Falling prices have been the dominant theme in the rare earths industry in 2024. A steep slump at the start of the year capped two years of price declines that have slashed profits and upended processing margins. Fastmarkets reached out to market experts to gather insight on the outlook for 2025 and the factors and events that could shape it.

Price recap

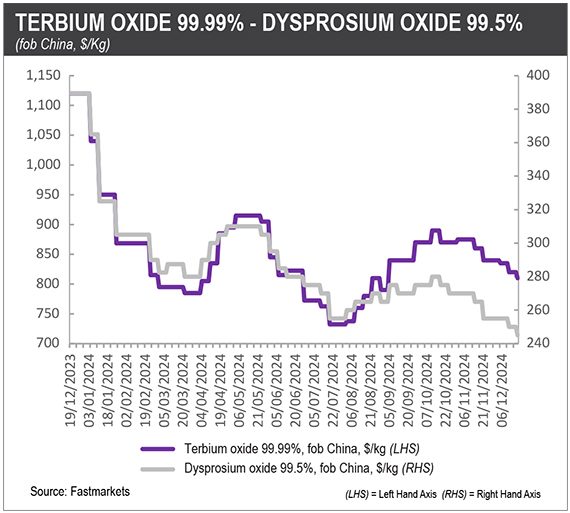

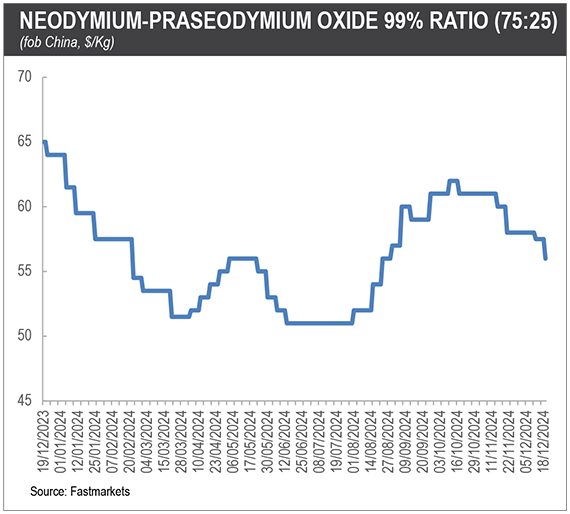

Prices for magnetic raw materials dropped in unison at the start of the year. By the summer, dysprosium had lost 30% of its value, terbium was down by 27%, and neodymium-praseodymium (NdPr) had fallen by 17%.

Fastmarkets’ weekly price assessment for dysprosium oxide 99.5%, fob China fell to $230-280 per kg on July 18, compared with $350-380 per kg on January 4 (all prices including value-added tax). Terbium oxide 99.99%, fob China dropped to $730-795 per kg on July 11, compared with $980-1,100 per kg on January 4. And prices for neodymium-praseodymium oxide 99% ratio (75:25), fob China slid to $50-52 per kg on June 13, compared with $60-63 per kg on January 4.

Week after week, suppliers attempted to raise offer prices only to be met with weak or absent demand from China’s huge downstream magnet sector. At the end of the summer, sellers reported an increase in purchases and prices began to move up. But the recovery began to lose steam in October and prices started falling again.

Prices for NdPr have partially recovered from the summer lows, last assessed at $55-57 per kg on December 19, down by 9% from the start of 2024. Terbium is now down by 22% from January 4 at $770-850 per kg. But dysprosium prices have fallen further, standing at $220-270 per kg on December 19, a drop of 33% from January 4.

In 2024, only two producers — Chinese state-owned major Northern Rare Earth and Australian major Lynas Rare Earths — said they had been able to retain a positive margin for refining rare earths and both reported steep declines in profits.

“The rare earths industry is swimming in red ink,” industry expert Constantine Karayannopoulos said, referring to the widespread financial losses across the sector.

Near-term outlook

“I don’t expect any major changes coming into Chinese New Year [January 28-February 4], but after the first quarter it could get tough,” Melvin Hill, vice president of GE Chaplin, told Fastmarkets.

This assessment was echoed by Jan Giese, senior manager for rare earths and minor metals at Tradium. “I’m pretty pessimistic for next year at this point. However, I’m not sure it has too much room to fall,” he said.

Lynas Rare Earths gave a downbeat but open-ended assessment in the chairman’s address to the annual general meeting on November 27: “Prices are likely to remain volatile until there is a strengthening in the Chinese economy” — a timely reminder that two-thirds of neodymium iron boron (NdFeB) magnet demand goes into legacy applications that are heavily exposed to China’s housing and construction sector.

But there was some more positive sentiment, particularly further out.

“I am pretty optimistic that by some time in 2025 or the first half of 2026 you will start to see inventories being whittled down and prices starting to increase,” Karayannopoulos said. “Fairly large inventories built up in 2023 and the first half of 2024 because of weaker than expected [magnet] demand caused by relatively negative consumer sentiment and political uncertainty — particularly about EV mandates outside China”.

Magnet demand

Global rare earth magnet demand is expected to keep rising in 2025 — as it has for the past five years — but not as fast as previously expected, according to John Ormerod, head of magnetics at metal consultancy JOC LLC.

“Most experts were looking at a 9% increase by volume next year. But I think we will be closer to 5%,” he said, pointing to the state of the Chinese economy, rare material pricing and the growth and mix of electrified vehicles.

A key theme of 2024 has been the resurgence of hybrids over pure electric. Hybrids also use high-performance NdFeB magnet motors, but with smaller output and using around a third the amount of magnets as a full electric vehicle.

Wildcards

Fundamentally opaque and exposed to political policy risk — the unpredictable nature of rare earth markets has been a constant theme for years. Fastmarkets asked market experts about the broader risks and factors facing the industry next year.

“For me, the really big question for the market next year is Myanmar. The Kachin Independence Army has taken control of the rare earth mining area in Myanmar and China has closed the border. No ammonium sulphate is going in and no rare earths are coming out,” Thomas Kruemmer, founder of The Rare Earths Observer, said.

“Chinese imports of raw materials from Myanmar were 40,000 tonnes during the first nine months of 2024. If that production drops out, there will be a big impact on [heavy] rare earth prices,” he said.

But not everyone agreed. “It has been an unstable situation ever since they started mining down there. I think you would have seen a bigger [price] reaction,” an industry source said. “Now if raw material imports were included in Chinese production quotas, that would have a big impact on supply and really push up prices.”

Imports of rare earth raw materials to China are exempt from the refining and smelting production quotas issued several times a year. Large increases in raw material supply have been cited by some as a factor in the apparent mismatch between supply and demand.

Other industry sources were quick to dispel the notion of a radical policy shake-up, describing such a move as “irrational.”

“I expect the Chinese regulators to try to tighten supply a bit to allow prices to rise to levels allowing more consistent profitability through the supply chain and to make sure the rare earths industry isn’t a subsidy provider to the EV industry in China. It can’t be — it’s too small,” a second industry source said.

US tariffs

“My top concern is that rare earths will get thrown onto the tariff list and they won’t differentiate between neodymium-praseodymium oxide, which the US does produce, and neodymium oxide and praseodymium oxide, which it does not,” Hill said. “If you look at the HS codes, a lot of rare earths fall under the same ones. There could be a lot of collateral damage.”

Any discussion of new trade restrictions inevitably raises the question of retaliation, however likely or unlikely it may be.

“If you look at the list of critical materials that China has put under restrictions, there aren’t that many left anymore,” Giese said.

Want to learn more about the data behind this article? You can speak with our team and get a demonstration of our product.