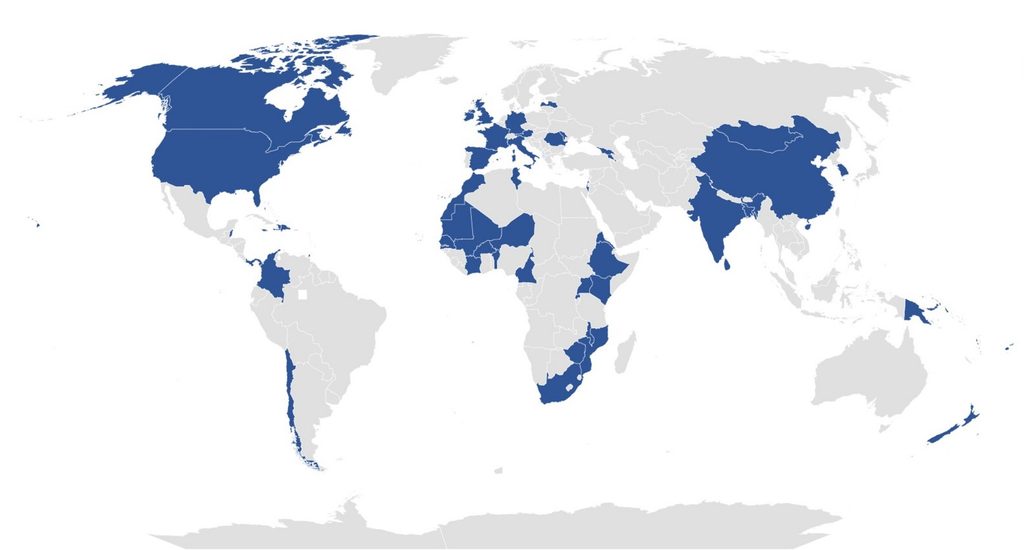

We also live in a time where consumers are limiting their reliance on single-used plastic. Europe currently leads the charge with wide-reaching legislation that seeks to reduce plastic pollution.

In North America, the charge is being led by state and local governments as well as companies adopting environmental and sustainability initiatives. More countries are due to follow suit, proving that it’s gathering momentum and this collective environmental concern is here to stay.

As per the image below, 65 countries worldwide have joined the movement to either ban or change taxes to promote the movement away from plastics.

Companies are finding a range of ways to eliminate packaging: some will redefine products to consume less plastic, some will find alternative ways to package.

Companies are finding a range of ways to eliminate packaging: some will redefine products to consume less plastic, some will find alternative ways to package.

But this undoubtedly will create opportunities for producers of fiber, as most substitutions will be in the form of fiber-based materials.

Input costs are rising

Cost inflation is still a huge issue for producers and buyers, as all inputs are still rising.

This is, of course, an international concern. But, if we use the US as an example, since the fourth quarter of 2020, variable costs have risen 25% for US SBS, 26% for CUK, and CRB variable costs jumped 34% over the same period.

We are starting to see some easing of shortages and bottlenecks, but it is unlikely that costs will drop to pre-pandemic levels anytime soon.

Inevitably this has a knock-on effect as the US folding boxboard price levels remain at historical highs. After a decade of relative calm, prices have increased significantly over the past year and a half.

Capacity closures, followed by the jump in pandemic-driven demand and rising costs, led to run-up in prices. To compound that, International shipping issues and international competitiveness prevented trade from easing tight market conditions.

Forecast summary

It’s evident from this piece that there is a whole range of factors at play, presenting both opportunities and challenges for those in the boxboard industry.

Opportunities for the boxboard industry

- Increased consumer spending

- Inventory restocking

- Environmental initiatives driving voluntary plastic substitution

- Legislation increasingly being used to mandate plastic elimination

- Work-from-home leading to more spending on processed foods and beverages

Challenges ahead include inflation, lowered spending

- Future waves of Covid affecting labor and supply chain

- Recession leading to lower consumer spending

- Inflation lowering spending

- High prices delaying plastic substitution

- Work-from-home hurting food service board

In summary

The demand for boxboard, which jumped during the pandemic, caused unexpected challenges with the supply chain. These are still being responded to now.

But permanently changing consumer behavior should help ensure that growth is sustained. The increasing desire for plastic substitutions is being driven by consumers and organizations voluntarily and legislatively.

In the background to this positivity, however, is the cost of inflation, which is affecting the entire supply chain. This will no doubt continue for an unspecified time, but there are signs that it is beginning to ease and, despite a potential recession, the future is bright for boxboard.