By Peter Hannah, index manager for Fastmarkets

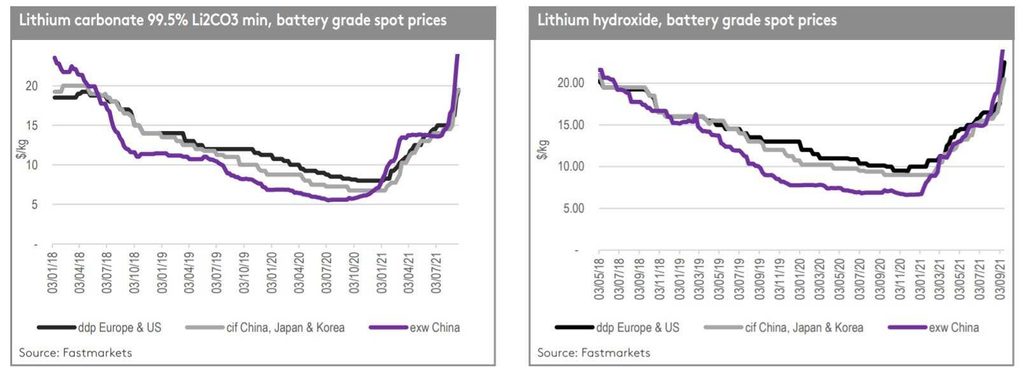

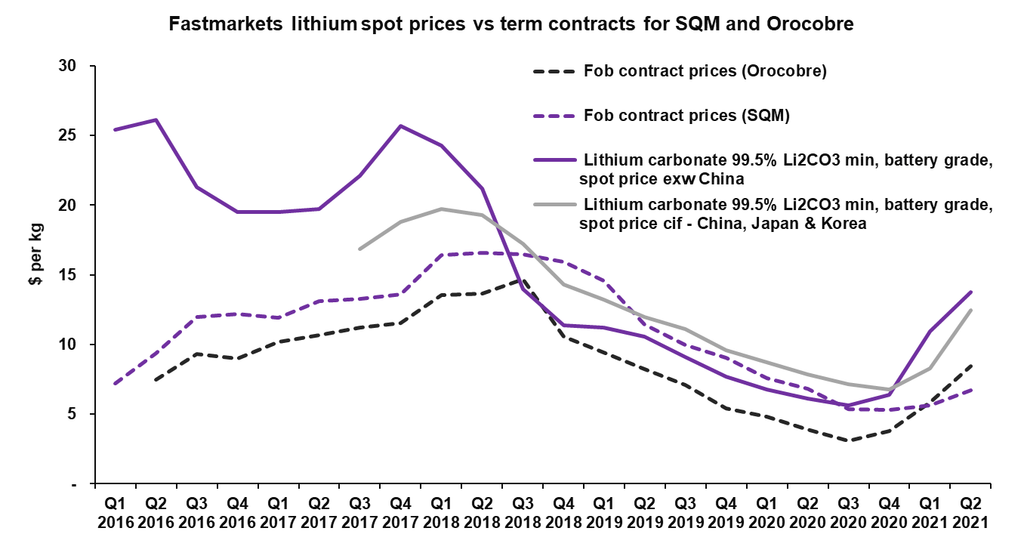

Prices for lithium, from concentrates to chemicals, have been surging in recent months. Well, spot prices have at least. But as many lithium market commentators will tell you – that’s not all lithium. In fact, spot business only accounts for a small fraction of supply compared with the volumes locked up in term contracts, where prices are either fixed between counterparties for set periods or linked to effectively self-referencing reflections of prevailing contract levels, such as trade statistics.

So, what is the “real” price then? And is this even a worthwhile question to ask? Given all prices are real insomuch as they are paid and received, perhaps the better question should be: “which of these prices better reflect market conditions”? And the answer to this is the spot price. Just like in a game of musical chairs, when most of the supply and demand is accounted for, it’s the fight, or shrug, over the last available scraps that provides insight on the market balance, and hence what each individual unit should be valued at. This is the so-called “marginal-tonne” pricing system that underpins the trade of many mature commodities.

Fig. 1: Lithium spot prices have been on a tear since the start of 2021

Pricing standardization, not product simplification

But wait a minute! Lithium isn’t a commodity – it’s a speciality chemical. This is the argument made by many as to why lithium products require a bespoke approach to pricing, accounting for the unique complexities that determine their value-in-use, and even whether they can be used in certain applications or specific supply chains at all. This issue is real, and it does to an extent currently limit the scope for a truly open and competitive spot market.

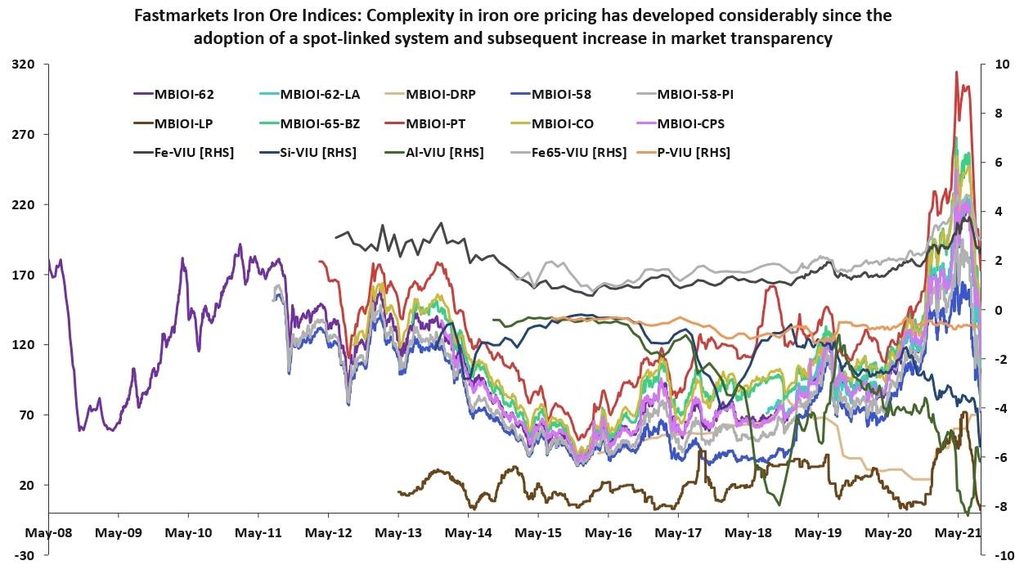

But there are many other “non-fungible” commodities exhibiting considerable quality-dependent value variation, which have nevertheless evolved to reference standardized spot price benchmarks, using premiums and discounts to adjust for different grades and circumstances. A frequently referenced example is iron ore, which adopted a spot-linked pricing system in 2008, despite the challenges of its inherent non-fungibility.

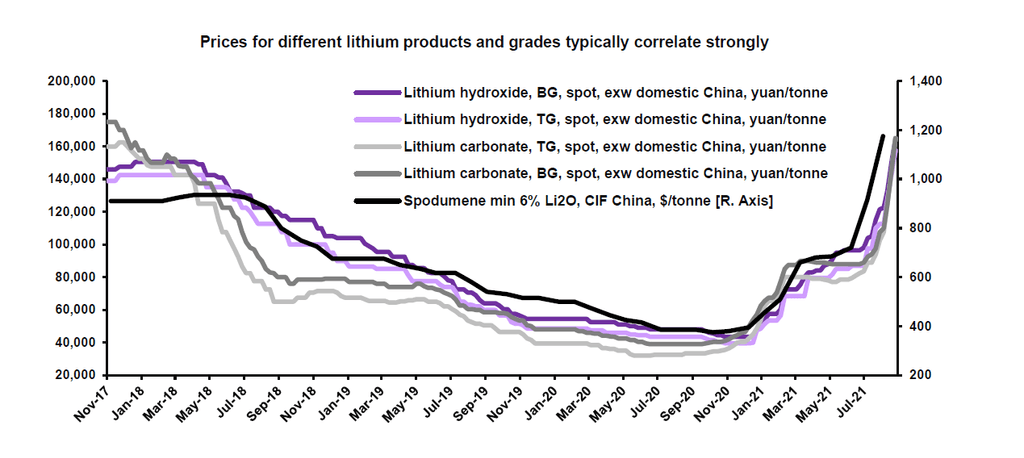

Drawing parallels between iron ore and lithium is fraught with issues, and we should not imagine that the value-in-use variability of the former is remotely comparable to utilization complexities of the latter. The application of lithium in batteries is an intricate chemical process and the qualification requirements for usage highly limit the ability for consumers to mix and match different batches. We must however also acknowledge that, in spite of this, prices for different qualities and types of lithium product do in fact correlate to a surprising degree. This is because at the margins of supply and demand, where price discovery ultimately takes place, there is a common competition for lithium units. Therefore, while the nature of lithium as a speciality chemical may instinctively prompt us to rebuff the notion of it adopting a more mature pricing system, the actual market dynamics we observe appear to lead us toward a different conclusion.

Fig. 2: Despite its reputation as a specialty chemical rather than a commodity, market prices for different lithium products and grades do still correlate reasonably strongly. Fastmarkets’ analysis of domestic Chinese data from local providers also shows that even a product as distinct as lithium metal may exhibit a price correlation of around 80% with lithium carbonate.

This is not to say that trade in lithium products should or could be in any way commoditized. Pricing evolution does not mean product simplification. To reference iron ore once again, it has only been in the years since adoption of market-based pricing that differentiation of product value has truly developed. The graph below serves as a striking visualization of how an initial standardization and adoption of a benchmark reference sparked the increase in market transparency that facilitated much more efficient valuation across different product types. If the lithium market were to similarly embrace a spot-linked pricing system, we would quite expect to see counterparties negotiating sometimes considerable adjustments to the base references. These would account not only for quality-related variables, but also environmental, social and corporate governance (ESG) merits and commercial considerations such as relationships and contract duration, given that security of the right supply is so critical in the industry. The need for technical and commercial experts on both sides of the negotiating table would thus remain every bit as great as before.

Fig. 3: Those concerned by a potential simplification of lithium as a mere “commodity” under an index-based pricing system should rest assured that markets generally tend toward greater granularity and complexity while transparency of price discovery increases. Iron ore is a good example of this.

Dashboard blinking red

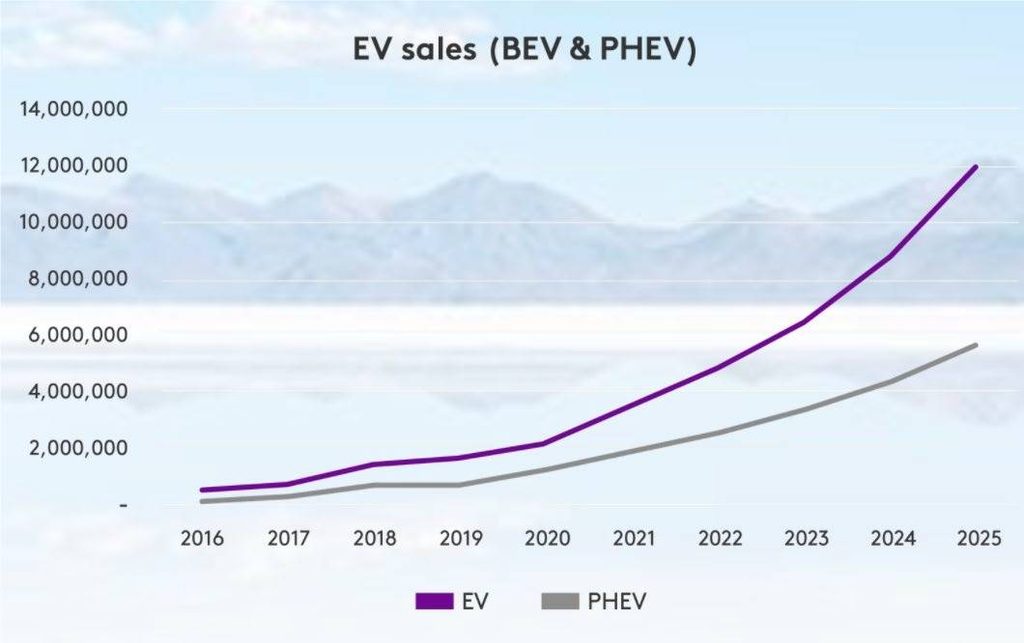

This is much more than an academic debate over pricing mechanisms. Lithium is indispensable to the electric vehicle (EV) revolution, on which the ambitions of international climate change targets are firmly riding. It is critical that sufficient supply can be brought to market to match the steep curve of projected demand, and opaque pricing may present a threat to this.

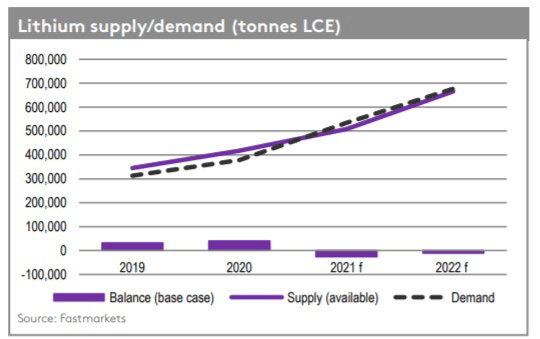

Granted, a run-up in spot prices a few years ago did see an initial supply surge, and this in part contributed to a three-year price slump, although a dip in demand growth owing to the reduction in Chinese EV subsidies was also a factor. Today, however, we are not merely at the precipice of a supply deficit, but may have already lost our footing, with Fastmarkets’ research division forecasting significant negative market balances for this year and next. To be clear, Fastmarkets’ research division does still believe that there is still time for supply to respond to avoid a major multi-year supply crunch, but the clock is ticking.

Fig. 4: Fastmarkets Research is forecasting substantial negative market balances for this year and next

Automakers around the world, having set out plans for ramping up production of electric models, are now beginning to question with increasing urgency whether the lithium is going to be there for their batteries, or at least how much they may end up having to pay for it. While they themselves are as liable to accusations of being asleep at the wheel as any other player involved in the mine-to-car supply chain, the fact is that the prevailing pricing system may ultimately be to blame more than any individual actors. Without price realization for industry players properly reflecting the evolving supply and demand situation, the “invisible hand” of the market may be struggling to guide investment to where it is required.

Fig. 5: Term-contract prices can often greatly lag movements in the lithium spot markets, delaying the time it takes for changing market conditions to reflect on some companies’ balance sheets

Spot prices rising at record rates are now like blinking red warning lights on a dashboard, only just beginning to be taken as seriously as they should. Analysts still point to the small volumes in question though and ask whether contract prices – the larger, submerged part of the iceberg – will catch up and converge. Perhaps they eventually might, but the price signal that markets require for efficient capital allocation would have been greatly delayed. Over time, such dislocations amplify the peaks and troughs of market imbalances. Volatility, though manifesting on a lower frequency, is made greater.

Risk mitigation

One of the key concerns market participants have around adopting a spot-linked pricing mechanism is that it exposes them to greater price uncertainty, but there are approaches to managing this that help pave the path toward market maturity. First, counterparties could opt to settle contracts using a “quotation period (QP) in arrears” approach, pricing this month’s shipments against the already known average of the spot price the previous month (or a longer period depending on their favoured timeframe). This approach has been employed by more conservative participants in other markets that have adopted index-linked pricing.

But in a market that has liquid derivatives contracts settled against the spot price being used in physical contracts, this becomes broadly unnecessary given that prices can be fixed well into the future. Both the CME and LME have already launched cash-settled lithium hydroxide futures, and it is likely that we will see further launches of carbonate futures and potentially even other lithium products in the future. Though nascent, as these contracts build liquidity over time, they will provide venues for market participants to independently manage their pricing exposure according to their own individual requirements.

More mature market pricing would also help mitigate industry risk in a much broader sense too. A spot-linked pricing mechanism, combined with the added transparency of a forward market, would help capital allocators act with even greater confidence to make effective and timely investments. By helping to avoid potentially serious supply crunches, this will support the acceleration of EV penetration in the years ahead, and hence lithium demand. In other words, it is in the lithium industry’s own interest that its products remain consistently cheap enough so as not to jeopardize the economic competitiveness of EVs relative to internal combustion engine (ICE) vehicles.

Rome wasn’t built in a day

Lithium is still a relatively small market at under $10 billion per annum if measured even at today’s elevated spot prices. The phenomenal rate of change while it grows to feed the wholesale electrification of mobility and revolutionize energy storage was always going to challenge every facet of the industry. Pricing is just one aspect of this challenge, but it is arguably disproportionately important given its impact on many others. Nevertheless, it would be naive to expect long-standing business practices to be ripped up and replaced overnight.

The truth is that the evolution is already underway. Several major market participants have disclosed that they have begun using Fastmarkets price assessments in an increasing proportion of their contracts. Relationships and reliability rightly remain hugely important though, and counterparties understandably seek mutual trust in whatever pricing system they employ. To this end, Fastmarkets looks to provide as much methodological clarity as possible to aid understanding of its assessments. We are also seeing growing efforts by industry participants to increase market transparency. Greater willingness to report transactions, as well as innovations such as public tender platforms, are tailwinds for transparency despite the limiting effect that the current market tightness is having on volumes available to support price discovery.

While supply continues to ramp up, we expect to see volumes allocated to the spot market grow, particularly as industry participants increasingly embrace price discovery responsibility as part of their overall strategies. We would also hope to see further developments to support visibility of price discovery across the supply chain (possibly building upon the recent innovation of platform auctions in the spodumene market) to establish transparent, electronic physical marketplaces where multiple participants can offer and bid.

Fig. 6: As the demand curve steepens in the years ahead, the stakes become higher for the industry – any major mismatches in supply could have serious implications for EV adoption ambitions

Lithium is the poster element of the energy transition, and it will undoubtedly take time for what was for so long a relatively niche market to grow into its role as one of the most significant materials of the 21st Century. The progress made by the industry to foster greater pricing transparency in recent years has supported the ability of agencies like Fastmarkets to provide assessments of ever-greater robustness, and we are now seeing these increasingly referenced in market contracts. As we travel further along the steepening curve of demand growth though, the stakes get ever higher for any serious mismatches in supply. Lithium production needs to quadruple between 2020 and 2030 to 2 million tonnes, and that is both a challenge and an opportunity for the industry. To ensure the right signals are sent to would-be financiers and investors along the way, a leap of faith to more fully embrace a spot market-linked pricing mechanism may be needed.