Learn more about Fastmarkets copper concentrate price data and news

Track price dynamics, access news and understand trends

Copper’s essential role in the energy transition is creating a volatile and dynamic market. A series of production problems has hit mine output around the world, leaving smelters scrambling for copper concentrates. The strong demand for copper concentrates has pushed the treatment charges and refining charges (TC/RCs) down to record lows. Meanwhile, the price for refined copper has hit all-time highs on the LME. Yet, as we switch from fossil fuels to renewable energy, copper demand is expected to soar.

Fastmarkets copper price data

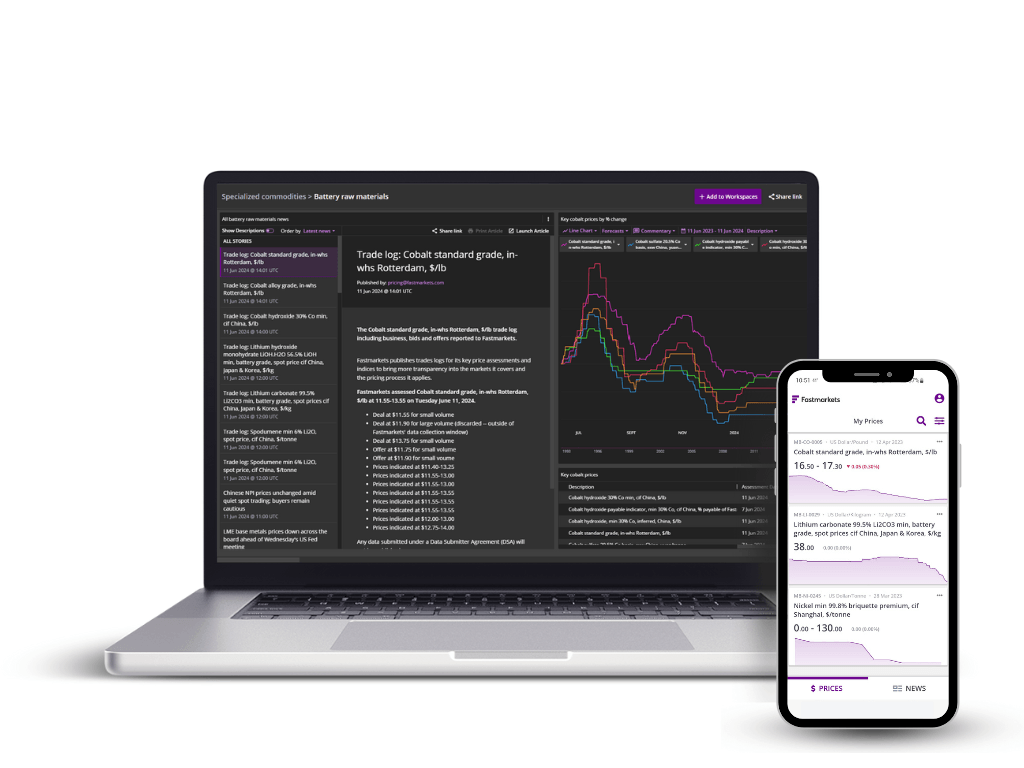

To help you navigate this complex market, we aim to bring you reliable and timely intelligence and analysis on copper, including both copper concentrates TC/RCs plus the implied smelter and trading buying levels. As these copper prices have broken through record levels, they’ve come under scrutiny from the industry. The divergence between between the spot TC price and the traditional, negotiated benchmark is disrupting the industry.

If you’d like to talk to us about our copper price data, news and market analysis, get in touch today.

Fastmarkets focuses on understanding the market dynamics through a process known as price discovery. Fastmarkets price reporters determine the current market evaluation of individual prices within the copper market by talking to those who buy, sell and trade copper.

Our subscribers get price data based on weekly and monthly price assessments that reflect the tradeable value in the open and competitive market. Our price data helps subscribers tackle:

- Market transparency

- Price volatility

- Opacity in the supply chain

- Changes in global production rates

Fastmarkets price data is trusted globally by thousands of companies. With over 130 years of experience in benchmarking commodities, our team of more than 200 expert price reporters and analysts ensure the most market-reflective commodity prices that are auditable and adhere to IOSCO-compliant methodologies.

Beyond price reporting, our team of experts also provide you with analysis and actionable insights on trading strategies and market and regulatory structures so you can make confident judgements about the industry. Learn more about the global team below.

Copper smelters struggling with record low treatment and refining charges (TCs/RCs) won’t be able to look to the Cobre Panama mine to ease market tightness any time soon.

After a consultation period, Fastmarkets is increasing the publication frequency of two copper concentrates index coefficients — MB-CU-0422 copper concentrates counterparty spread and MB-CU-0423 copper concentrates Co-VIU — from monthly to fortnightly.

Participants in the market for copper scrap and blister in China, the world’s largest importer of copper raw materials, expect there to be fiercer competition for material in 2025, industry sources told Fastmarkets in the week to Thursday January 9.

There has been a freefall in copper concentrates treatment and refining charges (TC/RCs) this year amid tighter supply in the market. In 2025, supply tightness is projected to keep copper concentrates TC/RCs low on average for the whole year, sources told Fastmarkets.

Fastmarkets proposes to increase the frequency of two copper concentrates index coefficients – MB-CU-0422 copper concentrates counterparty spread and MB-CU-0423 copper concentrates Co-VIU – from a monthly basis to fortnightly.

Fastmarkets invited feedback from the industry on the pricing methodology for its International Organization of Securities Commissions (IOSCO)-audited non-ferrous metals, via an open consultation process between October 8 and November 7, 2024. This consultation was done as part of our published annual methodology review process.

Trusted data

Our price data is market-reflective and backed by IOSCO-compliant methodologies.

Expert analysis

We have a global team of experts working exclusively on copper.

Exchange backed

We partner with major metals exchanges across the world, such as the LME, CME and SGX.

Global coverage

Robust presence in the Chinese market as well as key growth markets.

Metal Bulletin • American Metal Market • Scrap Price Bulletin • Industrial Minerals • RISI • FOEX • The Jacobsen • Agricensus • Palm Oil Analytics • Random Lengths • FastMarkets and more

Whether you’re interested in learning how to become a customer from our sales teams or looking to get in touch with one of our reporters, we’re here for you.

Navigate uncertainty and make business decisions with confidence using our price data, forecasts and critical intelligence.